MongoDB, a leading database software maker, experienced a significant increase in shares following the announcement of its healthy fiscal second-quarter earnings. The company exceeded expectations with earnings per share of 70 cents adjusted compared to the expected 49 cents. Additionally, MongoDB reported revenue of $478.1 million, surpassing the anticipated $464.1 million. This performance indicates a growth of 13% year over year, demonstrating the company’s ability to deliver strong financial results.

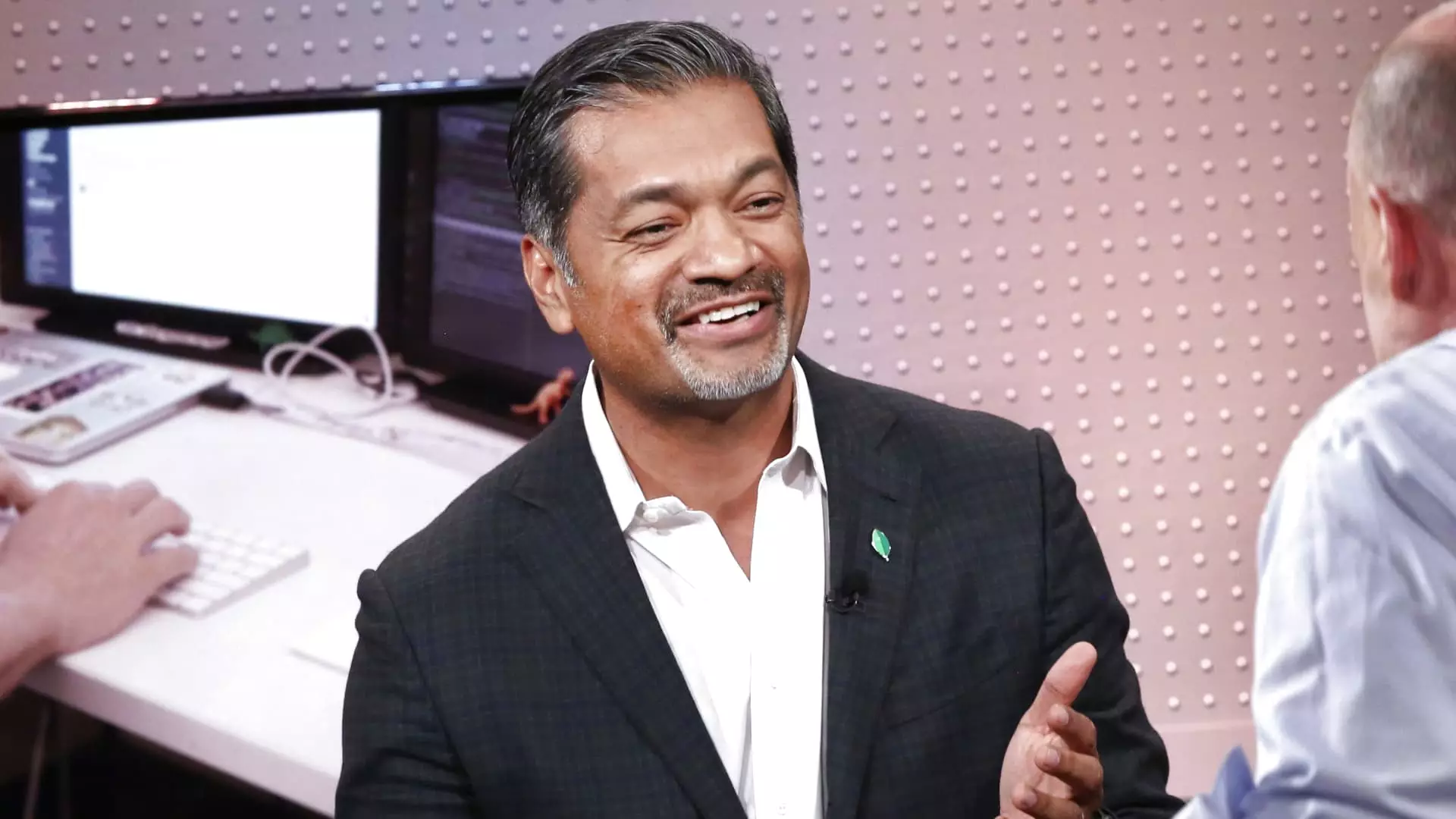

CEO Dev Ittycheria expressed confidence in MongoDB’s market position, stating, “We believe we are incredibly well positioned to help customers incorporate generative AI into their business and modernize their legacy application estate.” The company’s Atlas cloud database service also outperformed expectations, highlighting MongoDB’s ability to meet customer demand. Despite challenging economic conditions affecting Atlas consumption growth in the fiscal first quarter, the consistent performance in the second quarter suggests resilience in the face of market challenges.

During the earnings call, Ittycheria mentioned the company’s efforts to assist companies in migrating from Elastic products, reflecting MongoDB’s strategic positioning within the competitive landscape. Looking ahead, MongoDB provided optimistic guidance for the fiscal third quarter, projecting adjusted earnings of 65 to 68 cents per share on $493.0 million to $497.0 million in revenue. The company also revised its fiscal 2025 forecast, expecting adjusted earnings of $2.33 to $2.47 per share and revenue of $1.92 billion to $1.93 billion. This upward revision from previous guidance indicates MongoDB’s strong growth trajectory.

Despite the positive earnings report, MongoDB’s shares were down nearly 40% year-to-date, contrasting with the S&P 500 index’s 17% gain during the same period. The market reaction, excluding after-hours movements, suggests that investors may have expectations that MongoDB needs to meet in order to fully regain market confidence. Analysts had predicted $2.26 per share in adjusted earnings and $1.90 billion in revenue, indicating that there is a gap between market expectations and MongoDB’s actual performance.

MongoDB’s strong second-quarter earnings and optimistic outlook demonstrate the company’s resilience and competitive positioning within the database software market. While there are areas for improvement, such as meeting analyst expectations and addressing market concerns, MongoDB’s strategic direction and financial performance indicate a promising future for the company.