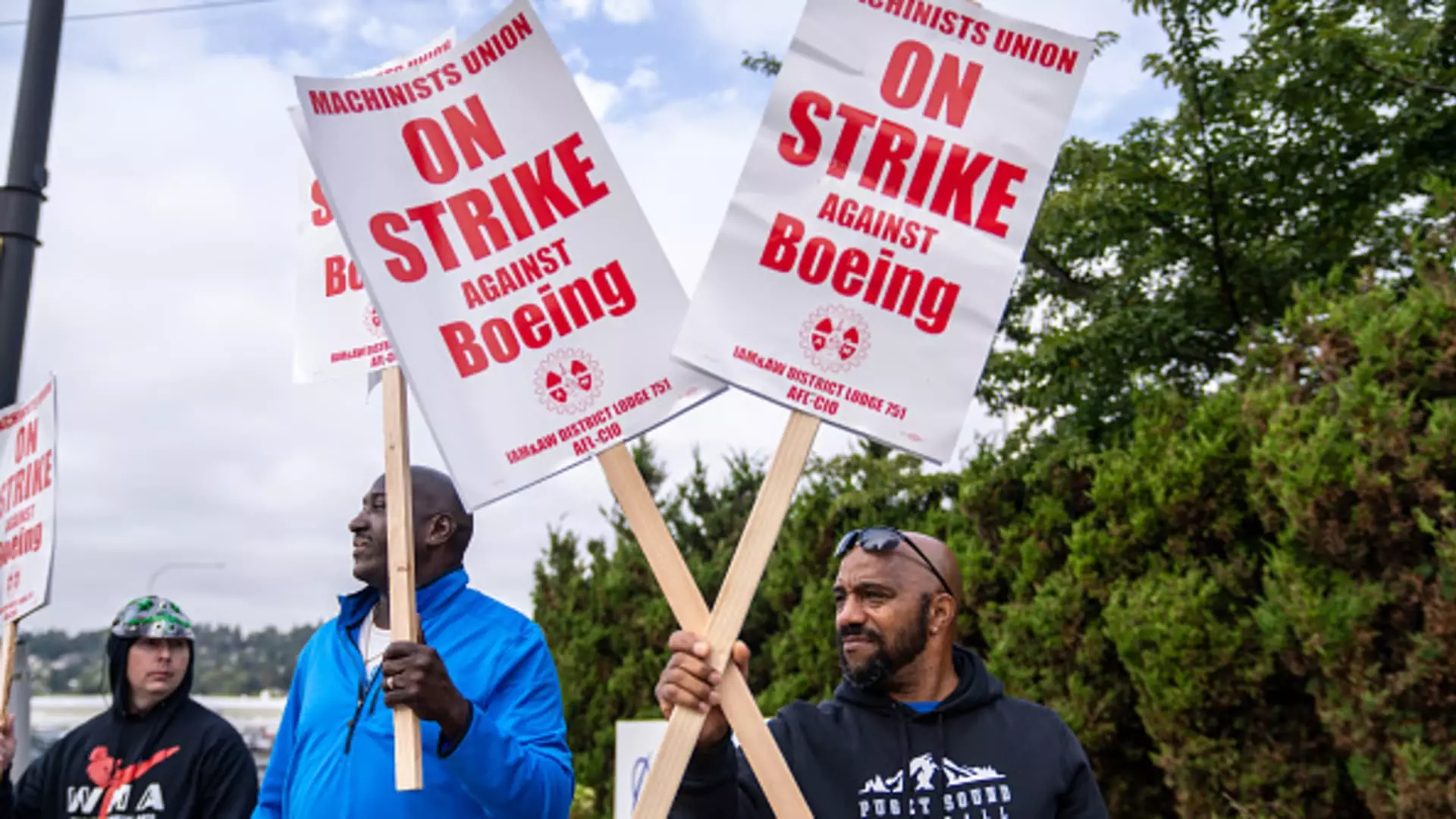

In a dramatic turn of events, Boeing finds itself at a pivotal crossroads, marked by a significant strike that began over a month ago when over 30,000 machinists walked off the job following a substantial rejection of a tentative contract. This strike reveals not just the power dynamics within Boeing but also highlights the escalating pressures on newly appointed CEO Kelly Ortberg, as he navigates a manufacturing giant besieged by crises. The strike’s financial burden on Boeing, estimated by S&P Global Ratings to exceed $1 billion monthly, adds gravity to the already challenging landscape shaped by previous operational turmoil, including the infamous 737 Max incidents that have haunted the company for years.

The strike’s implications ripple far beyond immediate financial losses; they signify a stifling halt in production across Boeing’s facilities, especially in the Seattle area. This production paralysis denies Boeing crucial cash flow, compelling Ortberg to devise strategies that may save face amid plummeting stock prices and increasing investor scrutiny. Unfortunately, optimism expressed by Boeing officials prior to the strike fizzled out when the overwhelming rejection of the labor agreement became apparent.

Efforts to resolve the strike have only complicated matters, as certified negotiations have crumbled under mounting tensions. Boeing’s recent formal accusation against the International Association of Machinists and Aerospace Workers paints a portrait of escalating conflict, rooted in allegations of bad faith negotiations that exacerbate the stalemate. The sentiments expressed by Jon Holden, president of the striking machinists’ union, exemplify the collective frustration and desperation for a resolution that truly caters to workers’ needs instead of merely settling for corporate platitudes.

As the temperature rises amidst these negotiations, union members find themselves in a precarious position, as they are devoid of paychecks and have lost essential health benefits. Nonetheless, unlike the 2008 labor strike, the presence of alternative job opportunities in the Seattle area—such as food delivery and warehouse work—provides a silver lining for affected workers who seek to bridge the financial gap during these challenging times.

While Ortberg faces the formidable task of reinstating normal operations, he must also reckon with the ramifications of Boeing’s recent decisions, which include a substantial reduction in its workforce and a halt to certain production lines. The unexpected announcement of a workforce reduction by approximately 10% bubbles up as an additional layer of strain, particularly as the company grapples with an expected significant loss for the third-quarter performance report.

Investor apprehension is palpable, as further deterioration in Boeing’s financial positioning has led to discussions about the potential for the company’s credit rating to plunge into junk status. A variety of complications—ranging from halted production of the 737 Max to inefficiencies in the supply chain—culminate in a dire narrative about Boeing’s viability as a leader in the aerospace industry. The downward spiral of share prices and the forecast of considerable financial losses exacerbate concerns that the machinery of Boeing is not merely stalled but has been rendered inefficient by overarching systemic issues.

As Boeing finds itself grappling with its legacy and future, one critical aspect remains undeniably clear: the dialogue between management and labor must evolve from mere negotiations to genuine collaboration. Industry experts assert that effective resolution requires not just a compromise that meets immediate obligations but a comprehensive understanding of mutual benefit that recognizes the essential role of labor in sustaining Boeing’s recovery trajectory. The balance sheet of labor costs accounts for a mere fraction—approximately 5%—of the final price of an aircraft, which raises questions about whether Boeing’s strategy to cut costs through layoffs is rather shortsighted.

The future of Boeing hinges on Ortberg’s capacity to inject new life into an embattled workforce and to create a plan that emphasizes sustainable production without crippling the company’s foundational relationship with its employees. In a market where transparency and trust are paramount, Boeing must prioritize open communication streams to quell discontent among union members. As negotiations may elongate into weeks, the spectrum of labor unrest remains potent, threatening to erode Boeing’s reputation and further destabilize an already shaky operation.

With anticipation building as Ortberg prepares to address investors for the first time since taking the helm, the coming weeks will be crucial as Boeing seeks to navigate through these discontented waters. The interplay between labor demands, corporate strategies, and market expectations will define not only the fate of the company but perhaps also the broader aerospace industry’s evolution. Only time will tell if Boeing can reclaim its stature or if it will continue to grapple with strikes, financial duress, and a potentially tarnished legacy.