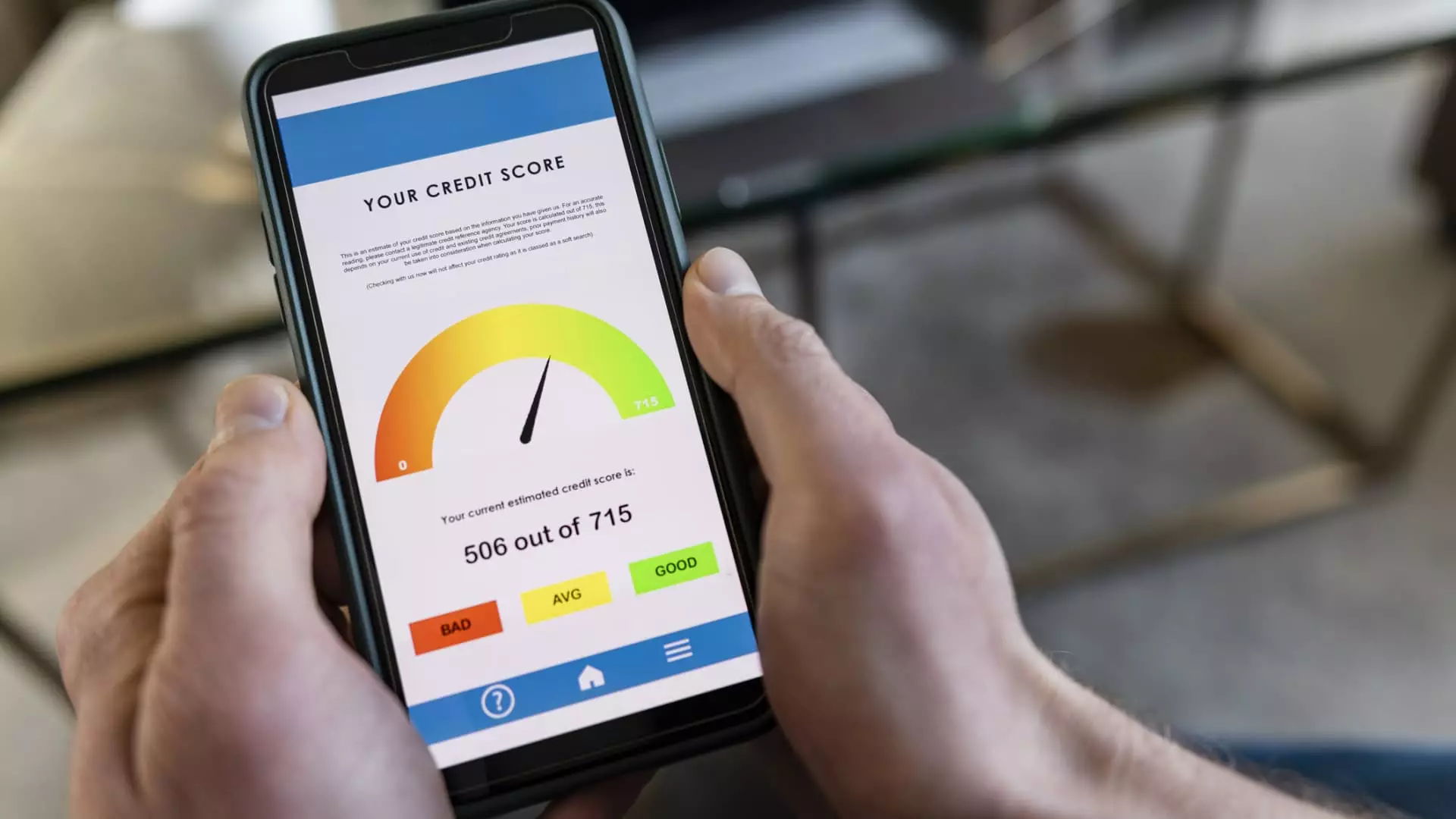

Once considered a pillar of financial health, the American credit score landscape is now visibly in decline. The latest data reveals that the national average credit score has slipped for the second consecutive year, falling from 718 in 2023 to 715 in 2024. This subtle decline might appear insignificant to some, but its implications ripple through the very fabric of our economy. It exposes a fragile web of financial vulnerability among millions of Americans, a stark reminder that economic stability is more illusionary than ever.

This downward slide follows a recent period of stabilization and modest growth, which many economists and policymakers had viewed as a sign of economic resilience. Instead, we are witnessing a troubling reversal, fueled by a toxic mix of high interest rates, inflation, and mounting consumer debt. These factors are eroding the progress many Americans thought they had achieved, shaking confidence in their financial security and, by extension, the broader economy.

The Alarming Rise of Debt and Financial Strain

What stands out in this disturbing trend is the surge in consumer debt, particularly credit card balances. As inflation and rising living costs continue to squeeze household budgets, more Americans are forced to borrow just to make ends meet, leading to a vicious cycle of debt accumulation and missed payments. FICO’s report underscores this reality by noting an increase in delinquent accounts, especially as late payments on student loans have resumed. The end of pandemic-era forbearance has exposed many borrowers to harsh realities, and the resulting drops in credit scores serve as a stark warning of future financial instability.

The report also highlights the contentious role of student loan payments—initially masked by forbearance—which are now revealing how vulnerable many borrowers truly are. For years, pandemic policies obscured the risk, artificially inflating credit scores. With the normalization of delinquency reporting, countless consumers are confronting significant score declines that threaten their access to credit, housing, and even employment opportunities. This reveals how policy decisions and economic conditions intertwine to shape individual financial trajectories—often to the detriment of the most vulnerable.

Unequal Impact: A Tale of Two Economies

Amidst this decline, a more complex picture emerges. While the average credit score is dropping, certain segments of the population are experiencing contrary benefits—thanks to their positioning in more resilient economic niches like the stock and housing markets. For those fortunate enough to have benefited from market booms, their wealth has likely increased, creating an unsettling divergence between different socioeconomic groups.

This chasm undermines the promise of an equitable economy. As lower credit scores restrict access to affordable credit, they further entrench economic disparities, making it harder for struggling families to recover from setbacks. Meanwhile, the fortunate few enjoy market-driven gains that propel their wealth, widening the social divide and fueling inequalities of opportunity.

Is Self-Help Enough in a Turbulent Economy?

Despite these grim realities, hope remains—though it’s a nuanced one. Experts emphasize that credit scores are fluid, influenced heavily by individual behaviors and choices. Paying bills on time, maintaining a low utilization rate, and avoiding unnecessary credit inquiries are essential strategies. However, it would be naive to believe that individual efforts alone can reverse systemic economic issues that are driven by macroeconomic policies and market conditions.

Moreover, for those already bearing the burden of a low credit score, the outlook feels bleak. The cost of poor credit extends beyond higher interest rates; it restricts opportunities, hampers upward mobility, and exacerbates economic inequality. Experts warn that the ongoing deterioration of credit scores could lead to a more divided society—where the fortunate pool further in wealth, and the struggling sink deeper into financial despair.

A Call for Rethinking Our Economy’s Heartbeat

Fundamentally, this trend exposes the deep flaws in how we manage economic growth and financial stability. The focus on market metrics alone—booming stock markets, rising home prices—fails to address the underlying struggles of everyday Americans. Our economic policies seem increasingly detached from reality, prioritizing superficial growth over genuine financial security for the majority.

As a society, we must confront the uncomfortable truth: the erosion of credit scores isn’t merely a statistical blip but a symptom of larger systemic issues. Widening economic disparities, reckless policy decisions, and an inability to protect vulnerable populations threaten to destabilize our social fabric. Addressing these challenges requires a shift in priorities—moving beyond superficial market success towards creating sustainable economic opportunities for all, especially those most at risk of falling behind.