China’s real estate sector, once a robust engine of the nation’s economic growth, has been grappling with a pronounced downturn since the government enacted stringent regulations on developers’ debt levels in 2020. The aftermath of these regulations has led to substantial disarray within the property market and has significantly affected the economy at large—cutting local government revenues and eroding household wealth. This situation has raised pressing concerns among economists and policymakers alike about achieving China’s yearly GDP target of approximately 5%.

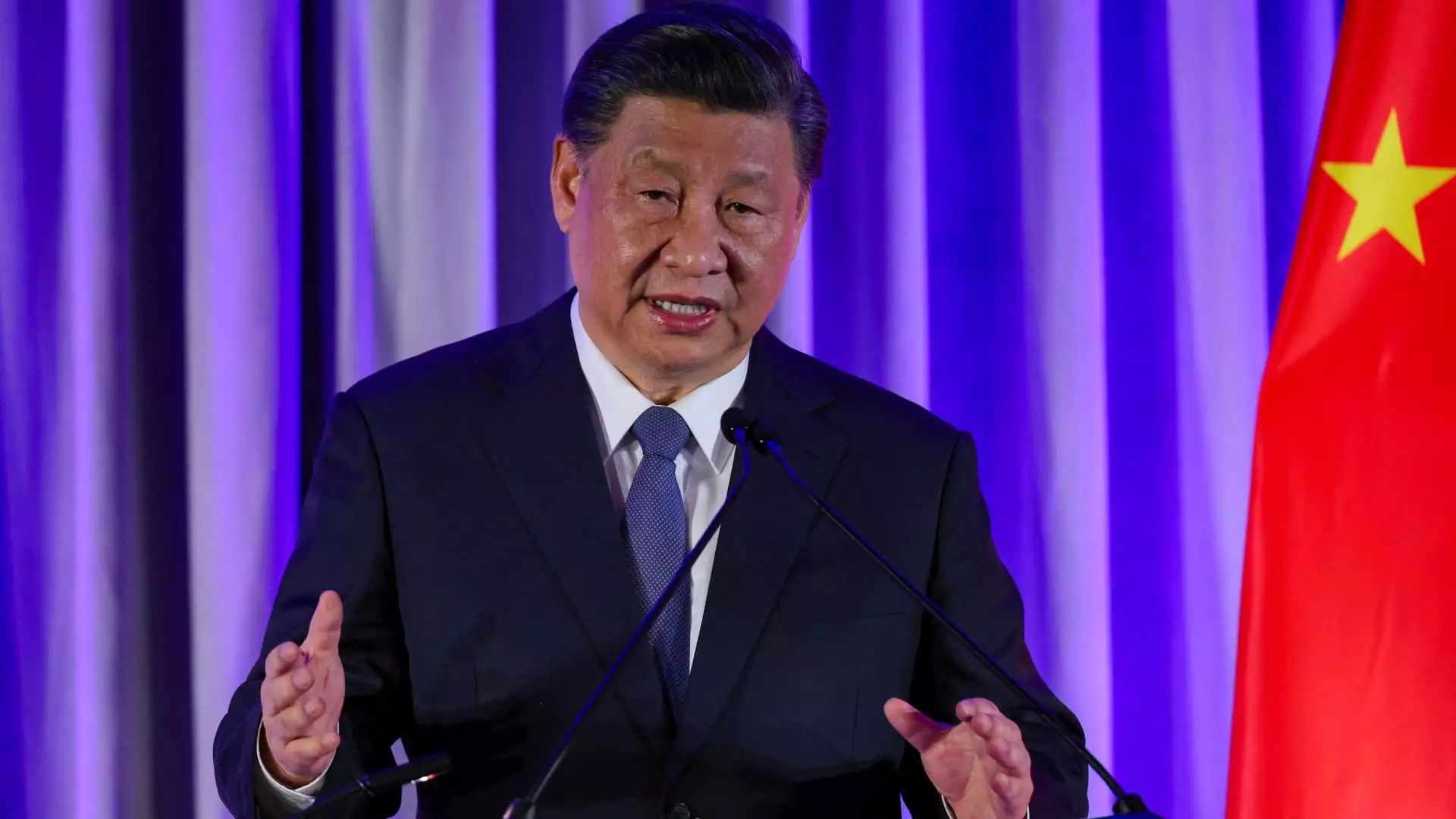

In light of these difficulties, Chinese leaders convened a high-ranking meeting last Thursday, which not only signaled an intent to address the real estate slump but also emphasized bolstering broader economic conditions. The meeting was led by President Xi Jinping and featured key discussions around fiscal and monetary support. State media reports highlighted a renewed focus on stimulating the economy and responding to the populace’s concerns—a crucial aspect as the government aims to navigate through increasing social pressures.

Following the high-level discussions, the stock markets in both mainland China and Hong Kong saw notable gains, particularly within the property sector, which experienced an astonishing surge of nearly 12%. Such an immediate positive market response suggests that investors are cautiously optimistic about the government’s new intentions. Analysts have interpreted the messages from the Politburo meeting as small yet meaningful steps toward a more balanced economic recovery, particularly in the real estate sector, which previously accounted for over a quarter of China’s GDP.

However, it is prudent to note that the meeting’s readout did not delineate specific strategies or timelines for implementation, leaving room for interpretation and skepticism. While financial analysts like Zhiwei Zhang from Pinpoint Asset Management have expressed optimism regarding the meeting’s outcomes, others urge caution, warning that substantive fiscal support is still required to lead to meaningful economic recovery.

Recent data paints a complex picture of the current state of the real estate market. Though the rate of decline has shown some moderation—with newly sold homes experiencing a 23.6% decrease up until August, slightly better than the previous month’s statistics—average home prices remain under pressure. According to Goldman Sachs, average property prices fell by 6.8% in August alone.

A critical element driving future home sales is the need for consumer confidence. Yue Su, a principal economist at the Economist Intelligence Unit, emphasized that achieving stability in the housing market is vital for consumer action. It has become increasingly important for the government to shift its focus from merely attempting to elevate housing prices for wealth effects to actively fostering an environment conducive for home purchases. This change in approach may ultimately help alleviate the downward pressures on the economy.

The readout from the Politburo meeting indicated a multi-faceted strategy that involves limiting the growth of housing supply, enhancing loan availability for priority projects, and reducing interest rates on existing mortgages. Such measures are designed to lessen the financial burden on homeowners, with projections suggesting that upcoming cuts could lighten mortgage payments significantly, with estimates around 150 billion yuan ($21.37 billion) annually.

While these plans might seem promising, their effectiveness hinges on the government’s ability to implement them swiftly and efficiently. The Politburo’s call for more decisive action reflects a shift in focus—differing from the more stabilizing tone adopted in earlier meetings. This suggests that policymakers are increasingly aware of the pressing need for initiatives that can yield immediate economic benefits without sacrificing long-term structural reforms.

In conjunction with these developments, major financial institutions have begun adjusting their growth forecasts in response to the evolving narrative from Beijing. Observers note that there has been a notable softening in the government’s aspirations for growth, with indications that the authorities may be willing to accept growth levels below the previously targeted 5%. This evolving perspective hints at a calculated balancing act aimed at both nurturing short-term growth and addressing necessary long-term transformations in the economy.

The recent meeting is a testament to the complexities within China’s economic landscape. By addressing real estate issues and emphasizing proactive policies, Chinese leadership seeks to stabilize the situation, benefiting not just the housing sector but the overall economy. While the path forward includes challenges, the intent demonstrated at the Politburo meeting may mark a crucial turning point for China’s economic recovery efforts, signaling a potentially new chapter in its approach to economic stability and growth.