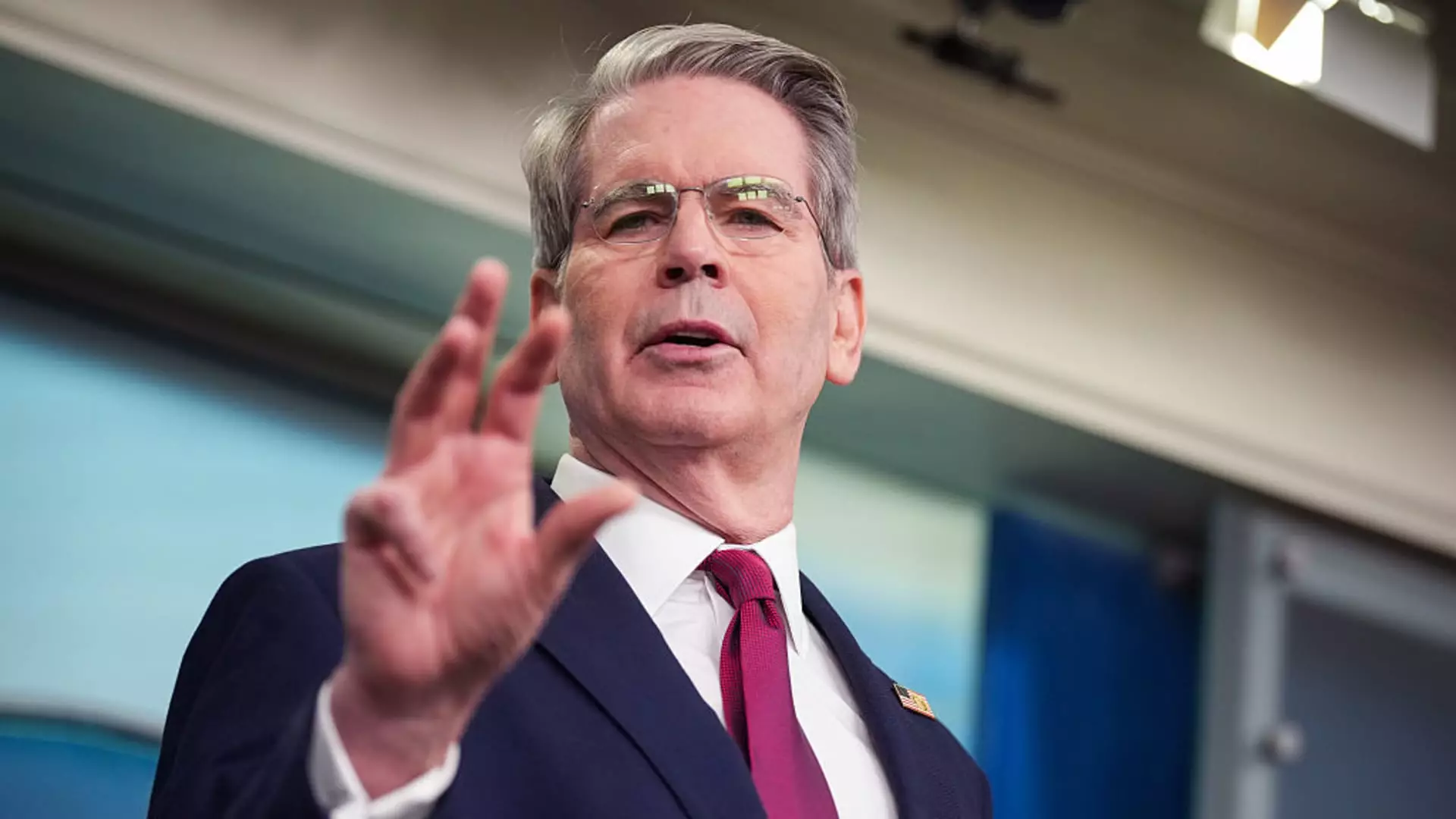

In an era marked by unprecedented market fluctuations and economic upheavals, the resilience of individual investors is nothing short of remarkable. Treasury Secretary Scott Bessent recently highlighted that while institutional investors are reacting with fear and skepticism, ordinary Americans are sticking to their guns, displaying a steadfast trust in President Trump’s controversial tariff policies. According to Bessent, an astonishing 97% of individual investors have chosen to refrain from trading over the past 100 days, a statistic gathered from Vanguard, one of the nation’s leading money management firms. This unwavering confidence stands in stark contrast to the panic exhibited by institutional investors, raising questions about the divergent perspectives within our financial landscape.

The Tariff Rollercoaster: Implications for Markets

Trump’s introduction of the highest tariffs on imports seen in generations was intended as a bold move to reshape American trade dynamics. However, the consequences of this policy have been both immediate and severe. Following the announcement, we witnessed the S&P 500 index, a critical barometer of market performance, tumble into bear territory—a staggering downturn reflecting investor trepidation. As financial analysts project the potential outcomes of prolonged tariffs, fears are mounting that these measures could inevitably slow economic growth, potentially leading to a recession.

While many retail investors appear undeterred, largely viewing the recent market downturn as a buying opportunity, there exists a growing concern regarding the long-term implications of Trump’s trade policies. Renowned economist Torsten Slok warns of a possible recession looming on the horizon, as consumers may soon feel the impact of trade shortages. His predictions introduce a critical perspective: how resilient can individual investors remain in the face of economic reality?

The Broader Economic Picture: Trust Versus Reality

Bessent’s remarks underscore a fascinating dichotomy between retail and institutional investors—a sentiment that underscores deeper ideological divides within our economy. Many ordinary investors may perceive themselves as patriots, supporting a President who they believe is fortifying the American economy through protective measures. However, such nationalistic fervor risks blinding them to the potential economic ramifications of sustained tariffs, particularly in an age where global interconnectedness defines market operations.

In stark contrast, institutional players, often characterized as the market’s ‘sophisticated’ participants, have reacted with a flurry of defensive strategies, retreating from the market and engaging in short-selling amid growing uncertainties. These contrasting responses suggest a deeper rift between a romanticized vision of American industry and the cold calculations of market realities.

The Risk of Tarnishing America’s Economic Brand

Ken Griffin, CEO of Citadel, portrays a sobering view on the potential fallout from Trump’s aggressive trade stance, warning that it could tarnish the United States’ economic brand on the global stage. For the United States, a country traditionally seen as a bastion of financial stability, the long-term effects of an erratic tariff regime pose a significant threat—not only to retailers and consumers but to the very fabric of confidence that underpins American economic might.

While individual investors may exhibit remarkable resilience, the impending trade-related challenges loom larger than the short-term faith they hold. The question lingers: can this faith withstand the pressures of an economy driven by increasingly complex global interdependencies? The coming months will likely prove critical in defining the perceived credibility of both President Trump’s policies and the steadfastness of American retail investors.