In a remarkable demonstration of market confidence, Oracle’s stock surged approximately 6% in after-hours trading following its recent financial announcements. The technology giant has significantly raised its revenue forecasts for fiscal 2026, now projecting at least $66 billion—exceeding analysts’ expectations of $64.5 billion. This savvy maneuver comes as part of a broader strategy showcased during the Oracle CloudWorld conference in Las Vegas. Notably, this week has been pivotal for Oracle, with shares increasing nearly 15% over just three trading sessions, underscoring investor enthusiasm largely fueled by impressive quarterly results.

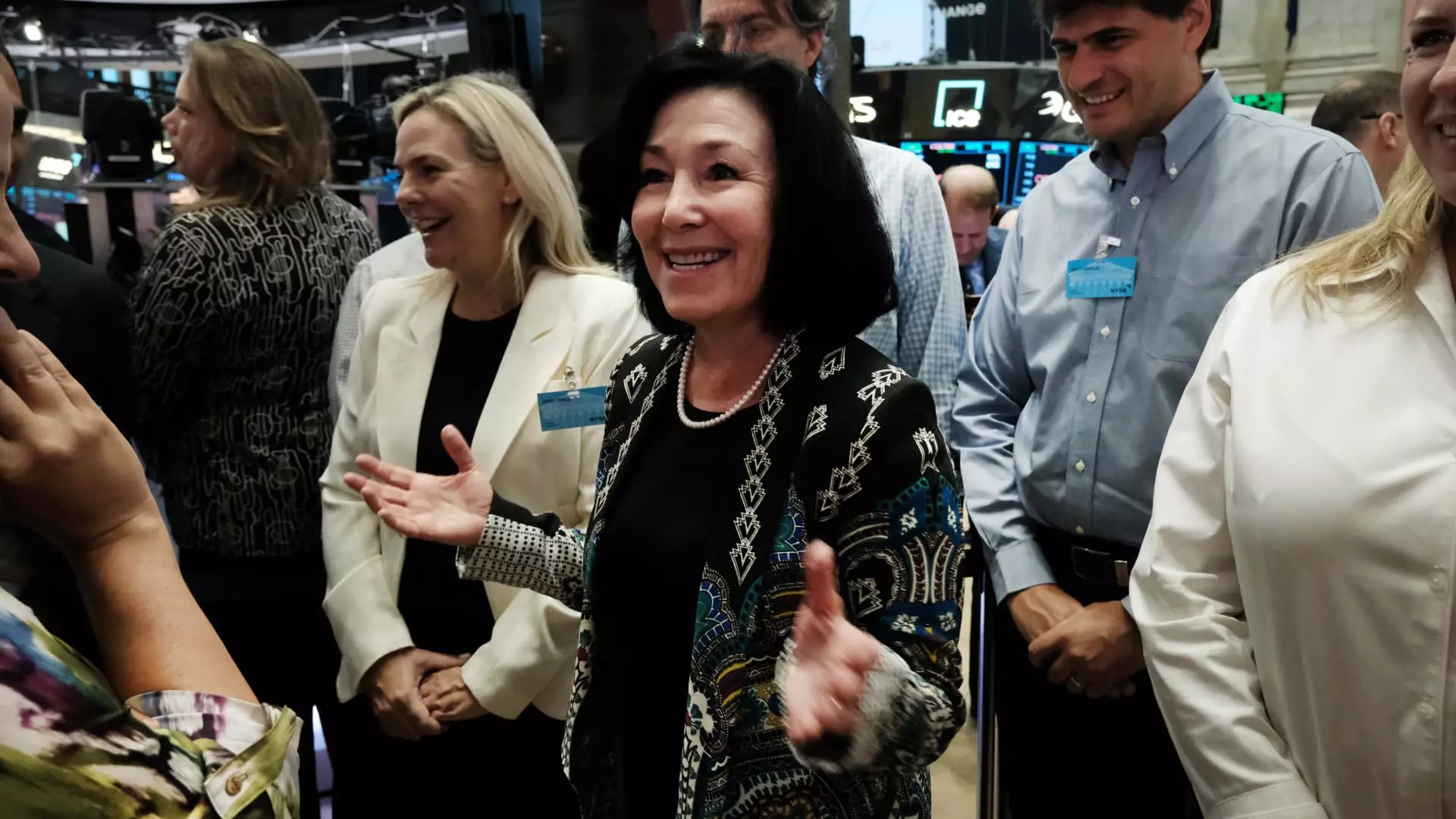

The momentum doesn’t stop there; Oracle also provided an ambitious outlook for fiscal 2029, forecasting revenues surpassing $104 billion along with an anticipated 20% year-over-year growth in earnings per share. This long-term strategy reflects the company’s commitment to sustained growth and market leadership in the database software sector. CEO Safra Catz expressed unequivocal confidence in meeting these projections, emphasizing that the goals are well within reach.

A key factor in Oracle’s optimistic outlook is its strategic partnerships with leading cloud providers such as Amazon, Google, and Microsoft. Such collaborations facilitate the seamless integration of Oracle’s database solutions within the cloud infrastructures of these tech giants. These partnerships are poised to amplify Oracle’s reach and enhance its service offerings, establishing it as a formidable player in an increasingly competitive space. The announcement of a relationship with Amazon earlier this week highlights Oracle’s proactive approach in aligning itself with established industry leaders.

The growth of Oracle’s cloud infrastructure revenue—recording an impressive 45% increase in the last quarter—further reinforces this positive outlook. This growth outpaces that of key competitors like Amazon and Google, positioning Oracle advantageously as more businesses transition their operations to cloud solutions. Moreover, the company’s strategic foray into artificial intelligence (AI) with the order of over 131,000 next-generation “Blackwell” GPUs from Nvidia signals its intent to expand not only in cloud services but also in cutting-edge technology domains.

To sustain its growth trajectory, Oracle is prepared to ramp up capital expenditures, with expectations to double these investments during the current fiscal year of 2025. This commitment to investing in infrastructure and technology showcases Oracle’s readiness to adapt to an evolving marketplace and its determination to innovate continuously. Such proactive measures are critical in maintaining competitive advantages and further enhancing its product portfolio.

Oracle’s recent financial performance and transformative strategies reflect a company poised for remarkable growth. With solid revenue forecasts, robust partnerships, and a focus on technological advancements, Oracle appears well-equipped to navigate the complexities of the tech landscape and achieve its ambitious objectives in the coming years.