Investing decisions are often driven by market sentiments, financial performance, and broader economic indicators. Recently, Jim Cramer has shifted his focus towards BlackRock, the world’s largest asset manager. This decision comes as BlackRock’s stocks have shown vigorous activity, culminating in record highs following impressive third-quarter earnings results. In this article, we will delve into the implications of these developments and the reasoning behind Cramer’s interest in adding BlackRock to his watchlist.

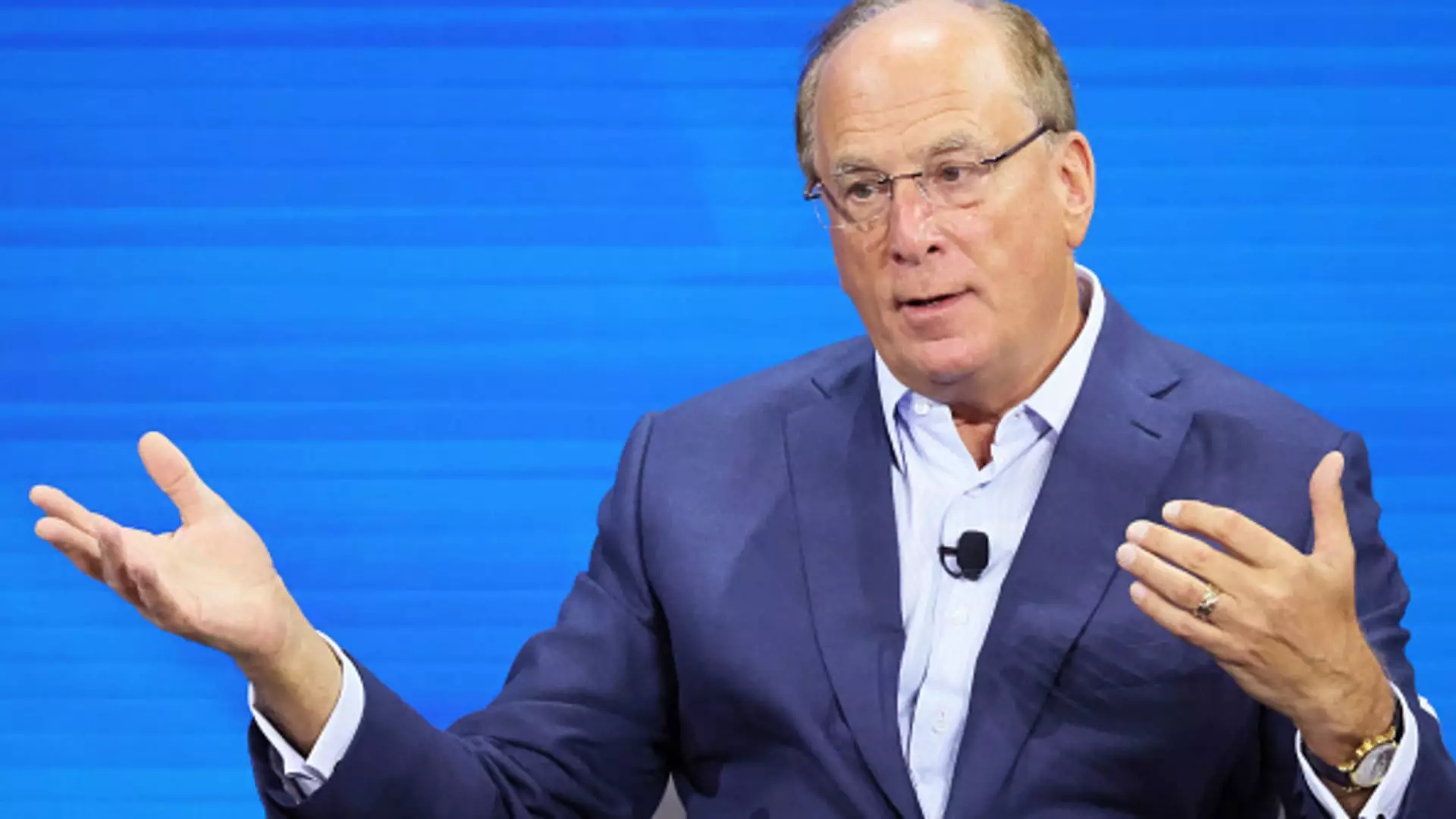

BlackRock’s third-quarter earnings report has certainly made waves in the financial sector, outperforming analysts’ predictions by a considerable margin. The firm’s asset management arms continue to thrive, surging to an unprecedented $11.5 trillion in assets under management. This figure not only emphasizes BlackRock’s dominant position in the industry but also reflects the robust inflows it has garnered from a recovering stock market. As CEO Larry Fink aptly put it, the recent addition of $2 trillion in organic growth over the last five years translates into the firm’s scale approaching that of the sixth largest asset manager globally. This growth trajectory signals a strengthening market presence and exemplifies the company’s strategic initiatives, such as the recent acquisition of Global Infrastructure Partners, which added another $100 billion to its asset pool.

The atmosphere in the financial industry has been relatively tumultuous, marked by fluctuating interest rates and uncertain economic policies. The recent earnings season kicked off with a mixed bag of results across Wall Street giants, but BlackRock’s performance stands out against this hazy backdrop. With the Federal Reserve’s interest rate adjustments—implementing a significant cut of 50 basis points recently—the economic landscape remains a focal point for market analysts. Subsequently, the speculation around potential further cuts has shifted, now leaning towards a conservative estimate of merely 50 basis points before the year’s end. This uncertain monetary policy context could significantly affect investment strategies across the board, providing both opportunities and risks.

Cramer has articulated a cautious approach concerning his investment decisions regarding BlackRock, emphasizing the importance of timing in the financial markets. It is noteworthy that he has been preoccupied with other significant holdings such as Wells Fargo and Morgan Stanley, which could explain the hesitancy in executing a buy on BlackRock. Cramer has highlighted the necessity of strategic patience in his investment philosophy; he refrains from making impulsive decisions even when high-performing stocks emerge. This disciplined stance not only strengthens investor confidence but also aligns with the best practices in portfolio management.

With Cramer’s endorsement and BlackRock’s robust performance, attention shifts to the firm’s future offerings and its ability to maintain or accelerate growth amidst competitive pressures. With its consistent inflows and historic expansion, including a noted 12% increase in share price over the past month against the S&P 500’s 4%, BlackRock presents a compelling case for potential investors. Cramer’s assertion that just because the stock has already surged does not imply it cannot climb further embodies an optimistic outlook toward the firm’s operational momentum.

Jim Cramer’s contemplation of investing in BlackRock stems from the asset manager’s stellar financials and strategic market positioning. The firm’s exceptional earnings and historical growth surge reflect its resilience in an unpredictable economic climate. However, Cramer’s measured and strategic approach to investment highlights the importance of careful consideration and timing. As BlackRock continues to evolve within the competitive landscape, potential investors would do well to stay informed and vigilant, keeping an eye on both market trends and company performance. The financial world is ever-changing, and with figures like Cramer at the helm of investment conversations, BlackRock is undoubtedly a stock worth monitoring closely.