China’s push for revitalizing consumer spending through its ambitious trade-in policy has stirred a wave of speculation and caution among industry experts and businesses. Despite the government’s commitment to allocate 300 billion yuan (approximately $41.5 billion) toward enhancing trade-ins and upgrading equipment, the tangible impacts of this initiative remain elusive. This article delves into the complexities surrounding China’s trade-in policy, the challenges it faces, and its potential implications on the economy.

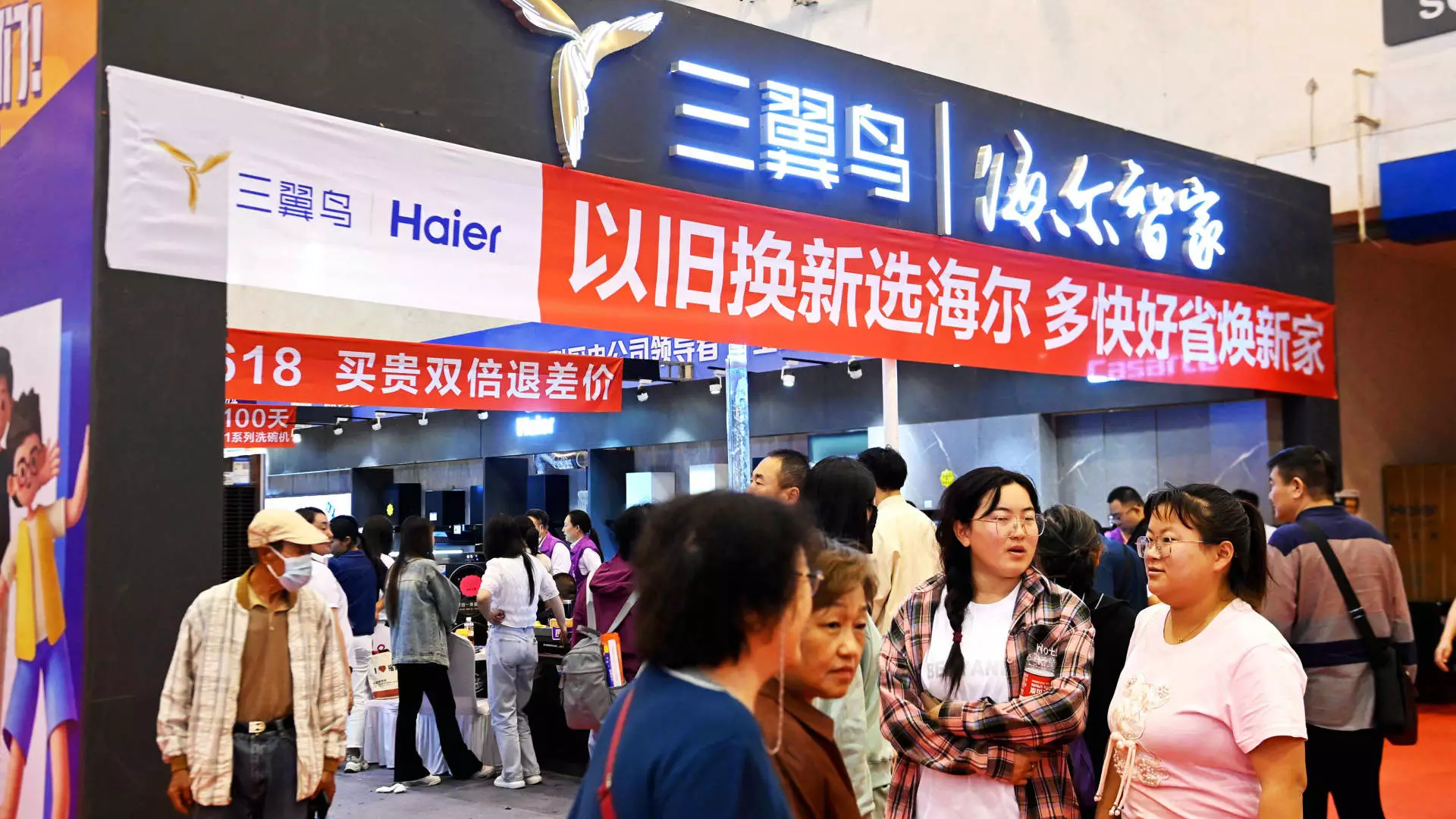

In July, amidst a backdrop of sluggish consumption growth, China announced its plan to allocate a substantial sum to improve its trade-in and equipment upgrade strategies. This initiative aims to boost purchases of automobiles, home appliances, and vital machinery, enabling consumers to trade their older models for discounts on new products. However, the crux of the plan necessitates consumers to have both cash and used goods to participate in the program, creating an inherent barrier to widespread adoption.

Industry analysts and stakeholders have expressed doubts regarding the potential effectiveness of these measures. Jens Eskelund, the president of the EU Chamber of Commerce in China, highlighted a prevailing atmosphere of skepticism, noting a lack of a direct correlation between the announced measures and concrete results on the ground. As businesses await measurable outcomes, they face a critical juncture where effective execution of policy could either rejuvenate the economy or stall amid consumer hesitance.

One significant hurdle for the trade-in policy lies in the cautious attitude of Chinese consumers. A report by the EU Chamber suggests that the actual financial benefit reaching households may be limited, potentially undermining the intended consequences of the scheme. The notion of requiring consumers to spend money upfront could deter participation, particularly in a climate where consumer confidence is already fragile.

UBS Investment Bank’s chief China economist, Tao Wang, indicated that the trade-in program may only buoy retail sales marginally, estimating its impact to be no more than 0.3% in 2023. This limited effectiveness raises questions about whether the current approach can stimulate the broader economic activity necessary for long-term recovery. The contrasting statistics in recent retail performance — a growth rate of merely 2% in June and an improvement to 2.7% in July — highlight the uphill battle that lies ahead.

The complexities involved in implementing the trade-in policy on a local level cannot be overlooked. While central government mandates are set, the efficacy of these initiatives heavily depends on how swiftly and effectively local officials can translate these guidelines into actionable programs. Installment of concrete measures has only begun taking shape recently, with many regions still finalizing operational details.

Furthermore, stakeholders within various sectors, including major elevator firms like Otis and Kone, report mixed outcomes in light of the new program. Otis noted a decline in equipment sales during the second quarter, which underscores a gap between governmental intentions and actual market responsiveness. Although optimism remains about future opportunities, the timing of when these benefits will manifest remains unclear.

On the other hand, businesses like ATRenew, which processes second-hand goods, remain hopeful. While immediate benefits may not be apparent, ATRenew executives believe that longer-term effects will bolster the second-hand market and drive consumer behavior towards trade-ins, particularly in select categories. This nuanced perspective is crucial for understanding the broader impact of such government initiatives.

China’s ambitious trade-in policy reflects the government’s awareness of urgent economic challenges but also reveals significant limitations tied to consumer behavior, implementation dynamics, and market readiness. While initiatives aimed at bolstering consumption are commendable, they must be matched with practical strategies that effectively engage consumers and address their reservations.

As businesses monitor the unfolding implications of these policies, their readiness to adapt will play a crucial role in shaping the economic landscape. While the long-term prospects look promising, immediate results could be slow to materialize. The challenge lies not only in mobilizing funds but also in fostering an environment where consumers feel confident to engage actively in the market. The upcoming months will be vital in determining whether these efforts pave the way for robust economic growth or if they remain a well-intentioned but underwhelming endeavor.