Observation is key for anyone involved in the stock market, especially during tumultuous times. Recently, we saw a dramatic swell in stock prices, subsequently underscored by significant swings that contributed to an exhausting week for investors. Such volatility isn’t merely routine; it highlights an underlying fragility within our economic framework. The unprecedented market reactions to developments like the U.S.-China trade war demonstrate the precarious balance that investors must navigate, raising profound questions about the sustainability of the current economic climate. For instance, stocks rallied to record gains only to lose ground again in an even shorter time frame, creating not just uncertainty for traders but also anxiety for anyone with a retirement portfolio or savings tied to the market.

This capriciousness stems from the constant reverberations of policy changes and geopolitical maneuvering. In this case, the announcement from the White House regarding hopes for a trade deal with China momentarily buoyed sentiments, despite Chinese tariffs spiking to 125%. Such contradictions sow confusion: How can one signal a hopeful outlook while simultaneously exacerbating existing tensions? It’s the collective impact of these conflicting narratives that makes Wall Street’s gyrations so troubling, revealing the tenuous grasp investors hold on the broader economic picture.

Sector Analysis Amidst Strain

For those closely following financial markets, the impressive bounce seen with the S&P 500—a staggering increase of over 5% in one week—could seem enviable. However, that superficial success must not obscure the deeper issues at play. Major players in the market, including Wells Fargo and BlackRock, showcased mixed results, reflecting that not every corporation can maintain momentum amidst the uncertainty. Wells Fargo’s decline in net interest income serves as a glaring reminder that the economic pressures affecting institutions can hit harder than anticipated, especially in a landscape where rates and tariffs fluctuate almost at will.

Contrast this with BlackRock’s ability to advance after reporting solid results, which suggests that while some companies may weather the storm, many are actively recalibrating expectations. Where does this leave investors? Conflicted, as they must sift through a sea of earnings reports that illustrate not just success, but also a grim vulnerability exacerbated by unpredictable external factors.

The Rise (and Fall) of Chipmakers

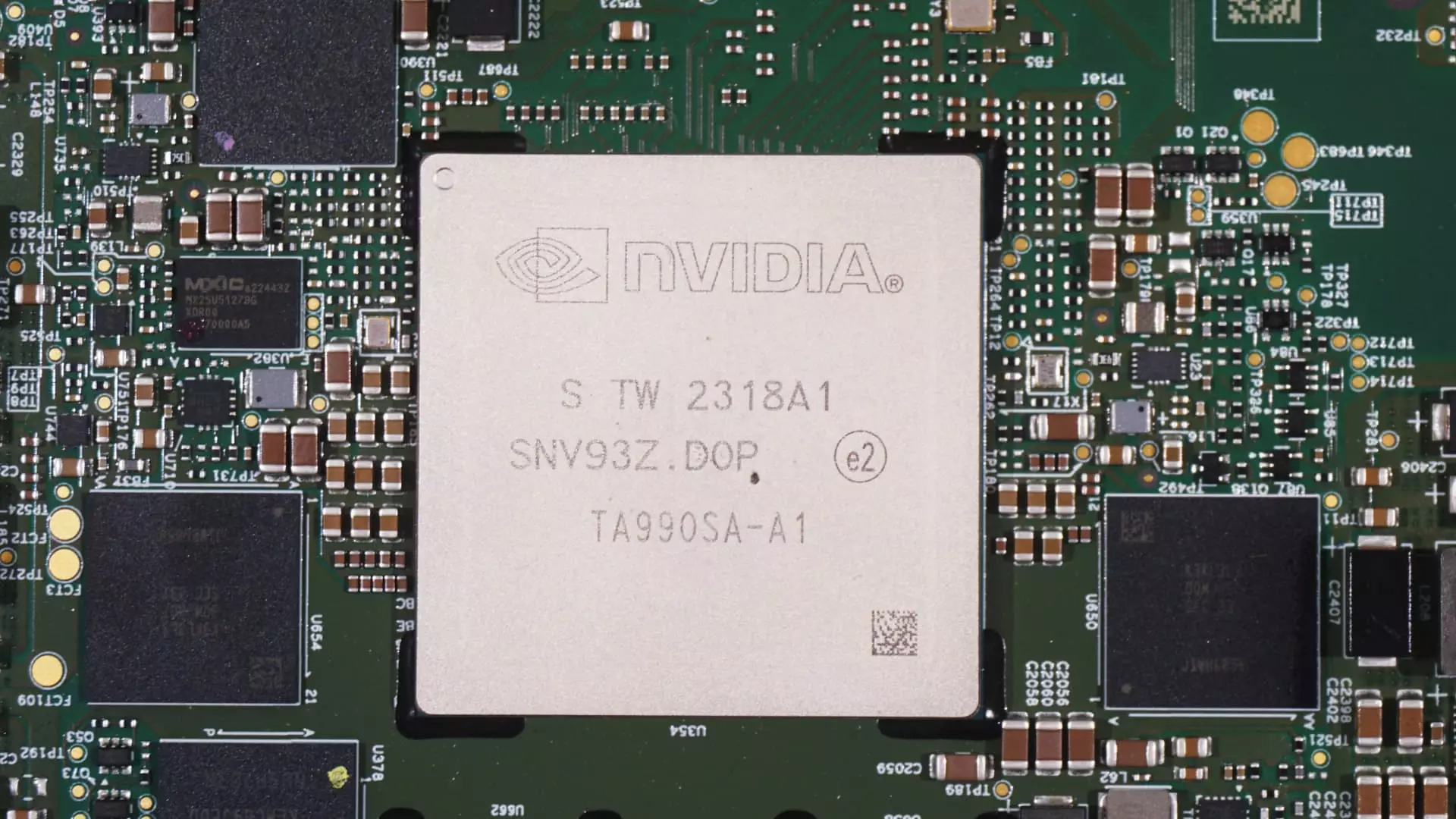

Interestingly, some of the most volatile stocks this week belonged to tech giants, particularly chipmakers like Broadcom and Nvidia. While their recent successes, with Broadcom up more than 22% and Nvidia rising 17%, deserve attention, we must also question the underlying mechanisms at play. This spike reflects a risky market ideology where stocks can soar based on snap-back rebounds following steep sell-offs. The reality remains: Such rebounds may not signal true recovery but rather signify a market poised for further correction.

Moreover, the announcement by the Chinese government regarding tariffs impacting chip manufacturing locations rather than shipment origin signals a larger narrative in play. It raises questions about the long-term viability of companies dependent on international supply chains. The market’s fixation on companies like Nvidia and Broadcom could blind investors to the potential hazards lying in wait as global tensions continue to escalate.

Analyst Opinions and Market Repercussions

The actions of investment analysts also highlight the precariousness of the current situation. Citigroup recently revised its price target for Nvidia, down to $150, ostensibly reflecting market conditions that are more fragile than previously anticipated. Yet this revision still represents an all-time high, indicating a peculiar optimism mixed with underlying trepidation. It’s a paradox that typifies today’s market—investors are being asked to navigate a landscape where promising investments are shadowed by geopolitical turmoil and economic apprehension.

As the earnings season rolls on, investors are left to grapple with the fallout from conflicting reports and economic indicators like the Bureau of Labor Statistics’ import and export price index and consumer spending data from the Census Bureau. Each piece of data adds another layer to an already intricate puzzle that requires urgent and thoughtful consideration. Investors must consciously align their strategies with an understanding of the intricate socio-political dynamics shaping the economy—acknowledging that the wild ride on Wall Street is not merely temporary chaos, but a profound reflection of the tensions that threaten its underlying structure.

In this transforming economic landscape, the only certainty is change, and for those holding investments, the stakes have never been higher. Those who remain informed, prepared, and willing to adapt will likely navigate these choppy waters more effectively than those who trust market trends will always reflect stability.