China stands at a crucial juncture in its economic journey. With a series of anticipated government supports yet to demonstrate tangible effects, investors remain concerned about the country’s sluggish recovery. Following recent policy adjustments that have included interest rate cuts and expansive stimulus plans initiated in late September, economic performance indicators reveal lingering challenges. As the official GDP figures for 2024 approach, the focus is on understanding China’s economic dynamics, particularly those influencing domestic consumption and investment.

Despite the government’s announcements of future fiscal interventions, substantial details will not emerge until the parliamentary session in March. Investor apprehension is rooted in the underwhelming impact of the current fiscal measures, as articulated by the BlackRock Investment Institute. Their recent reports underscore the limitations of preliminary stimulus efforts in addressing the deep-seated issues affecting economic growth.

One of the most pressing concerns highlighted in recent discussions about China’s economy is the pronounced decline in domestic demand. With consumer prices rising only modestly—0.5% in 2024 excluding volatile food and energy costs—there are palpable fears of deflation. This is the lowest consumer price increase observed in over a decade, suggesting a fundamental weakness in consumer sentiment.

Yin Yong, the Beijing city mayor, acknowledged the systemic issues plaguing consumer spending and foreign investment in an official report. Low consumer confidence has bred stagnation in various industries, an unsettling trend reflected in the city’s inflation targets and broader economic goals. The aspiration for a mere 2% inflation rate by 2025 sets a stark contrast against a backdrop of declining demand.

The commercial property sector, a traditional pillar of economic stability in China, further illustrates these economic strains. Predictions indicate continued pressure on property markets, with notable declines in rental prices for Grade A office spaces, plummeting by 16% in 2024. These statistics underscore enduring concerns about overcapacity and decreased demand in a market historically characterized by dynamism.

Interestingly, new shopping centers opened in 2024 were initially occupied at rates lower than the historical norms, revealing a paradigm shift in consumer behavior. Nonetheless, as these malls adapt, occupancy rates have reportedly improved, reflecting gradual recovery in consumer footfall.

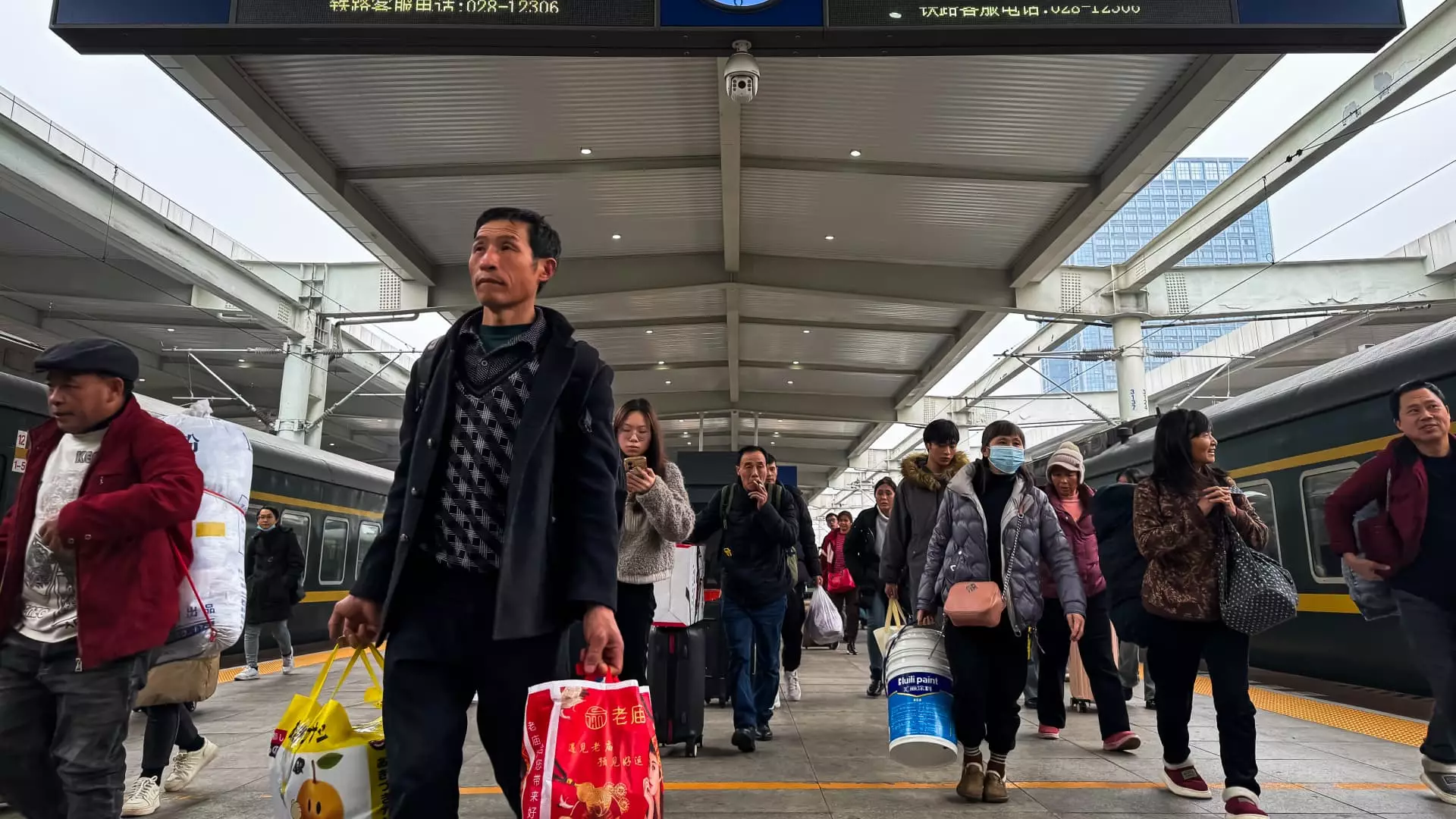

China’s strategy contrasts sharply with the U.S. response during the Covid-19 pandemic, where direct cash payments were widely distributed. Instead, Beijing’s approach involved introducing trade-in subsidies and funding for equipment upgrades, totaling 150 billion yuan ($20.46 billion). This initiative aims to incentivize consumer spending through the promotion of high-end product trades and upgrades, albeit its long-term efficacy remains a topic of speculation.

Real estate historically comprised a significant portion of China’s GDP, but recent government interventions aimed at alleviating the sector’s downturn raise critical questions. After years of stringent regulatory measures targeting excessive developer debt, a strategic pivot was announced in September to rejuvenate this vital market. However, analysts caution that ongoing high inventory levels in smaller cities could lead to further declines in housing prices and prolonged challenges in construction.

Reports suggest that in cities like Foshan, real estate inventories are jeopardized with supply that could take over a year to clear, highlighting the complexity of managing market dynamics effectively. Despite temporary boosts in sales figures in larger urban centers, uncertainties loom over the sustainability of this rebound amid looming fiscal and infrastructural constraints.

As China grapples with domestic economic challenges, the broader geopolitical landscape has intensified, particularly in relations with the United States. Efforts to secure domestic supremacy in strategic sectors have reshaped business dynamics, compelling numerous foreign entities to reconfigure their operations in China. This shift towards prioritizing national security reflects a deliberate move to bolster local industries amid dependency risks exacerbated by international tensions.

The focus on enhancing consumption—now regarded as the cornerstone of this year’s policy shifts—emphasizes Beijing’s commitment to nurturing domestic markets while accommodating a broader security agenda. Officials anticipate that renewed emphasis on stimulating consumer markets will foster resilience, although it’s vital for stakeholders to monitor the real impacts of these strategic moves.

While the Chinese economy stands poised for potential recovery through stimulus measures and a latent but vital consumer base, numerous systemic challenges demand attention. Upcoming fiscal policy announcements in March will be pivotal in shaping market sentiments, but immediate solutions must address the multifaceted pressures weighing on economic growth. As domestic demand remains tepid amidst shifting geopolitical realities, the success of China’s economic strategies will hinge on their ability to balance consumption stimulation with long-term structural reforms. The evolving economic narrative will undoubtedly require careful observation and analysis from investors and policymakers alike as China navigates these turbulent waters.