Costco has recently projected itself into the lucrative sphere of precious metals by introducing Swiss-made platinum bars to its already popular lineup. Priced at $1,089.99 for a 1-ounce bar, this addition showcases the wholesaler’s commitment to catering to investors drawn by the allure of tangible assets, spanning both the traditional gold and silver markets as well as now branching into platinum. This strategic maneuver underscores Costco’s adaptability and foresight in recognizing shifting consumer interests toward wealth preservation in uncertain economic times.

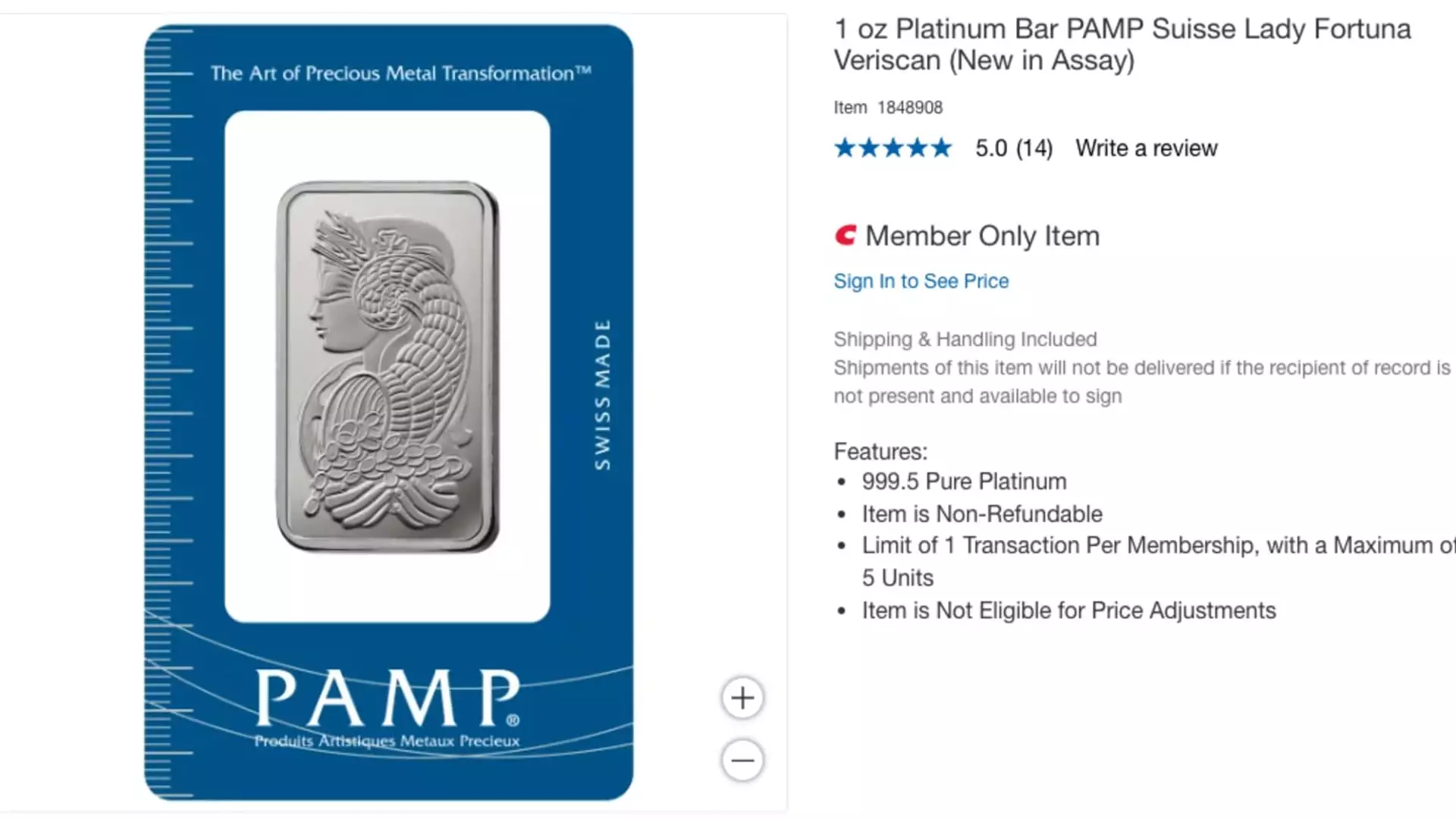

This new offering reflects a broader trend among retail establishments recognizing the rising consumer demand for investment-grade precious metals. By making platinum bars available for online purchase exclusively for Costco members, the company not only creates a unique selling proposition but also reinforces the exclusivity associated with membership. The requirement of a Costco membership—which ranges between $65 and $130 annually—ensures that their precious metal products reach a targeted audience, capable of affording and valuing collectible and investment-grade assets.

The recent wave of interest in precious metals, particularly gold, has been staggering. According to analysts at Wells Fargo, Costco has seen sales of gold bars soar to an impressive $200 million monthly. Richard Galanti, the former CFO of Costco, highlighted how gold bars are often sold out within hours of their online launch. Such high demand signals not only consumer enthusiasm but also the growing perception of gold as a reliable hedge against inflation and economic instability.

While gold’s price trajectory has proven to be robust—gaining over 40% in the past year—the dynamics surrounding platinum are markedly different. Having witnessed a rise of approximately 15% over the last twelve months, platinum does not exhibit the same unwavering trend as gold. Its recent fluctuations, especially a drop exceeding 8% from its earlier peak, highlight the volatility inherent in the platinum market, a factor that prospective buyers need to consider.

Interestingly, Costco’s distribution restrictions on platinum bars serve to narrow their market accessibility, disallowing shipments to states like Louisiana, Nevada, and Puerto Rico. This limitation might alienate potential customers, which raises concerns about the wholesaler’s broader vision for its precious metals division. Maintaining stringent limits not only affects revenue potential but may also diminish the perceived availability of such investments—prompting investment-savvy consumers to seek alternatives elsewhere.

This cautious approach contrasts with the robust demand exhibited in the gold market. However, such limitations might be leveraged as a marketing strategy, creating an impression of scarcity and exclusivity around specific high-value products. Ultimately, by evaluating both the opportunities and challenges existing in these markets, Costco is continuously redefining its role within the investment sphere.

Costco’s venture into platinum bars is a calculated gamble that reflects both current market dynamics and the company’s ongoing adaptation to consumer trends. As investors seek to diversify their portfolios with precious metals, Costco is poised to capitalize on this growing interest. The future trajectory of these offerings will heavily depend on consumer responses and the broader economic factors influencing the value of precious metals. With its established reputation and market presence, Costco remains well-positioned to navigate the complex terrain of precious metal investments and cater to a clientele that recognizes the importance of diversifying their wealth in challenging economic climates.