Philadelphia Federal Reserve President Patrick Harker recently expressed a strong endorsement for an interest rate cut in September while speaking to CNBC at the Fed’s annual retreat in Jackson Hole, Wyoming. Harker’s direct statement signals a high probability of monetary policy easing during the upcoming meeting of central bank officials. He emphasized the need to embark on a gradual process of moving rates down to stimulate economic growth and stability.

Market expectations currently predict a 100% probability of a quarter percentage point cut, with a 1-in-4 chance of a 50 basis point reduction. However, Harker remains uncertain about the magnitude of the rate cut and believes that further data analysis is necessary before making a definitive decision. The Federal Reserve has maintained its benchmark overnight borrowing rate between 5.25% – 5.5% since July 2023 to address persistent inflation concerns.

Harker reaffirmed the Federal Reserve’s independence from political influences, emphasizing the institution’s commitment to data-driven decision-making. As a self-proclaimed “proud technocrat,” Harker highlighted the importance of objectively analyzing economic indicators to determine the most appropriate policy responses. He stressed the urgency of initiating rate cuts based on a comprehensive assessment of economic data.

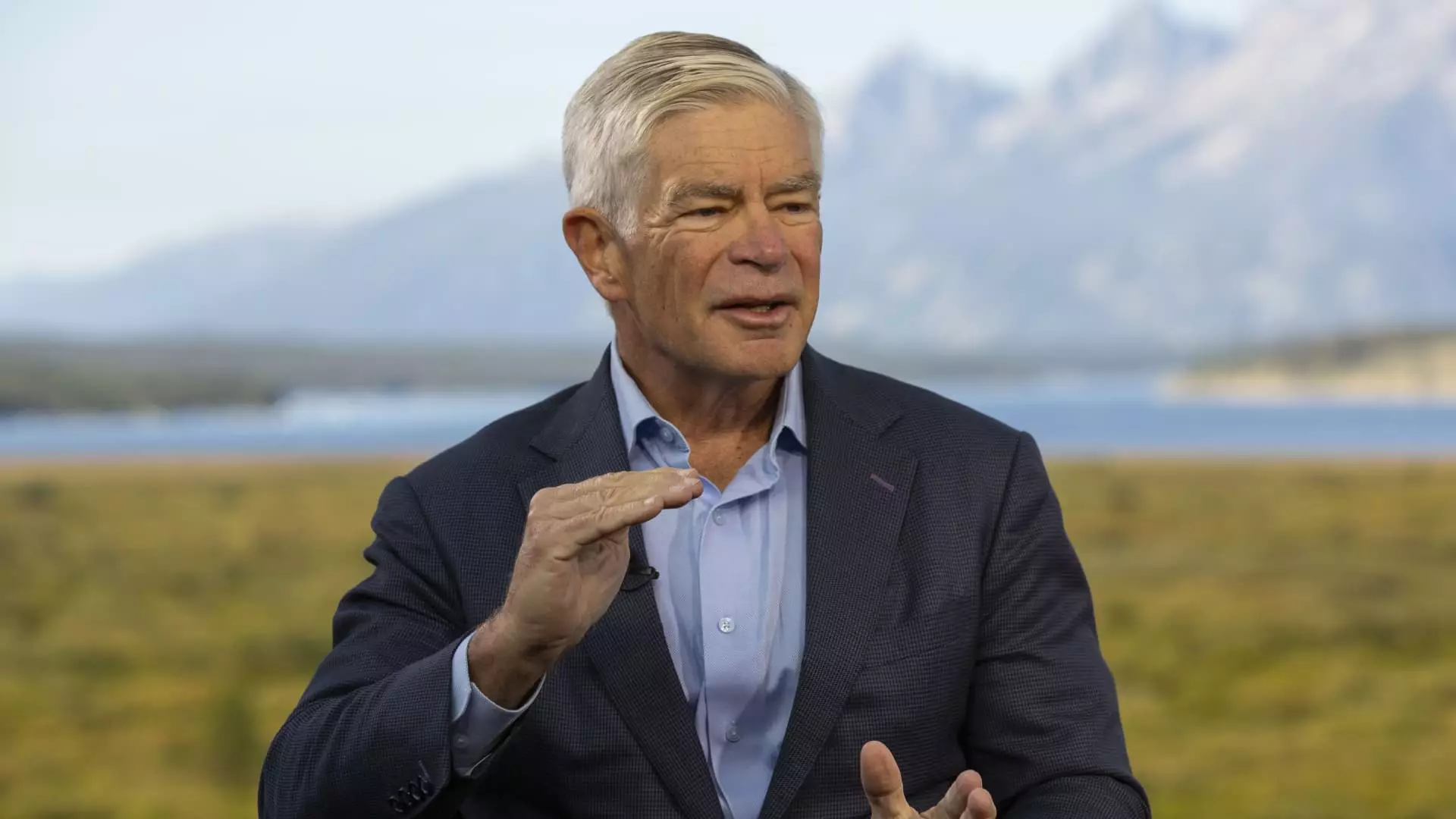

Kansas City Fed President Jeffrey Schmid also weighed in on the future of monetary policy during his CNBC interview. While offering a less direct perspective compared to Harker, Schmid acknowledged the rising unemployment rate as a critical factor influencing policy decisions. He emphasized the need to carefully evaluate the evolving labor market dynamics and their impact on inflation and economic stability.

Schmid highlighted the importance of monitoring labor market trends to assess the overall health of the economy. He noted that a cooling labor market could help alleviate inflationary pressures but cautioned that more analysis is needed to gauge the optimal policy response. While Schmid acknowledged the resilience of banks under the current high-rate environment, he suggested that a proactive approach to monetary policy is crucial to sustaining economic growth.

The insights provided by Federal Reserve officials such as Patrick Harker and Jeffrey Schmid offer valuable perspectives on the potential need for an interest rate cut in September. Their emphasis on data-driven decision-making, economic independence, and careful assessment of market dynamics underscores the complexity of policy implications in the current economic environment. As investors and stakeholders await the upcoming Fed meeting, the comments from Harker and Schmid serve as important signals of potential monetary policy shifts and their impact on the broader economy.