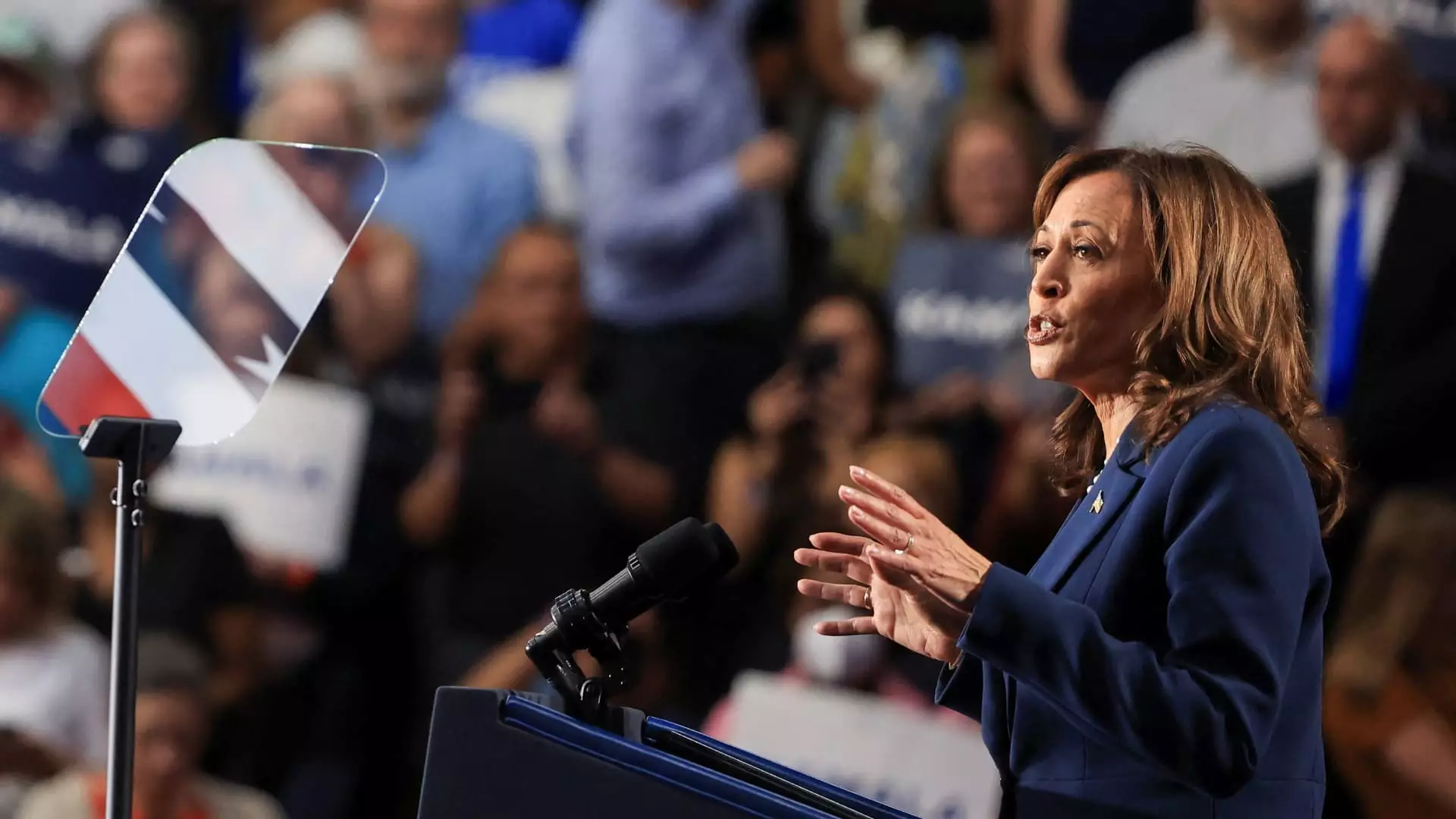

In a powerful address delivered recently in West Allis, Wisconsin, Vice President Kamala Harris reaffirmed a key objective of her nascent presidential campaign: strengthening the middle class. As she positions herself as a leading contender to succeed President Joe Biden as the Democratic party nominee, Harris stressed the importance of a robust middle class for the overall health of the American economy. “When our middle class is strong, America is strong,” she asserted, echoing a sentiment that has long been an essential part of her policy platform.

Her commitment to enhancing the economic stability of middle and working-class families is particularly timely amid escalating concerns about income inequality and the cost of living. It also sets the stage for what may become a defining issue for her campaign: the wealth gap that plagues modern American life.

One of Harris’s cornerstone proposals as a senator was the LIFT the Middle Class Act, aimed specifically at providing financial relief to lower- and middle-income families. The Act proposed an annual tax credit of up to $3,000 per individual or $6,000 per couple, a substantial boost for those who find themselves struggling with rising costs. This kind of targeted tax relief would offer direct help to countless households—especially renters who frequently face financial challenges exacerbated by hefty rent payments.

Expert analysis positions the LIFT Act as a potentially more effective solution to assist renters than the federal rent cap proposal fashioned by President Biden. While the 5% cap on rent increases aims to limit landlords’ price hikes, critics like economists Karl Widerquist and Jacob Channel warn that such measures might inadvertently dissuade landlords from maintaining rental properties or drive them out of the market altogether. In contrast, the LIFT Act directly addresses the financial struggles of renters, mitigating the adverse effects of rent inflation without distorting the housing market dynamics.

As inflation strains household budgets and the advent of artificial intelligence raises questions about job stability, economic anxiety is increasingly commonplace. Former White House Council of Economic Advisers chair Tomas Philipson underscores the fact that stagnant real incomes coupled with escalating living costs are weakening American workers’ financial footing. Kathleen Veldkamp, a finance and economics professor, highlights that fears surrounding AI-induced job displacement only add to the urgency for a social safety net that includes fiscal measures like the LIFT tax credit.

On this front, the LIFT Act presents a robust response, appealing to the electorate’s desire for concrete solutions in the face of economic uncertainty. Although the proposal holds merit, it also faces scrutiny regarding its fiscal sustainability. Funding a comprehensive tax credit would necessitate navigating complex political landscapes, particularly around repealing aspects of the Tax Cuts and Jobs Act that benefit higher-income earners.

While the LIFT Act addresses immediate concerns regarding income disparity, an affirmative shift in focus towards child tax credits has also captured national attention. The American Rescue Plan expanded the child tax credit, effectively reducing child poverty significantly during the pandemic. This policy garnered bipartisan support in the House, although it remains stalled in the Senate.

Harris has emphasized the transformative effects of direct financial support to families, contrasting her administration’s approach with the previous administration’s tax cuts aimed at wealthier individuals. In light of recent data reflecting a rise in child poverty post-pandemic aid, the urgency for renewed conversation around child tax credits has come to the forefront of policy discussions in her campaign.

The marching orders for the Harris campaign are clear. Addressing the wealth gap and rejuvenating the middle class must be central pillars of her administration if elected. This vision not only resonates with voters grappling with real economic pressures but also positions Harris as a candidate advocating for direct, actionable change. However, balancing these ambitious proposals against the practical concerns of fiscal responsibility and legislative viability will be an ongoing challenge.

As the landscape of American politics continues to evolve, Harris’s potential presidency could mark a significant shift towards policies that prioritize middle-class Americans. In a climate riddled with economic uncertainty and widening disparities, her proposed frameworks, like the LIFT Act and initiatives to enhance child tax credits, signal a renewed commitment to fortifying the bedrock of the American economy—its middle class. The upcoming electoral cycle could indeed serve as a litmus test for these ideas as they vie for public resonance and support, all while wavering between bold ambition and pragmatic governance.