Nvidia’s recent fiscal fourth-quarter earnings announcement has generated significant interest across the financial landscape, highlighting the company’s steadfast growth amid the AI boom. While the numbers indicate that the chipmaker continues to exceed expectations, a more nuanced exploration reveals the complexities underlying its staggering success and the pressures it faces moving forward.

Nvidia’s reported earnings for the fourth quarter exceeded Wall Street projections, signaling an unwavering confidence from the company. Their revenue reached an impressive $39.33 billion against analysts’ estimates of $38.05 billion, and adjusted earnings per share clocked in at 89 cents, outpacing the anticipated 84 cents. Introduction of forward-looking guidance indicates Nvidia expects a robust first-quarter revenue of around $43 billion, suggesting year-on-year growth of approximately 65%. However, it’s important to note that this projection indicates a slowdown compared to a staggering 262% growth recorded in the same period the previous year.

This deceleration nonetheless represents an extraordinary growth trajectory. Chief Financial Officer Colette Kress stated that Nvidia anticipates a “significant ramp” in sales of its next-generation AI chip, Blackwell. This anticipation echoes a broader trend where revenue and earnings appear robust, yet beneath the surface, patterns of deceleration raise questions about sustainability and market saturation in the face of an evolving tech landscape.

The critical driver of Nvidia’s earnings appears to be its dominance in the artificial intelligence sector, particularly through its Data Center Graphics Processing Units (GPUs). The fourth-quarter’s revenue increased by 78% from $35.1 billion and full fiscal-year revenue skyrocketed by 114%, culminating in $130.5 billion. However, as Nvidia grows, its ability to sustain such rapid increases will be tested.

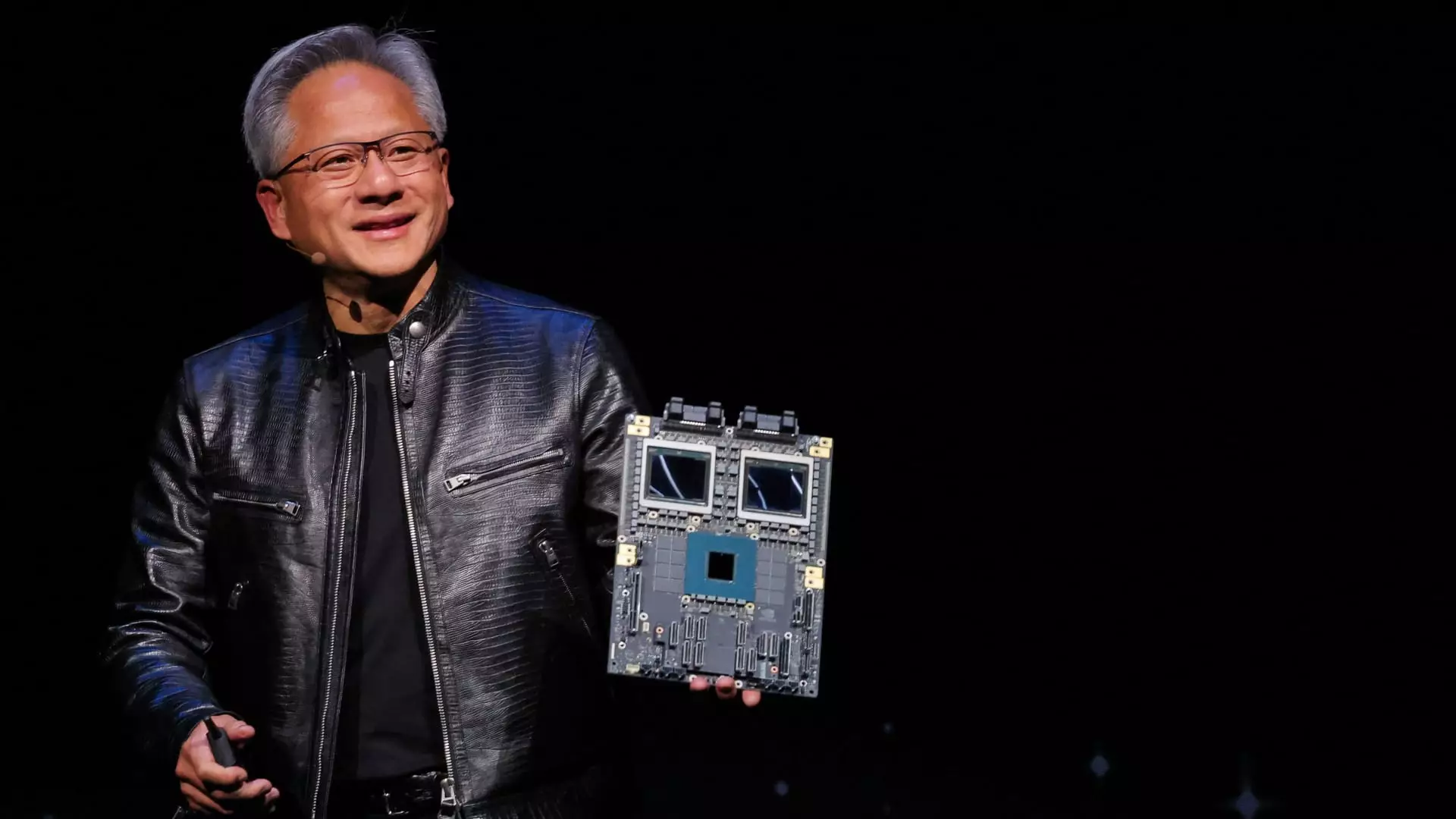

The new Blackwell AI chip is viewed as essential for maintaining competitive advantage, particularly as competition intensifies among tech giants like Amazon, Microsoft, and Google. Nvidia’s leadership under CEO Jensen Huang emphasizes the importance of Blackwell, proclaiming the demand for these chips to be “amazing.” Kress further outlined that Blackwell saw approximately 50% of its sales sourced from large cloud service providers, underscoring how integral major clients are to Nvidia’s success.

While the eagerness to integrate Blackwell into cloud infrastructures is notable, it raises a critical question: Can Nvidia maintain its pace amid increasing competition while technology evolves at a frantic rate?

A crucial highlight from the report is the growing dominance of the data center segment, which now contributes an astonishing 91% of Nvidia’s total sales. The data center revenue surged nearly tenfold over just two years, amounting to $35.6 billion this quarter, exceeding expectations of $33.65 billion. This shift emphasizes Nvidia’s pivotal role in shaping the future of AI software delivery, transitioning from developing AI models to deploying them.

Kress addressed investor concerns regarding competitive threats from models like DeepSeek’s R1, noting that advanced AI processes may require a hundredfold increase in computational capacity. As the emphasis shifts towards inference—the process of delivering AI predictions—Nvidia’s ability to meet this demand could dictate its future.

Notably, while Nvidia has signaled that networking solutions are a growth opportunity, sales in this area dipped by 9% from the previous year. This decline is indicative of the challenges that even industry leaders face in maintaining growth across their diverse portfolios.

While Nvidia shines bright in the AI landscape, its gaming division has not fared as well. Reported sales dropped to $2.5 billion, falling below expectations of $3.04 billion and marking an 11% decrease over the year. The gaming sector remains integral for Nvidia, representing a significant portion of its legacy market. The company announced new graphics cards based on the Blackwell architecture to rejuvenate this segment, but the question remains: can these innovations spark renewed interest and sales growth?

Additionally, while the automotive segment, valued at $570 million, remains small relative to Nvidia’s AI business, it saw a commendable 103% year-on-year increase. This highlights a strategic diversification in Nvidia’s revenue streams, crucial for navigating future market fluctuations.

Nvidia’s remarkable financial results illustrate a company at the forefront of technological innovation and a pivotal player in the AI sector. However, as the company embarks on the next chapter of its growth journey, the factors influencing its performance—from competitive pressures to market saturation—will be crucial analyses points for investors and analysts.

To maintain its leading position, Nvidia must navigate a complex landscape where competitors are continuously developing custom chips and alternative technologies. The forthcoming fiscal year presents a unique challenge of sustaining momentum while adapting to rapidly changing market dynamics. Nvidia’s ability to innovate across its traditional and emerging sectors will undoubtedly shape its trajectory in the coming years.