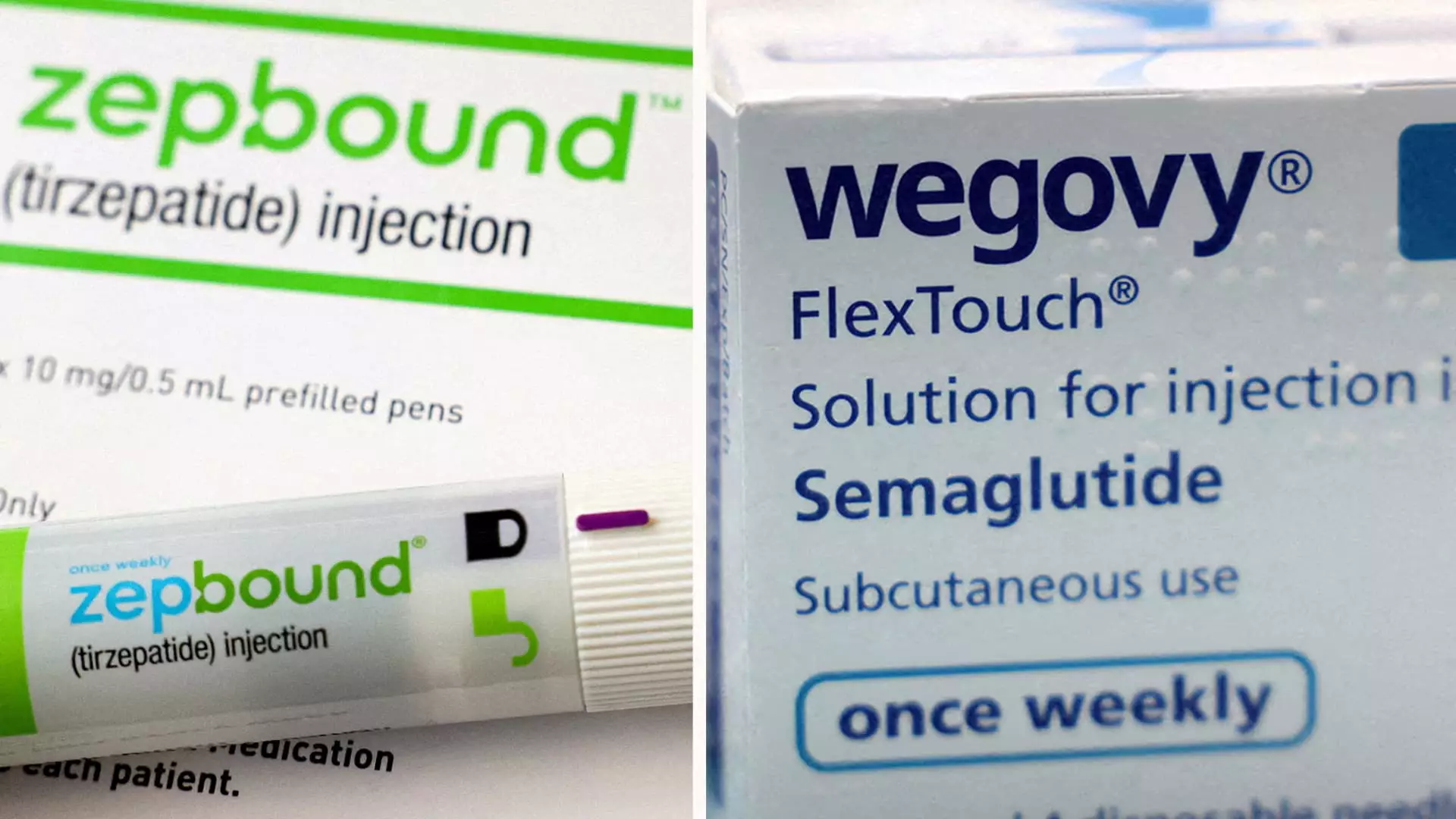

Recent developments in the realm of obesity medications have captured significant attention, particularly following Eli Lilly’s announcement regarding its drug, Zepbound. The findings from a head-to-head clinical trial against its primary competitor, Novo Nordisk’s Wegovy, have positioned Zepbound as a potentially superior option for weight loss treatment. The trial results indicated that patients treated with Zepbound achieved an impressive average weight loss of 20.2%, approximately 50 pounds, over a 72-week period. In contrast, participants using Wegovy saw a mean weight reduction of 13.7%, translating to about 33 pounds during the same timeframe.

The implications of these findings are profound, especially as obesity rates continue to escalate globally. With the trial showing a remarkable 47% higher relative weight loss with Zepbound compared to Wegovy, the data represents a pivotal moment in obesity treatment research and development. Furthermore, Zepbound’s efficacy is underscored by the trial revealing that over 31% of participants experienced a weight loss exceeding 25% of their body weight, whereas only about 16% of Wegovy users reached that benchmark.

The recent study stands out due to its random assignment of 751 participants, which lends credibility to the results. Focused specifically on individuals classified as obese or overweight with at least one associated medical condition—excluding diabetes—this trial illustrates a robust methodology that aligns with rigorous clinical research standards. The specificity in patient selection is integral as it replicates real-world scenarios where individuals often grapple with additional health complications due to excess weight.

Dr. Leonard Glass, a senior vice president at Eli Lilly, emphasized the necessity of such studies in guiding healthcare providers and patients through the intricacies of treatment choices amidst the burgeoning interest surrounding obesity medications. The trial not only sheds light on the effectiveness of Zepbound but also contributes essential data to the broader discourse on obesity management.

The competition within the weight-loss drug market is intensifying, with Eli Lilly and Novo Nordisk vying for dominance. Some analysts predict this lucrative market could balloon to an estimated $150 billion annually by the early 2030s. Zepbound, having entered the market later than Wegovy—who debuted approximately two years earlier—has nonetheless stirred optimism about its potential sales trajectory. GlobalData, a data analytics firm, postulates that Zepbound could reach an annual revenue of $27.2 billion by 2030, a figure that surpasses Wegovy’s projected $18.7 billion for the same year.

As demand surges, both Eli Lilly and Novo Nordisk have committed substantial resources to enhance their manufacturing capabilities. The challenges of supply and demand dynamics have been acknowledged, with both drugs experiencing periods where supply could not meet the considerable patient demand, propelling these companies into action.

Despite the promising results from clinical trials, economic considerations continue to hinder patient access to these therapies. In the U.S., the monthly cost for both Zepbound and Wegovy hovers around $1,000, and the inadequacies in insurance coverage for weight-loss medications present an additional barrier for patients. This stark reality casts a shadow over the otherwise promising landscape of obesity treatment options.

In terms of pharmacological mechanisms, Zepbound operates through a dual action of appetite suppression and blood sugar regulation, targeting both GIP and GLP-1 gut hormones. On the other hand, Wegovy primarily activates GLP-1 without influencing GIP. Emerging research suggests that these distinctions could offer insights into variations in individual responses to the medications, thus further complicating the decision-making process for both patients and healthcare providers.

As Eli Lilly’s Zepbound emerges as a potential leader in the obesity drug market, the findings from recent trials illuminate critical advancements in treatment efficacy. The weight loss results, in comparison to established competitors, not only heighten expectations but also inspire optimism for those struggling with obesity. Moving forward, it is vital for stakeholders—including pharmaceutical companies, healthcare professionals, and policymakers—to address the barriers to access and conduct ongoing research, ensuring safe and effective treatments reach the patients who need them most.