Warren Buffett’s Berkshire Hathaway has been undergoing significant shifts in its investment strategy, particularly regarding its stake in Bank of America (BofA). Recent regulatory filings reveal that Buffett’s firm has sold approximately $7 billion worth of BofA shares since mid-July 2023, reducing its ownership to a mere 11%. This move is not just a series of ordinary trades; it represents a calculated reallocation of assets by a figure known for his acumen in navigating the tumultuous waters of the financial market.

In a string of sales across several days, Berkshire offloaded around 5.8 million shares, generating around $228.7 million based on an average selling price of $39.45 per share. This latest divestiture marks the continuation of a selling streak that now spans 12 consecutive sessions—tying with a similar pattern observed in the summer months. To date, Berkshire has divested over 174.7 million BofA shares, leaving them with a reduced stake and a clearer picture of their shifting priorities in asset management.

The ramifications of these sales extend beyond mere numbers. BofA has dropped from being Berkshire’s second-largest investment to now occupying the third position, surpassed by tech giant Apple and credit card powerhouse American Express. This shift isn’t just semantic; it indicates a broader strategy, one that suggests possible concerns about the banking sector’s immediate future and Buffett’s burgeoning interest in technology and financial services.

Buffett’s history with Bank of America is notable; his initial investment of $5 billion in preferred stock and warrants during the post-financial crisis period in 2011 illustrated tremendous foresight amidst widespread pessimism. The conversion of those warrants in 2017 cemented Berkshire’s status as the largest shareholder of BofA, showcasing Buffett’s long-standing belief in the bank’s recovery potential. Additionally, significant share purchases made in 2018 and 2019 highlighted this steadfast commitment.

Yet this recent wave of selling raises questions. Is it a reflection of deeper market analysis or concerns over BofA’s ongoing performance in a shifting economic landscape?

BofA’s CEO, Brian Moynihan, addressed the situation in a recent public appearance, carefully navigating the topic of Buffett’s ongoing sell-off. He stated that he could not speculate on Buffett’s motivations, emphasizing a separation of interests that sometimes exists between the two parties. His comments reveal an institutional understanding that Buffett operates on a level that may not always align with traditional market logic or public insights.

However, Moynihan’s recognition of Buffett’s previous investment as pivotal in stabilizing BofA amid the subprime mortgage crisis underscores the sort of long-term partnership that can exist between institutions. He noted that investors today buying BofA’s stock would benefit from the low price at which Buffett entered—an affirmation of the Oracle of Omaha’s successful foresight.

As the dynamics between Berkshire and BofA continue to unfold, it’s worth noting the stock’s performance itself. Despite Buffett’s exiting maneuvers, BofA shares have only slightly decreased—about 1% since July, while showing a healthier increase of 16.7% year-to-date. This resilience indicates that the market can absorb such sell-offs, potentially paving the way for a reassessment of BofA’s value among investors.

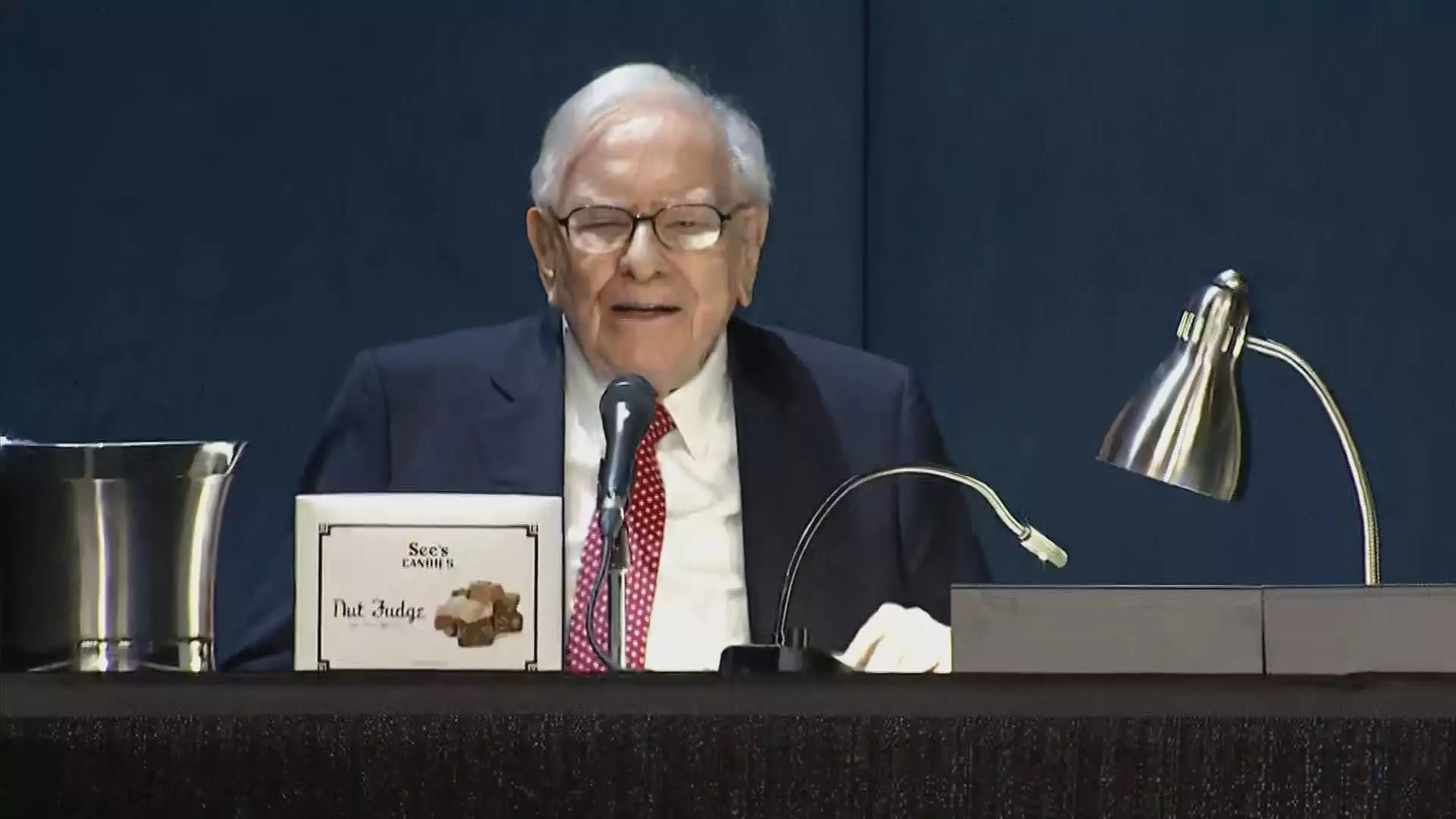

Moynihan praised Buffett’s investment strategy, remarking, “He just had the guts to do it in a big way,” alluding to the audacity that defines Buffett’s investment philosophies. As Buffet pulls back from BofA, the market must evaluate whether this signifies a broader trend toward technology-focused investments, which have captured investor attention more fervently in recent years.

Warren Buffett’s recent divestiture from Bank of America reflects more than just transactional behavior; it signals a potential reassessment of investment philosophies amid shifting market dynamics. As one of the most respected figures in the investment community, Buffett’s strategic moves are watched closely and analyzed intensely. The implications of these shifts warrant scrutiny, as they challenge existing paradigms in banking investments and open discussions on where the financial sector is headed in an evolving economic landscape.

This could very well mark the beginning of a new era for Berkshire Hathaway, one where technology and other sectors may take precedence over traditional banking investments, reshaping the narratives of high-stakes investing.