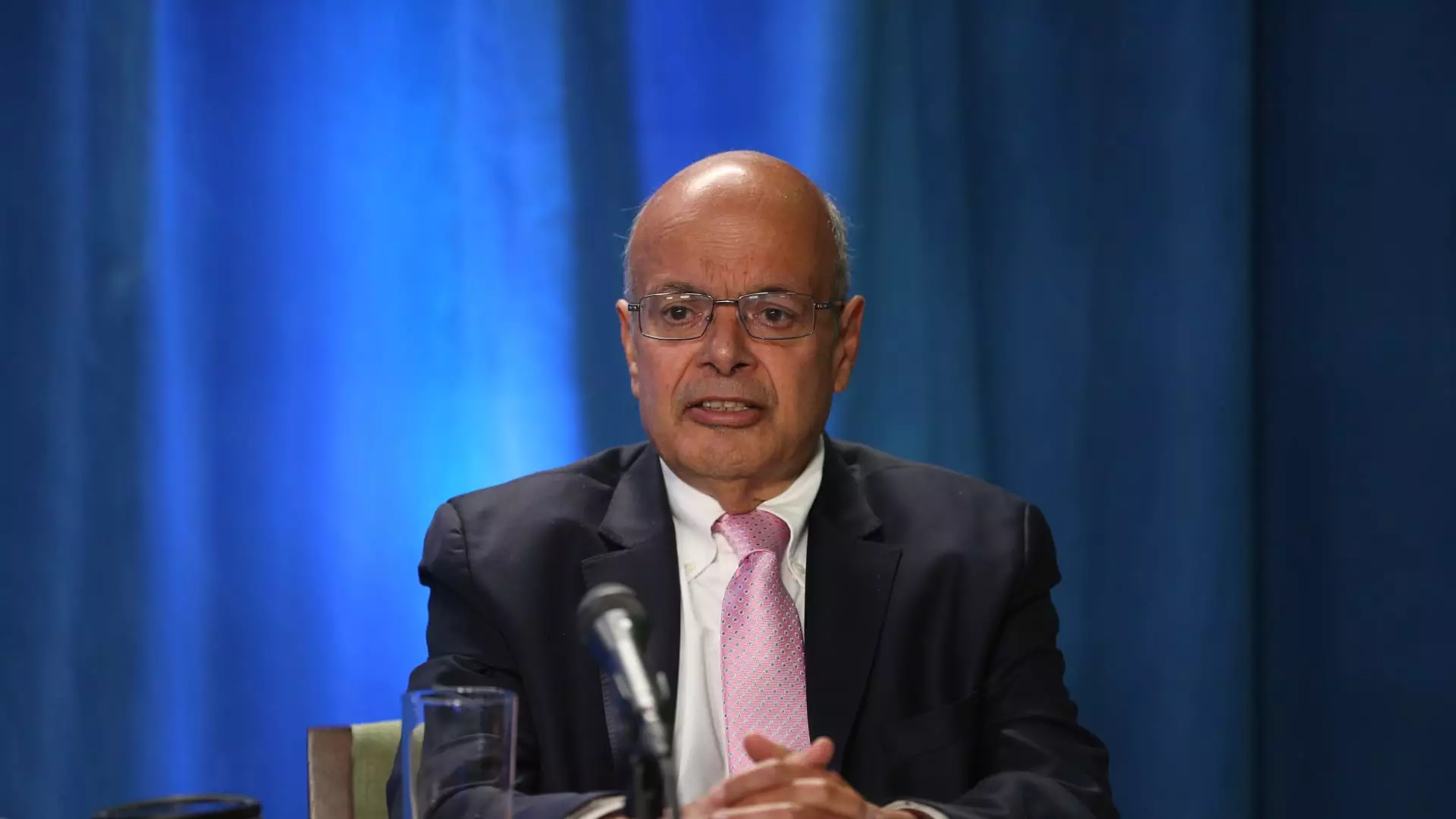

Ajit Jain, a prominent figure in the world of finance and a key executive at Berkshire Hathaway, recently sold a significant portion of his Berkshire Class A shares. This shift was highlighted in a regulatory filing that showcased a staggering divestment of over 55% of his holdings. At 73 years old, Jain has been an integral part of Berkshire’s operations since 1986, and this sudden move to liquidate 200 shares at an average price of around $695,418 has sparked considerable discussion among investors and analysts alike.

The sale marked a noticeable milestone in Jain’s tenure, leaving him with just 61 shares personally while also managing stakes held by family trusts and the Jain Foundation. Given that this represents the largest reduction in Jain’s holdings to date, many are left to ponder the underlying motivations for such a significant decision.

While it remains speculative to definitively identify Jain’s motivations, experts suggest that he capitalized on Berkshire’s valuation peak. The company’s stock has experienced remarkable growth, recently trading above $700,000, which subsequently led to a market capitalization soaring past the $1 trillion mark by the end of August. The timing of this divestiture could signify Jain’s belief that the stock is currently overvalued, a perspective supported by finance scholars like David Kass from the University of Maryland. He suggests that Jain’s action may well serve as a signal regarding Berkshire’s perceived peak value.

The reduction in share repurchase activity by Berkshire Hathaway further lends weight to this theory. The company bought back only $345 million worth of its own stock in the second quarter of the year, a stark decrease from the $2 billion repurchased in preceding quarters. This trend could also indicate a strategic shift in how the company views its valuation and the effectiveness of deploying capital for stock repurchases.

Insights from Financial Experts

Prominent figures in finance are responding to these recent developments with varying interpretations. Bill Stone, Chief Investment Officer at Glenview Trust Co., stated that with the stock trading approximately 1.6 times its book value, it hovers around what he believes is Warren Buffett’s intrinsic value assessment. Stone’s observation highlights a cautious sentiment surrounding Berkshire’s future repurchase intentions, implying that significant buybacks may not be forthcoming under the current pricing structure.

The psychological implications of Jain’s divestment cannot be overlooked, especially within the context of Berkshire’s robust reputation in the insurance sector. Jain’s achievements, such as his pivotal role in transforming Geico into a profit-generating powerhouse, have not only built wealth for investors but also solidified his legacy as a savior of the firm. Buffett himself praised Jain in past communications, suggesting that admire and trust in his leadership within the company are robust.

The Future of Berkshire’s Management Landscape

As speculation proliferates regarding who will eventually take the reins following Buffett’s eventual retirement, it is essential to consider Jain’s positioning within the company. Despite earlier rumors suggesting he may be a contender to lead the conglomerate, Buffett clarified that Jain is uninterested in the top role. This clarification seems to suggest that while Jain is indeed a key executive, he has no ambition to step into Buffett’s shoes as the face of the organization.

The divergence in perceived paths for Jain and Greg Abel, Buffett’s designated successor, raises intriguing questions about Berkshire’s management dynamics. Both have distinctive managerial styles and philosophies, thus creating a blend of strategies that might influence the conglomerate’s future direction.

Ajit Jain’s recent sale of a considerable portion of his Berkshire Hathaway shares not only underscores potential strategic recalibrations in response to current market conditions but also reflects broader sentiments about the company’s future valuation. As shareholders and analysts dissect these changes, the implications of Jain’s actions will undoubtedly resonate within investment communities. The evolving narrative surrounding Berkshire’s leadership transition adds another layer of complexity to the discussion, revealing the intricate interplay of personal ambition, market valuation, and corporate strategy.