The recent plunge of 22% in Super Micro’s stock price, reaching levels not seen since May of the previous year, marks a significant moment for the company. Once a rising star in the server manufacturing world, Super Micro is now grappling with disappointing financial disclosures and troubling questions about its corporate governance.

As of early afternoon on Wednesday, shares of Super Micro were trading at $21.55, a staggering 82% decline from its peak in March. This fall has translated to a loss of approximately $57 billion in market capitalization, reflecting a potentially severe crisis of confidence among investors. The immediate cause of this sell-off stems from the release of unsatisfactory unaudited financial results and the lack of a clear strategy to maintain its Nasdaq listing after facing scrutiny over compliance with regulatory requirements.

Last week, the company experienced its most tumultuous period in market history, exacerbated by the resignation of its auditor, Ernst & Young. This marks the second accounting firm to withdraw from its engagement with Super Micro in a mere two-year time frame. The pressures faced by the company extend beyond mere financial struggles; allegations of accounting irregularities and exporting sensitive technology to sanctioned territories have cast a long shadow over its operational integrity.

Super Micro’s risk of being delisted from the Nasdaq exchange looms large, particularly as it has failed to provide audited financial statements since May. The impending deadline to report results for the latest fiscal year to the Securities and Exchange Commission (SEC) by mid-November adds urgency to its situation. The company’s preliminary reports for the first fiscal quarter did little to assuage investors’ concerns, as management revealed uncertainty regarding the timeline for submitting its annual financials.

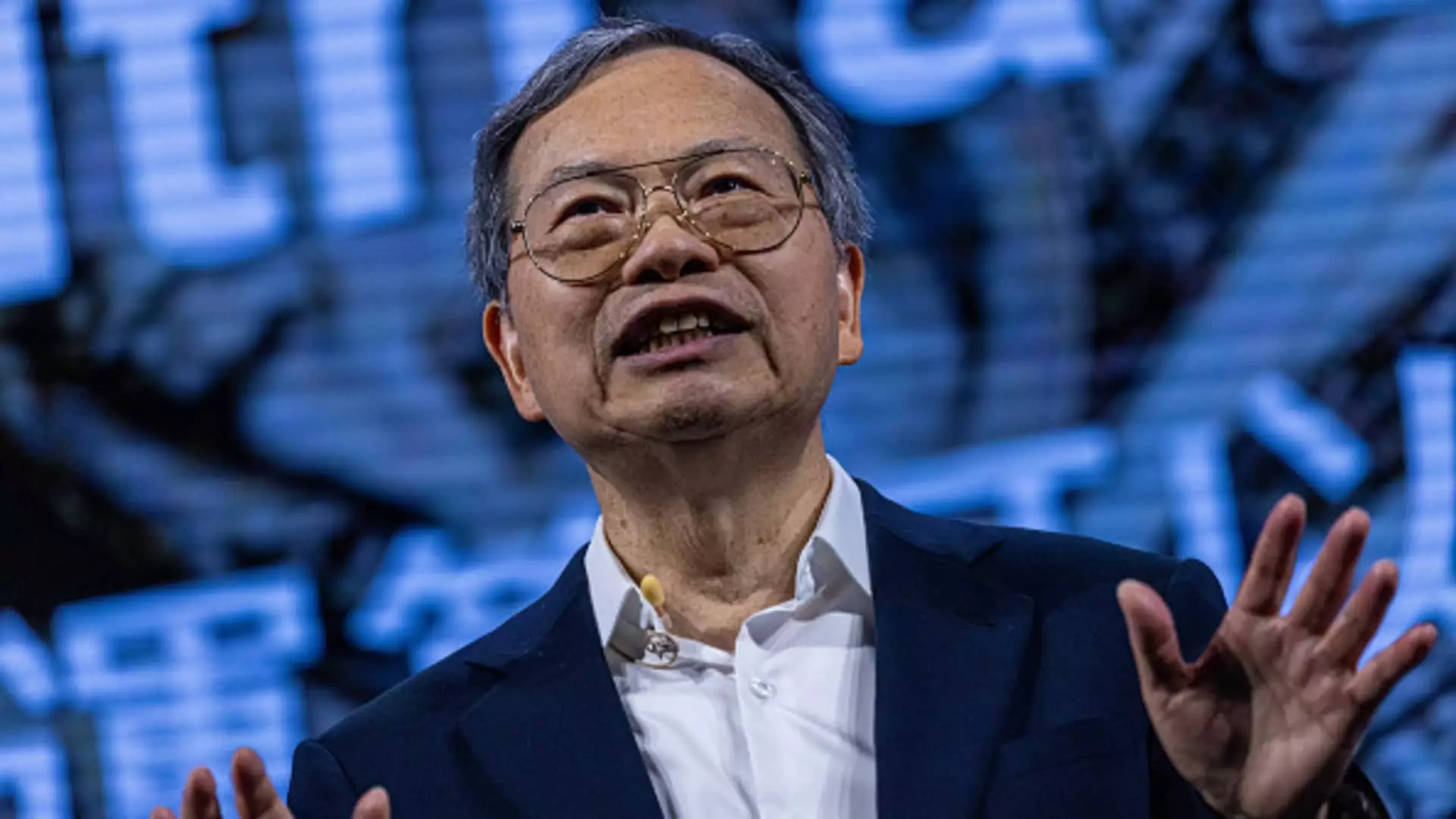

A recent conference call with analysts revealed a noticeable lack of transparency regarding Ernst & Young’s resignation and broader governance issues. CEO Charles Liang disclosed that the company is in the process of securing a new auditor, yet the absence of direct responses to the myriad of inquiries regarding corporate stewardship raises alarm bells for potential investors. The need for stable and competent oversight has never been more critical, as analysts from Mizuho and Wedbush have voiced their concerns, with Mizuho suspending coverage altogether.

In a contradictory turn, Super Micro reported that it generated net sales in the range of $5.9 billion to $6 billion for the quarter ending September 30, 2023. While this figure falls short of the $6.45 billion anticipated by analysts, it does represent a remarkable 181% increase year-over-year. The recent demand surge for servers equipped with Nvidia processors for artificial intelligence applications has been a bright spot amid the unfolding turmoil.

Super Micro shares soared by an astonishing 246% last year, and its peak was marked at $118.81 shortly after being added to the S&P 500—a moment that now feels distant and out of reach. Despite Liang’s assurances about strong demand for Nvidia’s latest GPU, the company faces an uphill battle in reconciling these operational successes with its current financial woes.

Looking ahead, Super Micro’s forecasts for the upcoming December quarter are disheartening, with expected revenues between $5.5 billion and $6.1 billion. This projection significantly undercuts the average analyst estimate of $6.86 billion, raising further questions about its financial stability. Additionally, adjusted earnings per share predictions of 56 to 65 cents fall short of the anticipated 83 cents.

In light of these challenges, Super Micro’s board of directors has instituted a special committee to investigate Ernst & Young’s concerns further. While this committee has reportedly found no evidence of fraud or misconduct, the lack of prior audited financial statements and ongoing governance issues continue to erode investor confidence.

The ongoing saga facing Super Micro illustrates the complex interplay between financial performance, regulatory scrutiny, and governance. As the company endeavors to stabilize its financial standing and retain its place on the Nasdaq, it must also prioritize transparency and accountability. The road ahead will require not just strong operational performance, but also a recommitment to sound corporate governance and investor relations. Failure to address these critical areas could hamper its recovery and lead to enduring challenges within the competitive landscape of technology and hardware.