In recent years, the landscape of travel rewards credit cards has drastically shifted, with providers seemingly racing to offer more extravagant perks at increasingly exorbitant costs. Major issuers such as American Express and Chase are now demanding annual fees that push the boundaries of affordability, often exceeding a thousand dollars when considering supplementary benefits. For

In recent weeks, the Federal Reserve’s decision to cut interest rates has sparked a wave of optimism among investors. Many see this as a golden opportunity to chase dividend-paying stocks, presuming they offer safety and steady income. However, beneath this apparent stability lies a complex web of risks and illusions. The narrative that dividend stocks

In an era where technological innovation is the backbone of economic growth, the abrupt decision by the Trump administration to impose a $100,000 annual fee on H-1B visas starkly reveals a shortsighted obsession with border enforcement at the expense of America’s future competitiveness. This move, cloaked as a crackdown on legal immigration, fundamentally sacrifices the

In recent weeks, the financial landscape has been rife with conflicting signals that challenge the conventional wisdom surrounding monetary policy and economic stability. While the Federal Reserve announced a modest rate cut, bond yields — particularly the 10-year and 30-year Treasuries — surged, defying expectations and exposing a fragile veneer of confidence. This dissonance underscores

In the quest for financial stability, many consumers cling to structured guidelines like the popular “20-4-10” rule—an easy-to-remember framework designed to prevent financial pitfalls when purchasing a vehicle. While such rules appear to provide a simple blueprint, they often mask more complex realities of personal finance and market volatility. As tempting as it is to

Workday’s meteoric rise over the past decade has fundamentally reshaped perceptions of enterprise SaaS solutions, particularly in human capital and financial management. From humble beginnings, the company ballooned to a valuation nearing $60 billion, driven by a relentless focus on growth, often at the expense of profitability. This “growth-at-all-costs” mindset, while initially effective, now reveals

In recent months, a disturbing shift has taken hold within the landscape of public health decision-making concerning COVID-19. What was once a unified, science-backed consensus on universal vaccination has been subtly dismantled, replaced by an increasingly fragmented and ambiguous approach. The decision by the Advisory Committee on Immunization Practices (ACIP) — arguably one of the

The recent interest rate cut by the Federal Reserve was heralded as a beacon of hope for indebted Americans, but this action is more superficial than transformative. It promises temporary relief but glosses over the deep-rooted issues that plague personal finances. Lower interest rates do little to change the fundamental behaviors that lead to debt

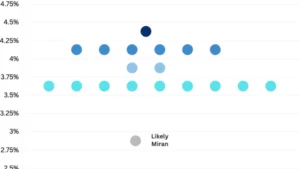

In recent months, the narrative surrounding the Federal Reserve’s independence has come under intense scrutiny. Official statements suggest that Fed members operate free from political pressure, but a closer examination reveals a different reality. The recent comments by Governor Stephen Miran illustrate a troubling trend: even when claiming to act independently, Fed officials are subtly

The recent proposal to shift from quarterly to semiannual earnings reporting under the guise of modernizing markets is fundamentally flawed. Advocates suggest that less frequent disclosures will allow companies to focus on long-term growth and reduce regulatory burdens. However, this perspective dangerously underestimates the importance of transparency and the critical role that timely information plays