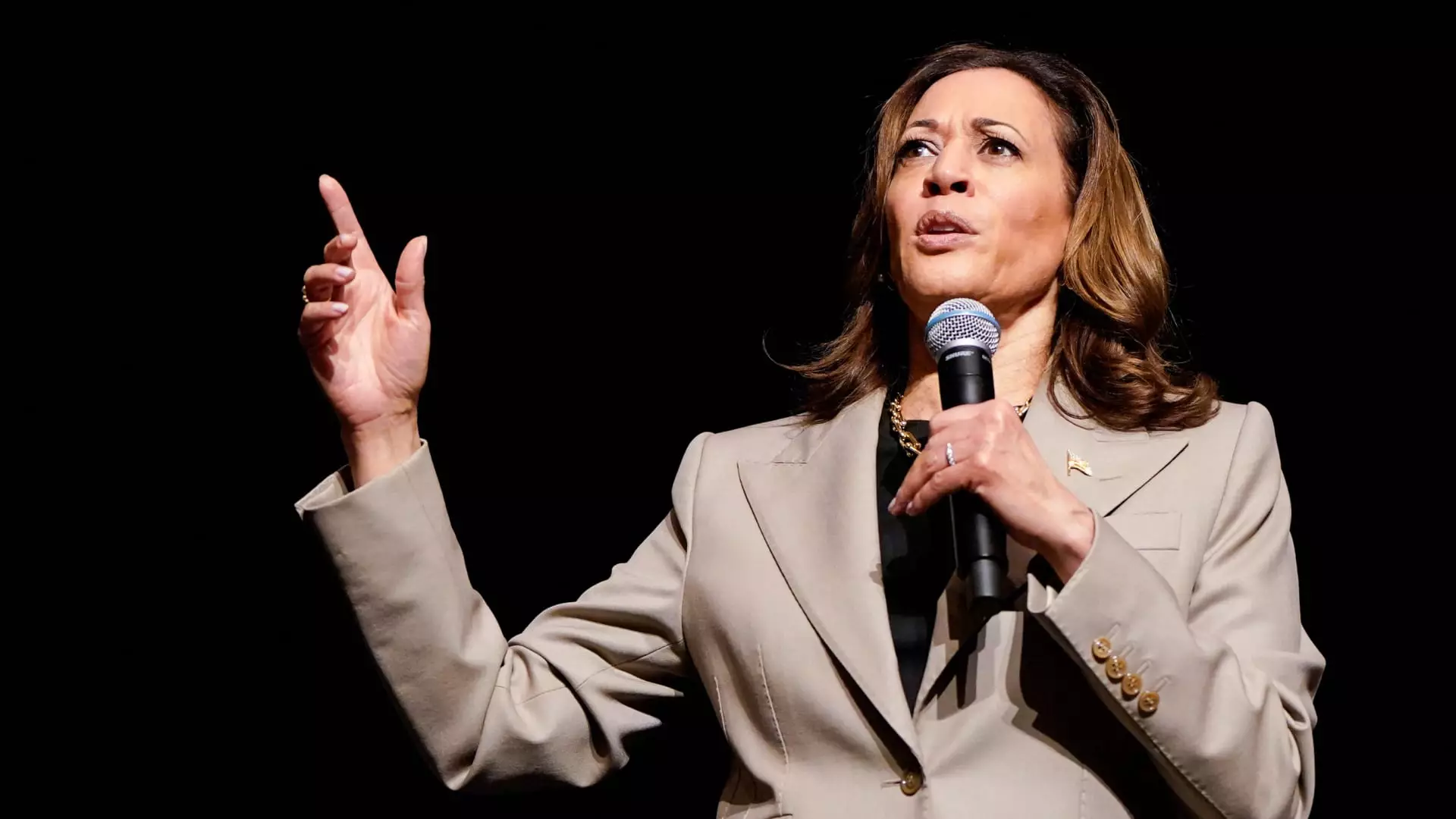

Vice President Kamala Harris recently unveiled an economic plan that includes an expanded child tax credit worth up to $6,000 to provide tax relief for families with newborn children. This plan aims to build on the higher child tax credit that was enacted via the American Rescue Plan in 2021.

Harris’s proposed tax break is designed to increase support for middle- to lower-income families during the first year after a child is born, providing $6,000 in total tax relief. This proposal stands out as it would offer families a significant boost during the crucial period following the birth of a child.

Political Landscape

The unveiling of Harris’s economic plan comes shortly after Senator JD Vance of Ohio, a former GOP running mate of President Donald Trump, suggested a $5,000 child tax credit. This aligns with a statement from a Trump campaign official indicating that Trump is open to expanding the child tax credit.

Reception and Response

Although Harris’s proposed child tax credit expansion mirrors President Joe Biden’s stance, the addition of a $2,400 bonus for newborns has raised eyebrows. Some experts, like Kyle Pomerleau from the American Enterprise Institute, view this bonus as a strategic move possibly influenced by Vance’s proposal.

Despite broad support in the House, an expanded child tax credit was blocked by Senate Republicans in August. However, there is hope for reconsideration post-election, as there appears to be bipartisan momentum behind expanding the child tax credit.

The cost implications of expanding the child tax credit are significant. For example, increasing the credit to $3,000 or $3,600 could amount to $1.1 trillion over a decade. The Harris campaign’s proposal for a $6,000 credit for newborns carries a price tag of $100 billion, raising questions about fiscal responsibility and long-term budget sustainability.

Future Outlook

Moving forward, the size and scope of the child tax credit expansion will largely depend on the outcome of the elections and the balance of power in the White House and Congress. It remains to be seen how lawmakers will navigate the competing demands of fiscal responsibility and social support programs.

Vice President Kamala Harris’s economic plan to expand the child tax credit reflects a commitment to supporting families during key life milestones. However, the feasibility and impact of such a bold proposal must be carefully weighed against the backdrop of budget constraints and political realities. As the debate surrounding the child tax credit continues to unfold, it is essential for policymakers to prioritize both financial prudence and social welfare in crafting sustainable economic policies.