Learning how to properly manage money is crucial to our survival. Our ancestors had to learn to deal with money the hard way to be able to control their personal finances.A lot of us don’t live that way these days.

Learning how to properly manage money is crucial to our survival. Our ancestors had to learn to deal with money the hard way to be able to control their personal finances.A lot of us don’t live that way these days.

Do thorough background research on any broker you cannot trust. Check their references and find someone else if you feel they are not being open with you. Your experience is also helpful when picking a major consideration.

Stop loyal purchasing of certain brands unless there are coupons for them. For instance, if Coke is your brand of choice but Pepsi is offering one dollar off coupon, go with Gain and save the green.

This is a great technique which forces you to put aside a little bit of money much better each month. This is extremely beneficial when you are saving money for something like a special occasion in the near future.

It may be possible to see a drop in your credit score will go down while working to fix your credit. This should be temporary and doesn’t mean that you have caused more damage to it. Your credit score will rise as time goes on if you take steps to improve your record of payment for your debts.

Make savings your first priority with each time you receive.

A lot of credit card companies provide bonus points that you can use to get low cost or discounted flight tickets to be redeemed from purchases for no additional charge. Your frequent flier miles will constantly increase and are redeemable at thousands of hotels for room discounts or freebies.

Find a bank that is free.

Take advantage of automated online alerts that your institution. Many banks will send you email or texts when there is activity reported on your account.

To guarantee that you are not late on any payments set up an automatic monthly bill pay through your checking account automatically. Even if you are unable to pay your credit card balance in full, making the minimum payments before the due dates give your credit report positive data. By setting up an automatic debit from your bank account, you can ensure that your payments won’t be late, and you can pay a little extra each month if you are able.

This reduces the likelihood that you will forget to make a late payment. This will allow you to budget and allow you from incurring late fees.

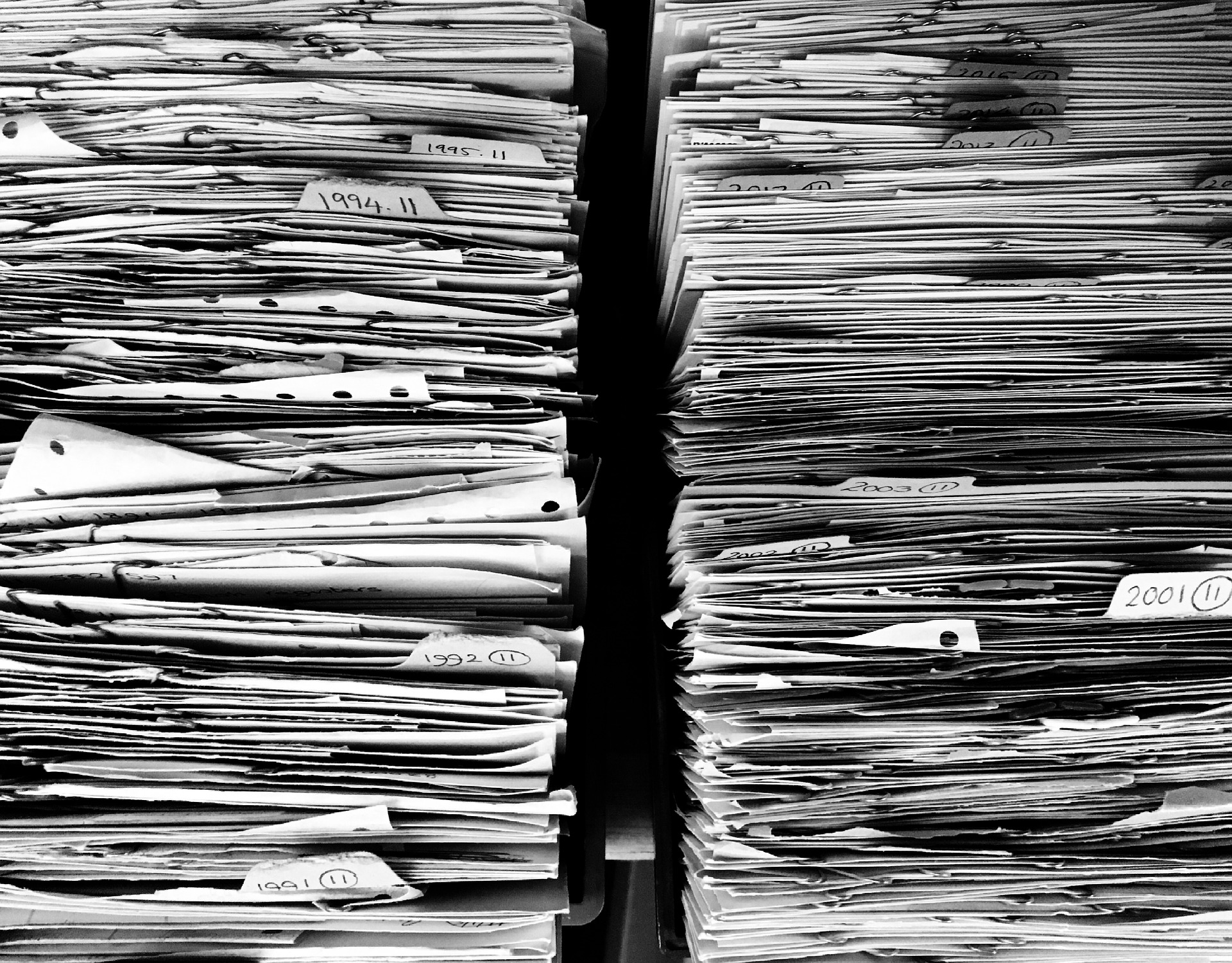

Keep your important documents in files to access them easily. Keep all your important documents such as receipts or insurance papers in one file so you can find them easier.

Try to pay off debt and don’t get in any new debt. It’s easy to be tempted, even though we have become trained to think it is impossible.

Find and target areas where you are spending a lot of money.Any extra money each month should be used to pay off debt or getting deposited in a higher-yield savings account.

Think about working from home to save your money. You have to pay for things like parking, parking, and gas.

These savings over time.

Contribute to your Individual Retirement Account if you are eligible to do so. This helps to better your personal financial situation in years to come.

One of the sharpest tools in the shed is a knowledge about things financial. Tracking your hard-earned dollars and proactively managing your spending and saving can make your financial status something to be proud of. Your goals are obtainable, and these tips will help you on your way.