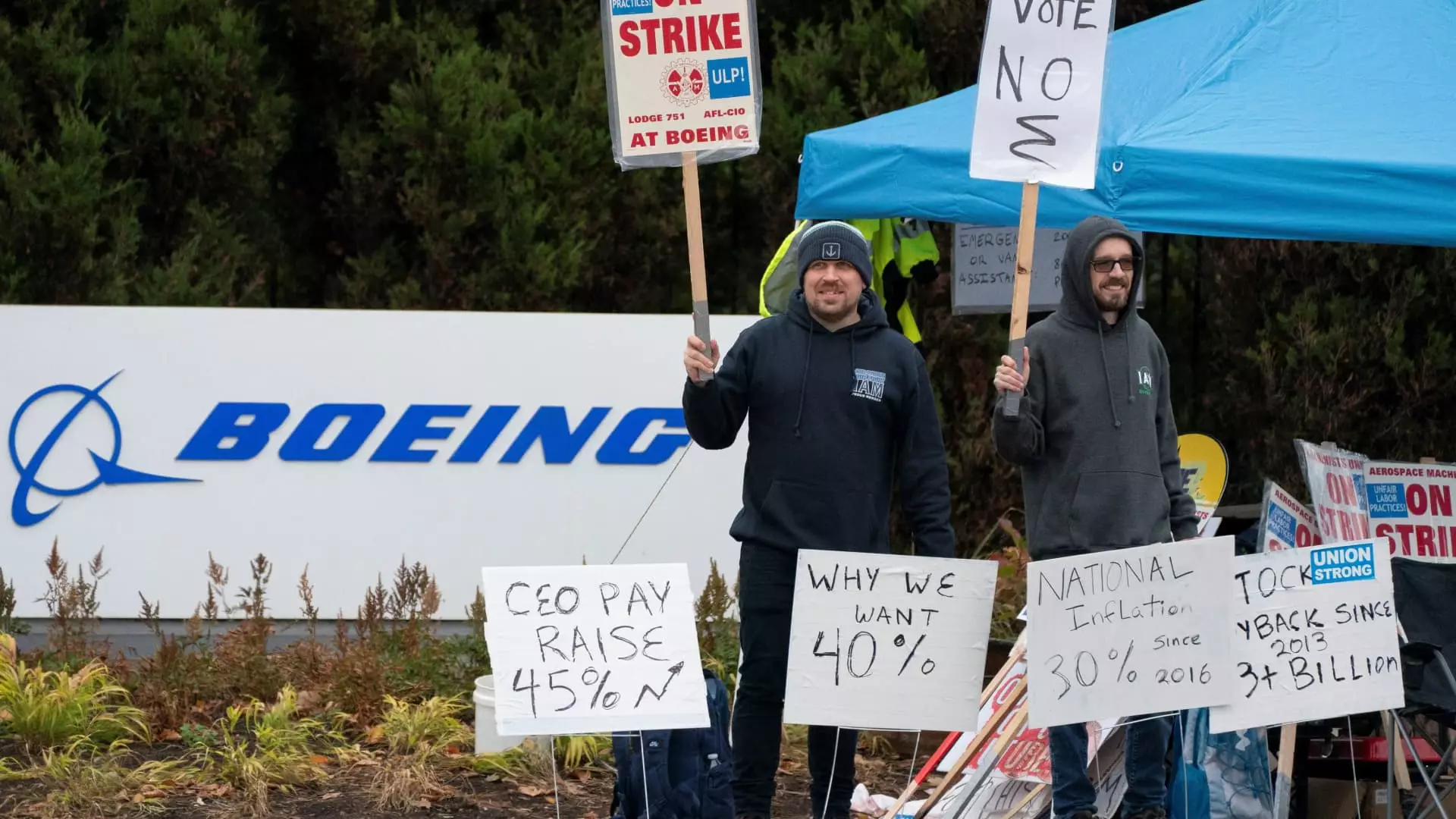

The Boeing machinists’ strike, which started on September 13, has been a significant event, impacting not only the company but also the broader U.S. economy. With more than 32,000 machinists primarily in the Seattle region involved, the ramifications of this work stoppage have prompted concerns about production disruptions in one of America’s key manufacturing sectors. As reports indicate, the strike was initiated after workers rejected initial contract agreements, signaling dissatisfaction with their pay and working conditions. These unions are not merely bargaining chips in corporate negotiations; they represent voices advocating for fair remuneration amidst rising living costs, particularly observable in tech-centric regions.

In a bid to resolve the extended strike, Boeing has proposed a new contract that presents a compelling offer to its workers. This latest settlement includes a generous 38% wage increase over four years, surpassing the previous 35% offer. Additionally, the contract outlines a substantial one-time ratification bonus option of $12,000, or an alternative route comprising a $7,000 bonus coupled with a $5,000 contribution to employees’ 401(k) plans. It exemplifies a strategic maneuver by Boeing, as the company aims to restore normalcy within its operational framework while acknowledging the union’s call for enhanced compensation that reflects the economic realities of its workforce.

Implications for Boeing Going Forward

Boeing’s CEO, Kelly Ortberg, has expressed a desire for unity among workers to stabilize the business and resume production of what has historically been termed “the world’s best airplanes.” The message echoed from Boeing’s corporate office seeks to reintegrate employees into the workplace promptly, emphasizing the financial health of the company that has suffered greatly during the strike. The employment numbers released in October depicted a stark reality where the strike had severely hampered not only Boeing’s production but had repercussions on national employment statistics just days before a crucial presidential election.

Interestingly, the Biden administration has taken an active role in facilitating negotiations between the machinists’ union and Boeing. Acting Labor Secretary Julie Su’s involvement underscores the national significance attributed to the outcome of this struggle between labor and management. The administration’s attention to the situation reflects an understanding that labor relations impact broader economic conditions. President Biden’s support of the machinists’ push for a strong contract indicates an inclination toward nurturing a favorable environment for labor unions while ensuring corporate accountability.

Challenges Ahead for Boeing and Its Workforce

While the newfound contract proposal appears promising, underlying issues persist. Workers have voiced frustration regarding Boeing’s decision to relocate part of its production, such as the 787 Dreamliner, to non-union facilities. This long-standing grievance illustrates a perceived threat to their job security and the union’s strength. Moreover, Boeing’s reputation has been tarnished due to past production oversights and safety incidents, such as the recent midair failure linked to a 737 Max aircraft. Each of these factors compounds the challenge of rebuilding trust among its workforce.

As the machinists’ union prepares to vote on the proposed contract, the stakes are high for both Boeing and its employees. Resolving this stalemate is crucial not only for returning operations to standard levels but also for ensuring that employees feel valued and recognized in their contributions to the company’s success. The outcome of the vote will likely determine whether Boeing can overcome the crisis it has been grappling with in recent years, opening a new chapter toward stabilizing its workforce and addressing the enormous losses it has experienced. The implications of this moment extend far beyond the factory floors, influencing the economic landscape as a whole.