Recent headlines trumpet the U.S. stock market’s record-breaking highs with almost celebratory zeal. The S&P 500 and Nasdaq Composite reaching unprecedented peaks paint a picturesque image of economic vigor and investor confidence. Yet, beneath this glossy surface is a tableau riddled with contradictions and looming risks that deserve sober reflection. The market’s astonishing 24% rebound

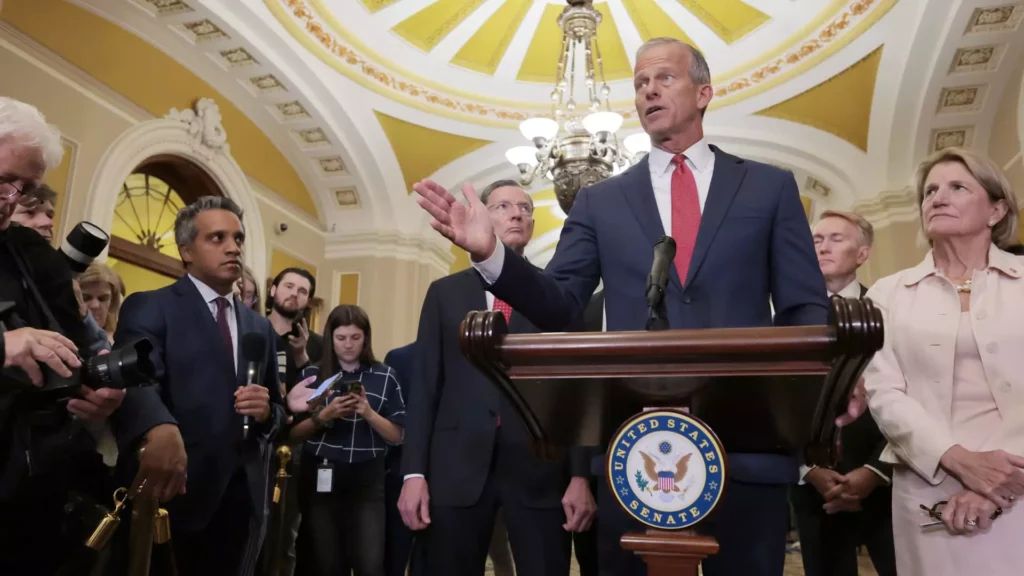

Despite political rhetoric framing the proposed Senate bill as a comprehensive boost to the American economy, the stark truth is that it would significantly worsen the financial standing of the bottom 20% of households. Research from the Yale Budget Lab paints a grim picture: the bill threatens to reduce the incomes of the poorest Americans—those

The WNBA’s recent announcement to expand the league with three new teams in Cleveland, Detroit, and Philadelphia is undoubtedly a watershed moment — a bold and ambitious push designed to increase the league’s footprint in major U.S. cities steeped in basketball history. Yet beneath the celebratory headlines lies a more complicated and risk-laden scenario that

BitMine Immersion Technologies, a relatively obscure bitcoin mining company, has suddenly captured market attention by charting an audacious new path: making Ethereum (ETH) its primary treasury reserve asset. This shift, announced alongside the appointment of Fundstrat’s Tom Lee as chairman, signals more than just a change in asset allocation—it suggests a potentially transformative but hazardous

Despite the recent surge of the S&P 500 reaching new heights, the broader economic landscape remains riddled with uncertainty. Inflation pressures, geopolitical tensions, and evolving consumer behaviors create a volatile environment where sustained growth is far from guaranteed. In these times, many investors understandably seek refuge in dividend-paying stocks—not merely for income, but as strategic

Debt isn’t merely a financial challenge—it’s a pervasive shadow darkening the career aspirations of millions of Americans. Far from a neutral economic factor, debt exerts a powerful and often corrosive influence on how people navigate their professional lives. For many, the sheer pressure to manage repayments forces them to settle for jobs they neither desire

Coinbase’s explosive rally in June has astounded many investors, catapulting the crypto exchange to the top of the S&P 500 performance charts. At first glance, the surge, boasting a 44% increase in just one month and a fresh peak since its 2021 IPO, seems to signal a decisive turning point for the company and the

The extravagant wedding of Jeff Bezos and Lauren Sanchez in Venice epitomizes the dissonance between immense wealth and the fragile reality faced by ordinary citizens. Celebrated on the private island of San Giorgio and continuing within Venice’s historic Arsenale, the three-day affair reportedly cost upwards of $50 million. This display of unprecedented luxury does more

In recent years, American consumers have weathered a storm of economic uncertainty, from unpredictable tariffs to lingering inflation and job market anxieties. This volatile environment has catalyzed a striking shift in financial behavior — moving away from the impulsive spending frenzy known as “revenge spending” that followed the pandemic, toward a more disciplined and prudent

The luxury real estate market in 2025 is witnessing a fascinating, if troubling, bifurcation. At its core, this divide stems from economic uncertainty—the kind that usually chills spending but seems to have created two very different buyer personas within the ultra-luxury sphere. On one end are the ultra-wealthy, those with fortunes exceeding $30 million, who