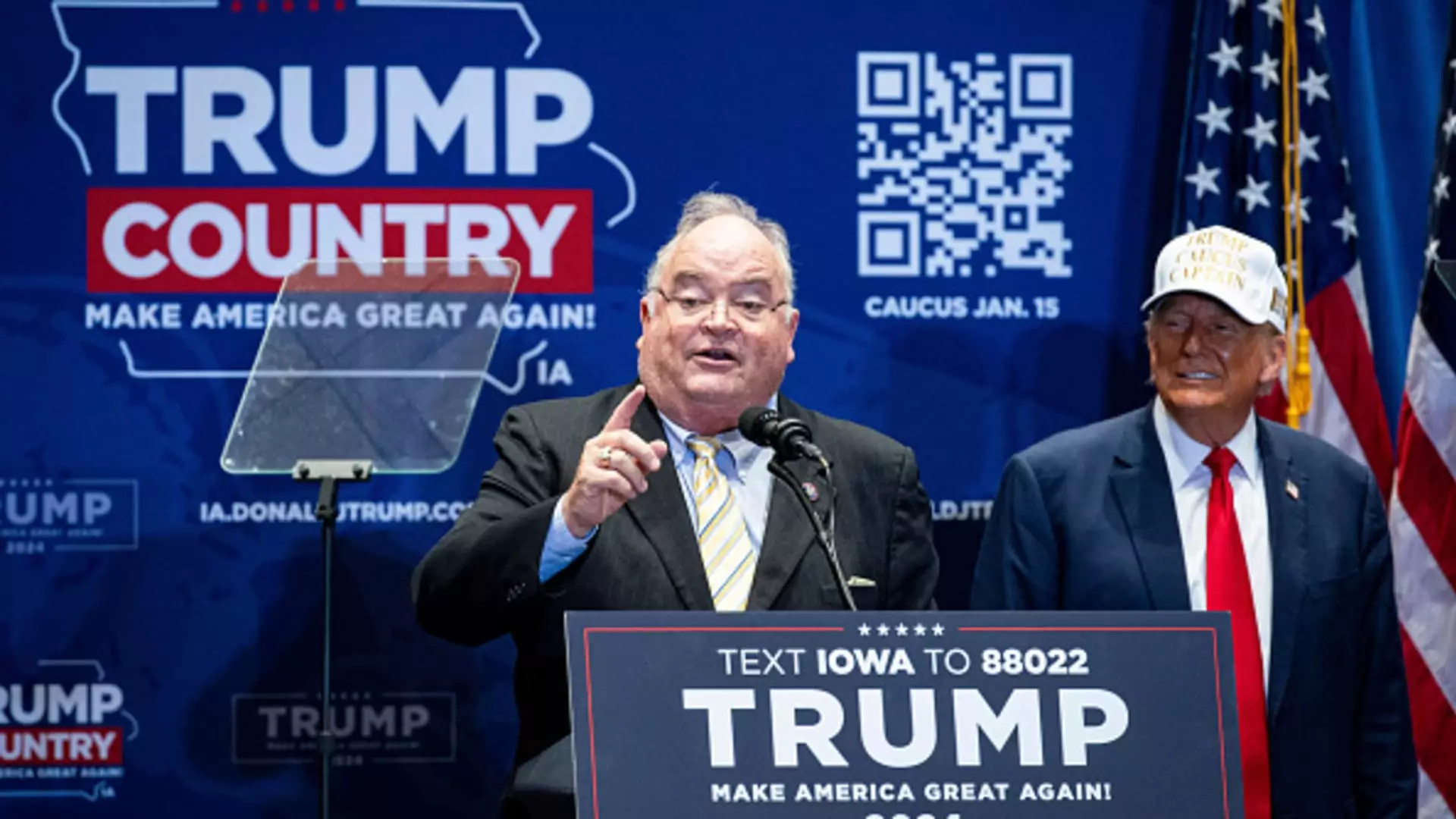

The announcement of Donald Trump’s nomination of former Missouri Congressman Billy Long to lead the Internal Revenue Service (IRS) has sparked significant discussion and debate. As the IRS embarks on a multi-faceted overhaul, Long’s potential leadership raises questions about direction and priorities for an agency grappling with modernization, enforcement, and taxpayer trust. This analysis delves into the implications of Long’s nomination, examining the potential challenges and opportunities that lie ahead for the IRS under his leadership.

Long’s selection represents a pivotal moment in the IRS’s ongoing transformation. The agency has been granted nearly $80 billion in funding by Congress, aimed at restructuring customer service, enhancing technology, and potentially launching a free filing program. These initiatives intend to improve taxpayer experience while also intensifying enforcement actions to recuperate unpaid taxes from affluent individuals and corporations. Long’s background and intentions, however, remain a subject of scrutiny.

His tenure in Congress, alongside a career that included auctioneering, provides a unique, albeit unconventional, perspective on tax issues. While Trump argues that Long’s experience offers an advantage in navigating the complexities of the IRS, critics are wary. Previous IRS leaders have typically come from more traditional backgrounds, which raises questions about Long’s capability to understand the intricacies of the agency effectively.

Long’s appointment is poised to initiate friction points in an already fragmented political landscape. Democrats have expressed sharp reservations regarding his candidacy. Senators like Ron Wyden have labeled the choice as “bizarre,” particularly highlighting Long’s post-congressional activities in the tax advisory space, where issues regarding credibility and ethics have surfaced, especially concerning the Employee Retention Tax Credit. This pandemic-era relief program has come under fire due to numerous improper claims and associated scams that have tainted the narrative around tax reform efforts.

The stark political divide creates an uphill battle for Long, considering an administration’s history of contentious relationships with tax agencies. Although the Republican majority, including figures like Senator Mike Crapo, supports Long’s vision for reforming the IRS—with an emphasis on efficiency and taxpayer protection—this support is far from universal. Navigating differing agendas will require delicate political acumen and an exceptional understanding of bipartisan dynamics.

If confirmed, Long will be tasked with executing a vision that balances enforcement objectives with user-friendly services, an increasingly pivotal aspect for modern tax administration. As the IRS continues to automate and digitize processes, the need for robust cybersecurity measures and data privacy standards are paramount. The growing complexity of tax regulations in the U.S. necessitates not only strict enforcement against tax evasion but also competent guidance for taxpayers filling out returns.

Long’s prior experience with small businesses may equip him to advocate for reform that addresses compliance burdens. His ability to effectively communicate with both taxpayers and policymakers will be critical in rebuilding trust in the IRS, particularly after ongoing claims of inefficiency and bureaucratic hurdles.

The independence of the IRS is a cherished principle that must be safeguarded, differing views may emerge about how best to uphold this autonomy. Ensuring that the IRS operates free from political pressure will be a delicate responsibility for Long. Achieving a balance between enforcement and service—a frequent criticism of the agency—will require careful strategy and an understanding of taxpayer sentiment.

Furthermore, maintaining the agency’s credibility amidst a politically fraught atmosphere will demand transparency and accountability in operations. Building relationships across party lines while simultaneously ensuring that the IRS can execute its functions efficiently is crucial for sustaining public confidence.

Billy Long’s nomination as the head of the IRS embodies both potential and challenge in an ever-evolving political landscape. While some view this appointment as an opportunity for much-needed reform, others perceive it as a concerning shift that may not align with the values of fairness and integrity. As the agency faces unprecedented scrutiny and transformation, Long’s leadership will be pivotal in shaping how the IRS serves and protects taxpayers. Clear communication, bipartisan engagement, and a commitment to upholding the agency’s crucial role in American society will define whether Long’s tenure can successfully bridge the gap between enforcement and facilitation.