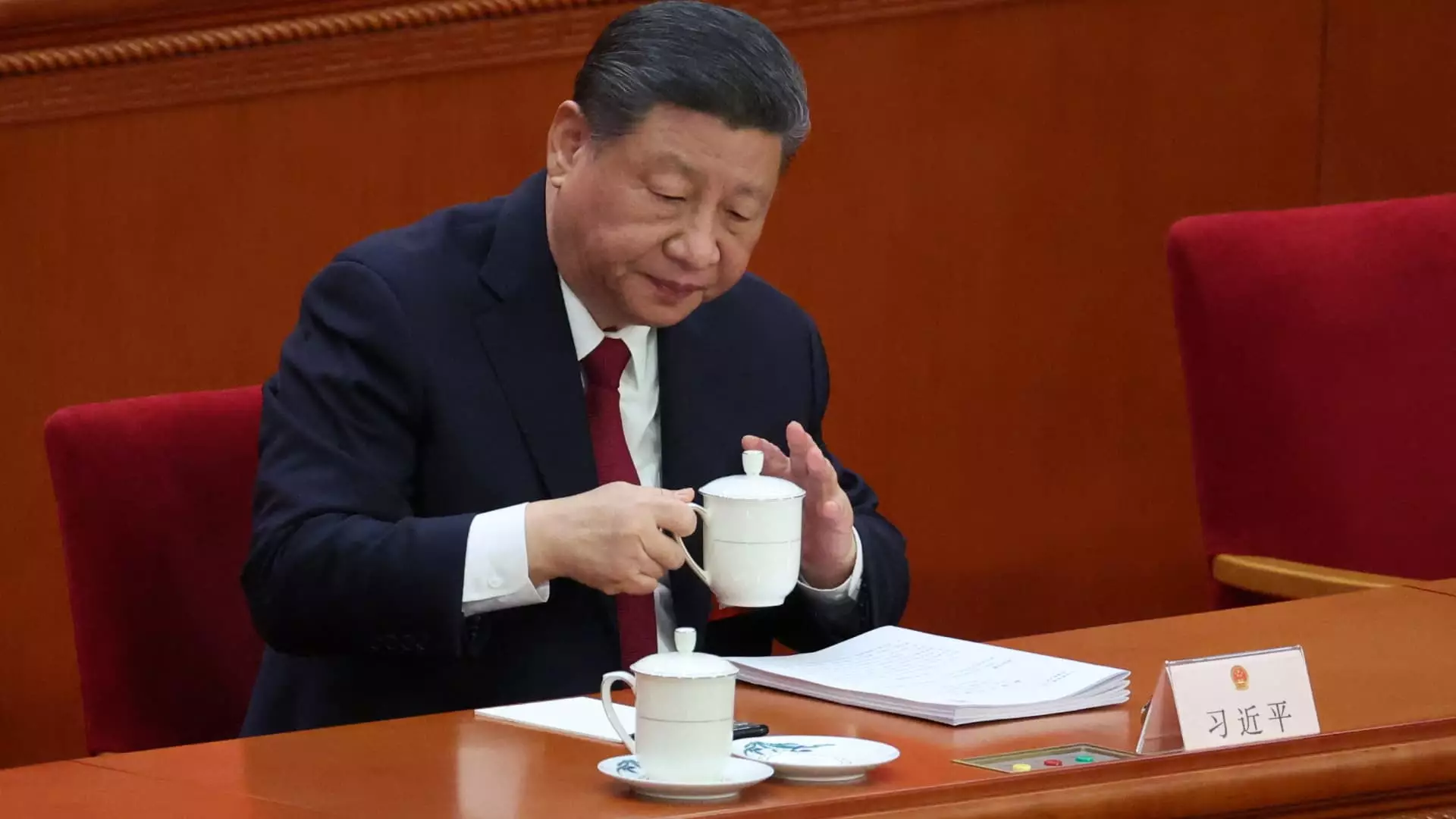

China’s economic landscape is increasingly pressured, not just by local factors but by mounting external shocks. The latest meeting of the Politburo, with high-ranking individuals directly under President Xi Jinping, reflects a dire response to these challenges. With renewed tariffs exceeding 100% from the United States, the aggressive economic strategies employed by Washington have sent shockwaves through China’s financial system. This situation demands an astute reassessment of the economic strategies that have traditionally focused on outward growth rather than proactive resilience.

In an era where geopolitical tensions dictate economic prospects, further dependency on foreign markets could lead to significant pitfalls. The results of such dependency are evident in the downgraded GDP forecasts by prominent Wall Street banks, a reflection that should serve as a wake-up call. The once-cherished target of a steady 5% growth appears increasingly elusive as these international pressures mount.

Targeted Support: A Double-Edged Sword?

The Politburo’s announcement regarding targeted measures for struggling businesses seems well-intentioned but raises several critical questions. While initiatives like easing interest rates and adjusting the reserve requirement ratio may appear beneficial on paper, there’s an inherent risk of these policies fostering dependency rather than sustainable growth. Without a robust infrastructure for these businesses to thrive independently, the economic support offered may only serve as a temporary crutch.

Additionally, this move indicates a harrowing reality: that the economy needs rescuing, which in itself poses further questions regarding the efficiency of existing government policies. The narrative of the ‘middle and lower-income groups’ taking the frontline in economic recovery sounds promising, yet practical strategies for genuinely uplifting these demographics remain vague and untested. It remains vital to examine whether there’s a solid framework to support these groups beyond mere rhetoric.

Innovation or Stagnation? The Challenge of Technological Development

Another focal point of the Politburo meeting was the emphasis on technological advancement, specifically the integration of artificial intelligence. Yet, innovation in the era of escalating technology wars is a precarious sticking point. While pushing for development seems vital for economic revitalization, the fear of a stifling atmosphere—over-regulation and bureaucracy—could curb potential breakthroughs.

Investment in innovation should not only aim to appease state rhetoric but also foster an environment conducive to creativity and entrepreneurship. If the government does not encourage competitiveness and collaboration, efforts to advance technology will likely end up as just another bureaucratic measure stacked among unfulfilled promises. The future should focus on what systemic adjustments are necessary to cultivate a thriving innovation ecosystem, rather than superficial pledges for technological supremacy.

Fiscal Policies: More Than Just Numbers

China’s decision in March to raise its deficit target to 4% of GDP could be seen as an acknowledgment of obstacles on the horizon. However, the effectiveness of such policies hinges on their implementation. Fiscal policy needs to be strategic, targeting not just the superficial symptoms of slow growth but also the structural issues that plague the economy. A more nuanced approach can provide sustainable support that does not merely paper over the cracks but addresses the core of the challenges faced.

Finance Minister Lan Fo’an has indicated flexibility in policy implementation; yet, flexibility can breed instability if not governed wisely. True economic resilience would stem from a deliberate, well-coordinated response that considers the complexities of both domestic and international markets. The politicians in charge must pivot from mere economic management to genuine economic stewardship.

Public Sentiments: Trust and Engagement Needed

The challenges faced by the Chinese economy extend beyond numbers; they penetrate the fabric of society and the public trust in government efficacy. For many citizens, the notion that their future hinges on government interventions often translates into skepticism. In a system where accountability is limited, the economic upliftment promised by the government risks falling flat without public endorsement and engagement.

Restoring trust necessitates transparent communication and a consistent demonstration of accountability from policymakers. The days ahead will require more than just fiscal adjustments and policy announcements—it demands genuine community involvement and an economic vision that resonates with everyday citizens. Only an engaged citizenry will enable China to withstand external shocks in the long term, and without that, the policies adopted might remain little more than well-intentioned gestures.