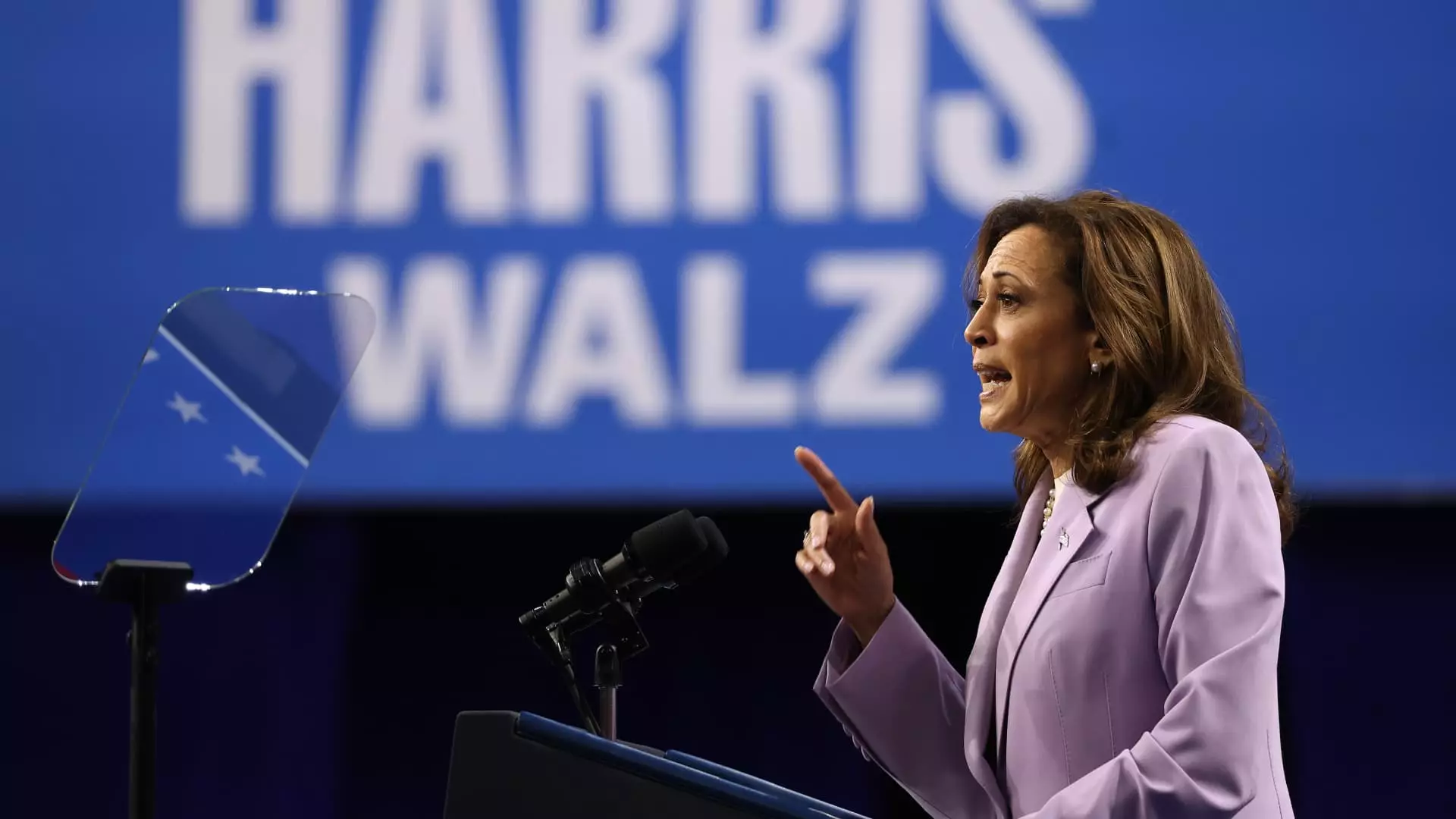

Affordable housing is a vital component of Vice President Kamala Harris’ proposed “opportunity economy,” as highlighted in a recent economic policy address. Harris emphasized the importance of making homeownership more accessible and affordable in the United States. During her speech in Raleigh, North Carolina, she expressed the need to increase the supply of housing units by constructing 3 million new homes over the next four years. This initiative has been met with enthusiasm by housing experts, who believe that it will help address the affordability crisis in the housing market.

Since the foreclosure crisis, which occurred between 2007 and 2010, there has been a significant decline in the construction of new single-family and multi-family housing units. This has led to a shortage of affordable homes, impacting renters in search of quality rental properties and first-time homebuyers alike. To combat this shortfall, Harris’ proposed administration plans to introduce a tax incentive for homebuilders who sell starter homes to first-time buyers. This, in conjunction with the Neighborhood Homes Tax Credit, aims to promote the creation and rehabilitation of affordable housing in distressed communities.

The Debate on Housing Supply Proposals

Former President Donald Trump has also raised the issue of increasing housing supply as part of his campaign proposals. However, Edward Pinto, a senior fellow at the American Enterprise Institute’s Housing Center, expressed skepticism regarding “supply-side proposals.” Pinto believes that stimulating demand through consumer-friendly measures may be more effective than focusing on supply-side initiatives. This underscores the ongoing debate surrounding the most effective strategies to address housing affordability.

One of the critical challenges in the affordable housing sector is defining what constitutes a “starter home.” James Tobin, CEO of the National Association of Home Builders, highlighted the complexity of determining a standard price point for starter homes, given variations in labor costs, land expenses, and material costs across different markets. The diversity of housing markets makes it difficult to establish uniform affordability criteria, especially in regions like California, where housing prices are substantially higher than in other parts of the country.

Critique of Harris’ Housing Proposals

While Harris’ housing proposals have garnered support for their ambition, there are concerns about their feasibility and impact. The proposed $40 billion innovation fund, aimed at empowering local governments to address housing issues, has faced skepticism from experts who doubt its effectiveness. Redfin’s Daryl Fairweather pointed out that localities may resist initiatives to increase housing stock, despite financial incentives. Additionally, the high cost of the innovation fund raises questions about its practicality and bipartisan support in Congress.

Down-Payment Assistance and Rental Housing Legislation

Harris’ plan includes providing $25,000 in down-payment assistance to first-time homebuyers and advocating for legislation to address predatory investing in the rental housing market. The down-payment assistance program aims to support renters who aspire to become homeowners, particularly those from underserved communities. However, concerns have been raised about the potential impact of such initiatives on housing demand and affordability. Furthermore, proposed legislation targeting predatory investing and algorithmic rent pricing seeks to regulate practices that may contribute to market distortions.

The debate around affordable housing initiatives underscores the complexity of addressing housing affordability in the United States. While efforts to increase housing supply and provide financial assistance to homebuyers are commendable, the effectiveness and sustainability of these measures remain subjects of scrutiny. Balancing the need for affordable housing with market realities and policy constraints presents a formidable challenge for policymakers and stakeholders alike.