In a remarkable turnaround that’s captured market attention, AppLovin’s shares surged an impressive 45% in just one day, following robust guidance that significantly surpassed analyst estimates. This phenomenal growth comes on the heels of the company’s third-quarter earnings report, which revealed a striking increase in both revenue and profits. With shares now trading above $245 and a year-to-date increase of 515%, AppLovin stands out in the tech industry, especially among companies valued at over $5 billion.

Financial Highlights that Speak Volumes

The numbers speak for themselves—AppLovin reported third-quarter revenues of $1.2 billion, reflecting a 39% increase compared to the previous year, effectively surpassing the anticipated figure of $1.13 billion. The company’s earnings per share also exceeded expectations, coming in at $1.25 against an average projection of 92 cents. Looking forward, AppLovin’s outlook for the fourth quarter is promising, with projected revenues ranging from $1.24 billion to $1.26 billion. This anticipated growth of approximately 31% from the previous year clearly indicates the company’s potential for sustained success.

While AppLovin initially gained fame in the online gaming industry, the company’s robust growth now largely stems from its foray into advertising technologies. The gaming segment, although stagnant in growth, has been complemented by the company’s thriving advertising division, which has benefited immensely from advancements in artificial intelligence. The revamping of its AXON advertising engine has proven to be a game-changer, allowing AppLovin to deliver more targeted advertising across its portfolio of mobile gaming apps. As the AI landscape continues to evolve, so too does AppLovin’s capacity to leverage these advancements for enhanced performance.

A pivotal aspect of AppLovin’s ascendancy is its impressive profitability. The company’s net income skyrocketed by 300% to $434.4 million in the third quarter alone. This surge in profits showcases not only the effectiveness of its business model but also instills confidence among investors. The software platform’s adjusted profit margin reached an extraordinary 78%, a figure that is particularly appealing to Wall Street, which increasingly values profitability alongside growth.

Analysts from Wedbush highlighted AppLovin’s extraordinary revenue growth and efficient EBITDA conversion, which prompted them to elevate their price target for the stock from $170 to $270—a clear indication of market confidence in the company’s trajectory.

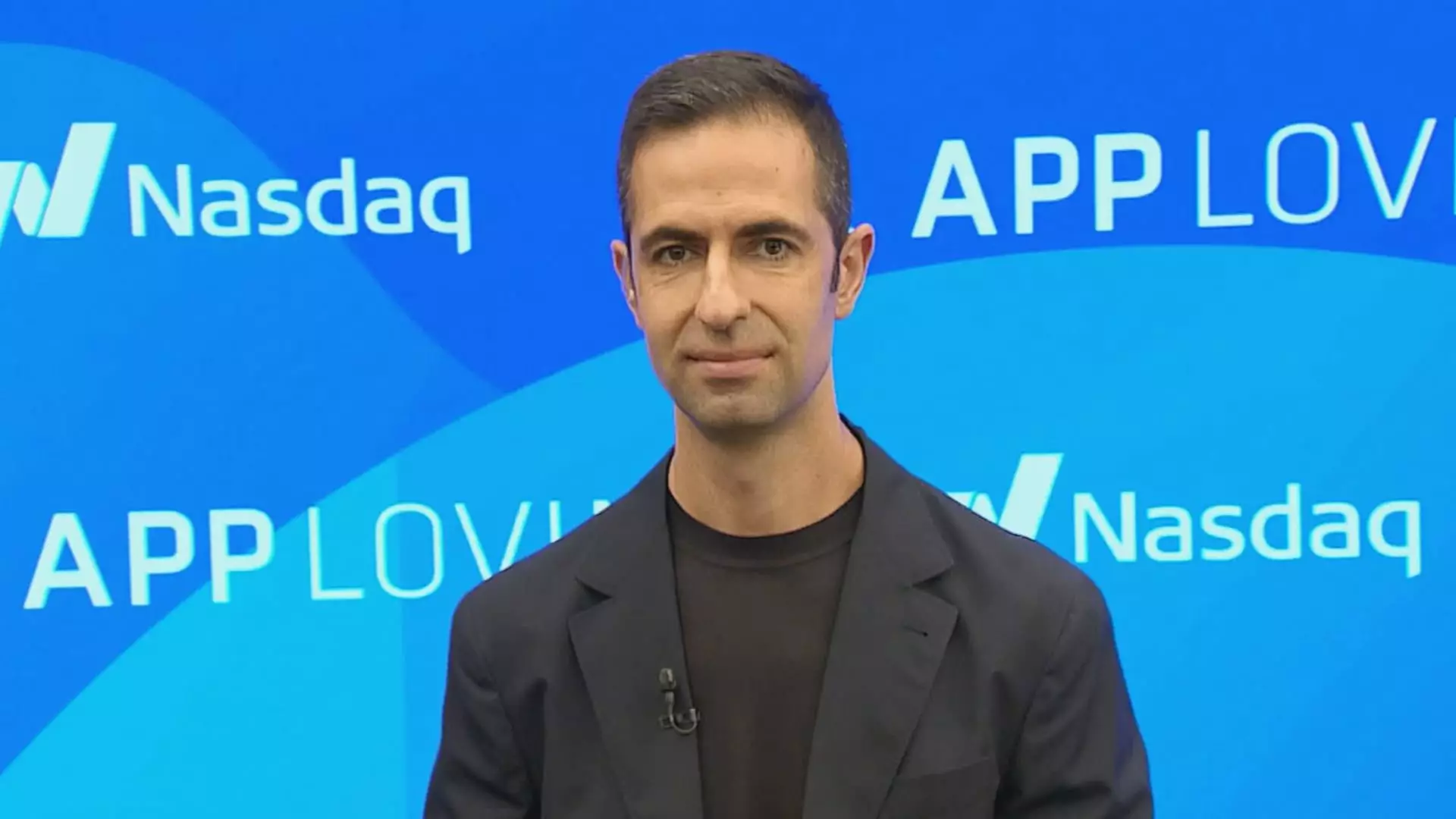

CEO Adam Foroughi provided further insights during an earnings call, discussing a pioneering e-commerce project aimed at enhancing ad targeting within games. Foroughi’s enthusiasm was palpable as he described the initiative as the best product released by AppLovin, underscoring its potential despite still being in the pilot phase. This forward-thinking approach suggests that AppLovin is not merely resting on its recent successes but is continually innovating to maintain its competitive edge.

AppLovin’s recent achievements underscore the dynamic nature of the tech landscape, revealing a company adept at transforming challenges into opportunities. As it harnesses the power of AI and strengthens its advertising capabilities, there’s little doubt that AppLovin is poised for an exciting future.