In a notable turn of events, Warren Buffett has substantially reduced his company, Berkshire Hathaway’s, investment in Apple over the last four quarters. As of the close of September, the conglomerate’s holdings in Apple amounted to $69.9 billion, signaling a significant downsizing. This drop includes Buffett divesting about a quarter of his Apple shares, leaving approximately 300 million remaining. This adjustment marks a stark 67.2% decrease from the previous year’s third-quarter figures, raising eyebrows among investors and analysts alike.

Buffett’s selling trend began in the final quarter of 2022 and escalated during the second quarter of this year when he took the surprising step of selling nearly half of his Apple stake. Analysts are left pondering the motivations behind this strategy. While some speculate that elevated valuations triggered this decision, others suggest a desire to manage portfolio concentration may be at play, especially since Apple had once represented half of Berkshire’s equity portfolio.

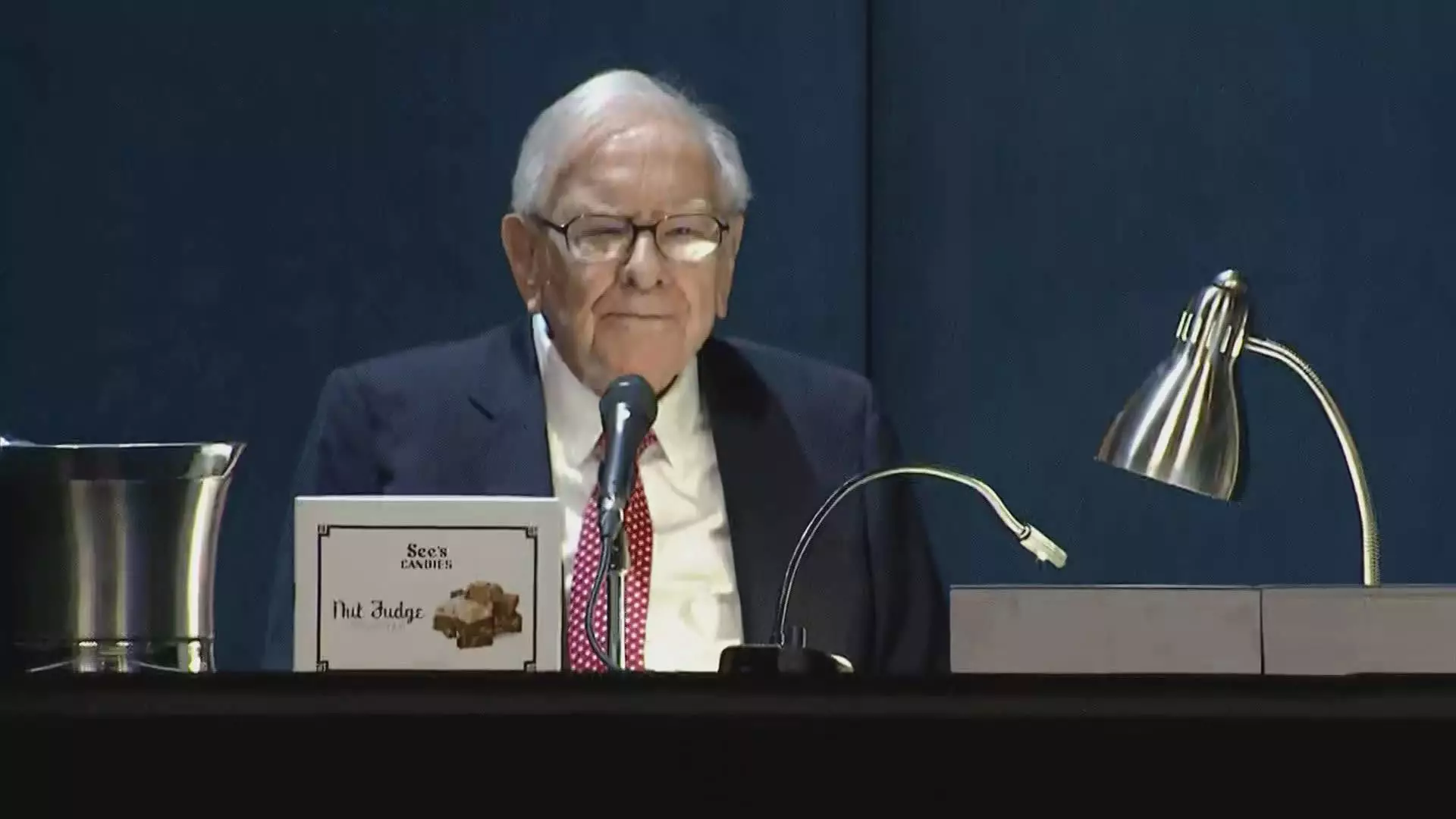

Buffett has also hinted at the possibility that future tax implications on capital gains may have influenced his decisions. During Berkshire’s annual meeting in May, he noted the potential for increased taxes as the government seeks to address a rising fiscal deficit, thus making this divestment partially a pre-emptive financial strategy. However, the scope of these sales indicates a deeper rationale that may go beyond mere tax considerations.

Historically, Buffett approached the technology sector with caution, shying away from investments that he believed fell outside his “circle of competence.” However, in a remarkable change of heart, he embraced Apple, attracted by its devoted customer base and the pervasive demand for its products, particularly the iPhone. Over time, Buffett escalated his stake in Apple until it became his flagship investment, even dubbing it the second most crucial business behind his stable of insurance firms.

As the continuing sell-off unfolds, it’s essential to note the broader implications for Berkshire Hathaway. The company’s cash reserves have ballooned to a record $325.2 billion in the third quarter, prompting speculation about Buffett’s next moves. Interestingly, during this same period, there was a complete halt in share buybacks, which raises questions regarding the strategic direction of the company amidst this liquidity-rich environment.

Despite these adjustments, Apple’s stock has shown resilience, gaining 16% year-to-date, yet it lags behind the S&P 500, which has surged by 20%. This discrepancy in performance could reflect market reactions to Buffett’s sell-off, leaving some investors cautious about the tech giant’s near-term potential.

Ultimately, Warren Buffett’s recent actions underscore a complex interplay of financial strategies, market dynamics, and personal philosophies. The future of Berkshire Hathaway’s investments in technology and specifically in Apple will be closely monitored, with analysts eager to uncover the underlying strategy behind one of the investment world’s most celebrated figures. As the narrative unfolds, investors will remain vigilant, anticipating how these significant changes may reshape the landscape of Buffett’s investment legacy.