On a significant Thursday, the Biden administration revealed its latest initiative aimed at alleviating student debt burdens across the nation. This so-called final round of student loan forgiveness has been earmarked to alleviate over $600 million in liabilities for approximately 8,650 borrowers, a gesture that underscores a commitment to rectifying the longstanding struggles faced by graduates. Among those benefiting from this relief are 4,550 individuals eligible for debt cancellation through the Income-Based Repayment (IBR) plan and an additional 4,100 former students of DeVry University, a for-profit institution now facing scrutiny for misleading claims regarding its job placement rates.

The relief granted to DeVry University alumni has roots intertwined with allegations of deception that surfaced in findings released by the U.S. Department of Education in February 2022. The revelations indicated that the institution had significantly inflated its job placement rates, an act deemed exploitative to students who, in good faith, sought education that promised career advancement. As it stands, the university’s silence in response to the forgiveness announcement raises questions about accountability and the need for transparency in higher education. Such cases spotlight a critical aspect of the student loan crisis: the responsibility of educational institutions in upholding the integrity of their claims.

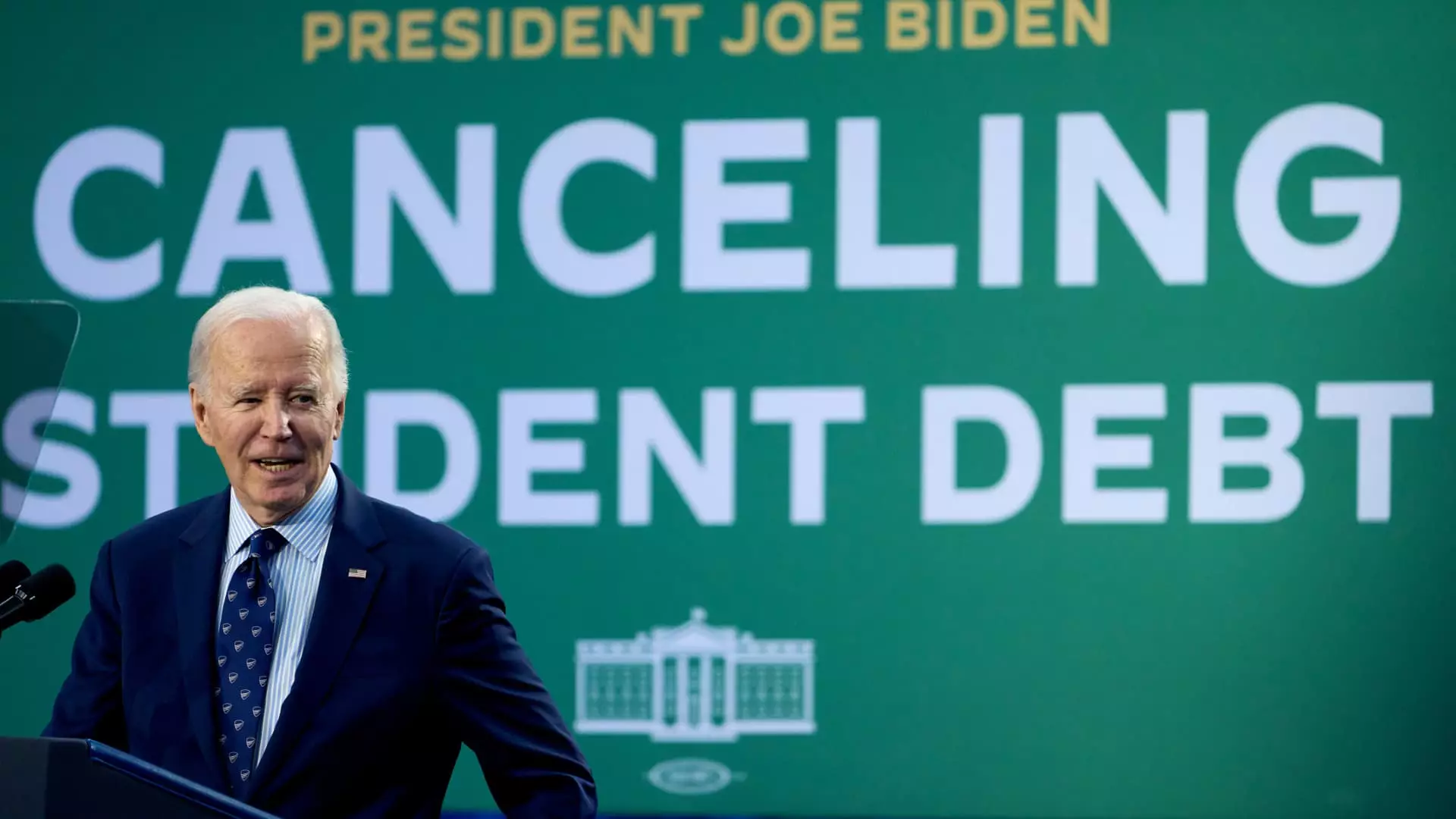

Over his presidency, President Biden has managed to forgive a staggering $188.8 billion in student loans for approximately 5.3 million borrowers. This recent announcement marks not only a financially impactful moment for those individuals but also concludes a significant chapter in Biden’s efforts to reshape America’s student loan landscape. Mark Kantrowitz, an acknowledged expert on higher education finance, recently remarked that Biden’s tenure is characterized by unparalleled debt forgiveness compared to his predecessors. Nonetheless, these actions are juxtaposed against the backdrop of the Supreme Court’s recent decision to block large-scale student loan forgiveness plans, reflecting the ongoing challenges the administration faces in navigating the complexities of policy advocacy and judicial scrutiny.

Despite the hurdles, U.S. Secretary of Education Miguel Cardona emphasized that the administration is committed to addressing the “broken” student loan system. His statement highlights a pledge made four years ago to rectify an educational financing framework that has failed many borrowers. This includes significant revisions to existing relief programs, showcasing a proactive approach to not just student debt cancellation, but also to enhancing the accountability of loan servicers. Consumer advocates have long criticized these servicers for their inability to effectively monitor borrowers’ progress towards loan forgiveness. Enhancements made to the system now allow borrowers to access accurate payment counts, a move expected to enhance transparency and trust between students and their lenders.

Though these initiatives signify progress, they also illuminate the larger systemic issues that persist within the realm of student loans. As student debt levels continue to rise, the conversation surrounding accessible education and responsible lending practices must remain at the forefront. The Biden administration’s actions reflect an essential turning point, yet the journey toward comprehensive reform is far from over. Recognizing the real-world implications of these financial policies remains crucial as millions continue to await signs of relief and a reversal of the mounting pressures of student debt. The ongoing efforts and discussions promise a future where education is more attainable and financial stability is not an unattainable dream for millions of Americans.