Nvidia is about to unveil its fiscal third-quarter earnings report, a pivotal moment that will captivate both investors and analysts. Scheduled for release after market close, the tech giant’s results are highly anticipated, with Wall Street projecting revenues of approximately $33.16 billion, accompanied by an adjusted earnings per share (EPS) of 75 cents. These figures come at a crucial time in Nvidia’s trajectory, as the company seeks to maintain its rapid growth in the rapidly evolving artificial intelligence landscape, now entering its third year.

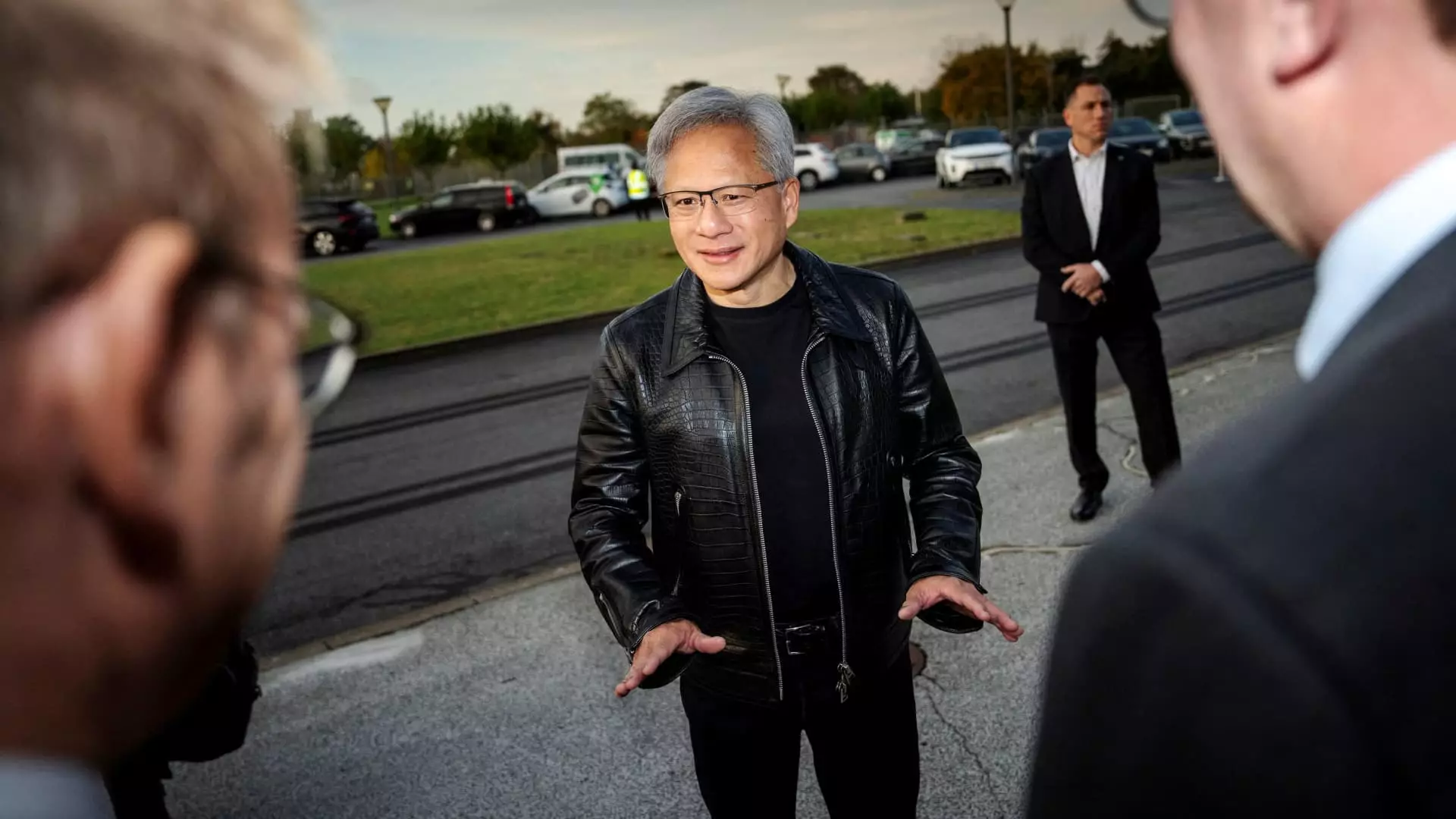

However, it’s not just the financial figures that matter; Nvidia’s guidance for the upcoming quarter is of even greater importance. Analysts expect the company to suggest an EPS of 82 cents and sales reaching $37.08 billion. This forecast will serve as a litmus test for Nvidia’s ability to sustain its aggressive growth strategy amidst a competitive market filled with technological advancements. Investors are keen to hear from CEO Jensen Huang, who is likely to provide insights into the evolving demand for Nvidia’s next-generation AI chip, Blackwell.

Blackwell, positioned as Nvidia’s new AI chip for data centers, is critical for the company’s future growth. This technology is expected to serve vital clients like Microsoft, Google, and Oracle. The anticipation of Blackwell’s success underscores the need for Nvidia to articulate a robust narrative around its product performance and market reception. However, concerns have arisen regarding reported overheating issues in systems utilizing Blackwell chips. How Nvidia manages these challenges will play a significant role in shaping investor sentiment and stock performance.

Nvidia’s stock valuation has seen a meteoric rise, nearly tripling since the beginning of 2024. The fundamental analysis suggests that this surge has been fueled not only by its prior success but also by the overarching momentum in the AI sector. Despite a remarkable 122% growth in sales reported in the most recent quarter, there remains a slight deceleration in comparison to prior quarters that boasted growth rates of 262% and 265%. This discrepancy raises questions about Nvidia’s future scalability and market saturation.

As Nvidia stands on the brink of its earnings announcement, the eyes of Wall Street are fixed on both the results and the forward-looking statements that will elucidate the company’s path ahead. The stakes are high, with Blackwell likely serving as both a beacon of potential and a source of concern. Nvidia’s ability to navigate these complexities, respond to market demands, and rectify product challenges will be crucial in determining whether it can sustain its impressive growth trajectory in an increasingly dynamic AI marketplace. Investors will no doubt be eager to glean insights that reveal not just the current health of Nvidia, but also its strategic vision going forward.