Nvidia has long been the beacon of innovation and growth in the tech world, especially in the realm of graphics processors. As demand for artificial intelligence (AI) infrastructure swelled, Nvidia seemingly rode the wave, with profits skyrocketing. However, as the anticipation for the company’s earnings report looms, a stark shift in sentiment paints a less rosy picture. Enter China—the focal point of the latest restrictions that threaten to stifle Nvidia’s remarkable ascent.

The U.S. government’s tightening grip on technology exports to China has turned a bright future into murky waters. The letter dispatched by the Trump administration mandating an export license for Nvidia’s H20 chip—a variant of its Hopper processor—sends a clear message. The fear? That these AI chips could be wielded for military purposes by adversaries, thus eroding the very foundations of U.S. technological superiority. It’s a dismal intersection of geopolitical machinations and corporate ambition, and Nvidia, once positioned as an unstoppable titan, finds itself navigating uncharted, hostile terrain.

The Cost of Political Warfare

The fallout from these restrictions has been severe. Nvidia’s $5.5 billion write-down on inventory is a headline that reverberates through the industry like an earthquake. Analysts are calling it unprecedented, and for good reason. Such drastic measures signify not just a financial loss but a fundamental threat to future revenue streams. David O’Connor, an analyst at BNP Paribas, put it bluntly: “This inventory write-off implies a $15 billion H20 revenue hit on a rolling 12-month basis.” The stark reality emerges: a company once celebrated for explosive growth now grapples with a potential collapse in demand.

The prospect of a significant deceleration in growth from last year’s astonishing 250% to a projected 66% for the current quarter is enough to rattle investors and industry stalwarts alike. Even as Nvidia skirts the brink of impressive revenue figures, the conditions under which these gains are realized have deteriorated. Uncertainty looms like a dark cloud as analysts predict growth could plunge further, settling at around 53% for the remainder of the fiscal year. This is a fate no company wants to experience.

The Price of Complacency

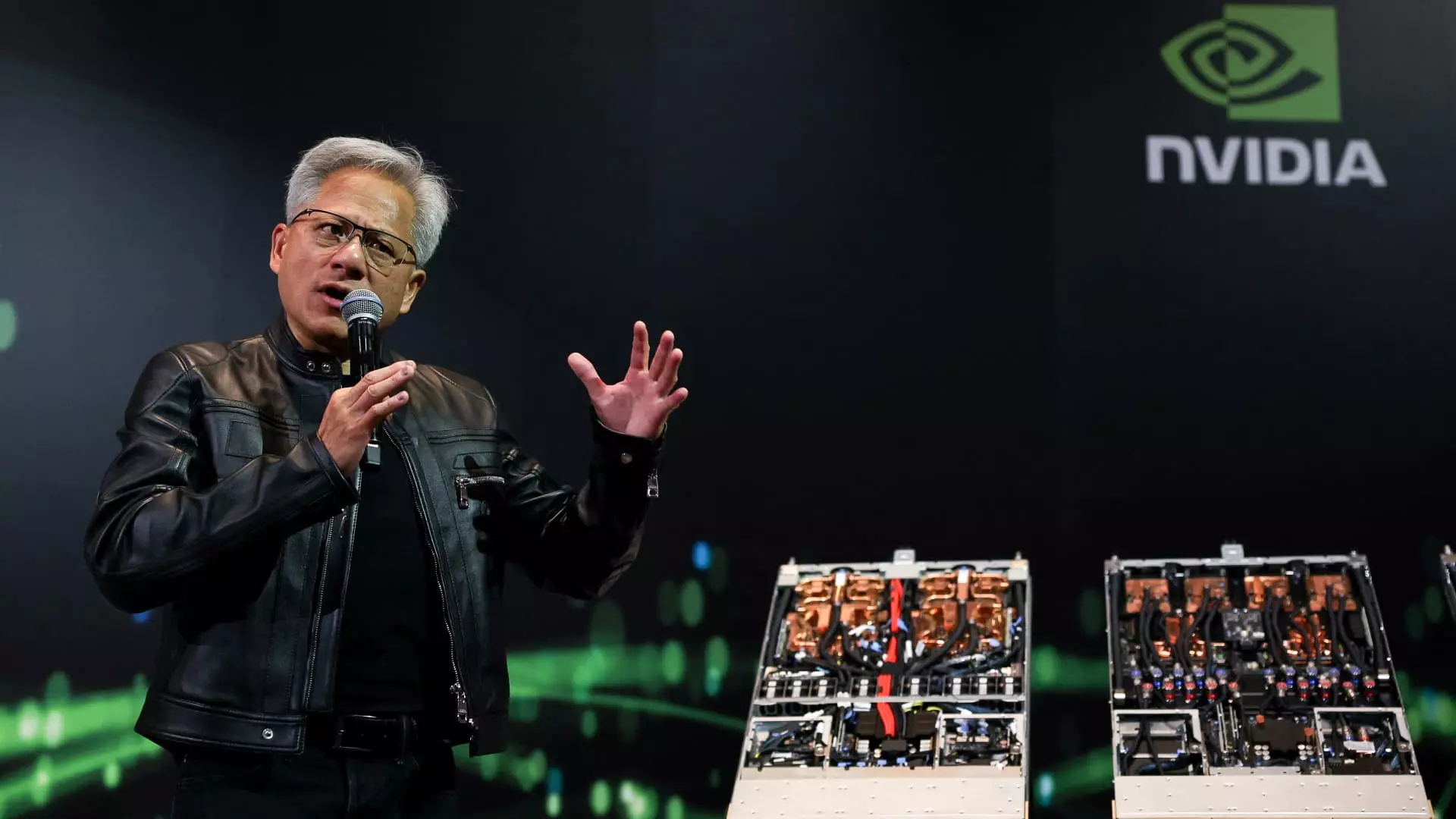

While many may perceive Nvidia’s position as enviable due to its past successes, complacency might be its greatest adversary. CEO Jensen Huang’s statements reveal a fundamental misunderstanding of the competitive nature of technology. Once dominating the Chinese market with a staggering 95% share, Nvidia now finds that number halved under the weight of international policies. Analysts caution that this retreat from the Chinese market doesn’t merely signify a hiccup but could potentially spur local Chinese firms to innovate aggressively. As Huang correctly pointed out, this could lead to a burgeoning Chinese semiconductor ecosystem that threatens U.S. dominance—an irony given that these restrictions were meant to solidify it.

Increasingly, it seems Nvidia stands at a crossroads. Adversity may breed innovation and competition in realms previously dominated by Western powers. Continuing to lobby for licenses and attempting to navigate a labyrinth of regulatory red tape could signal a slower journey toward growth—one less about soaking up market share and more about survival.

Hope Amid Despair: U.S. Regulatory Shift

In an ironic twist of fate, Nvidia received some much-needed regulatory relief when the Trump administration rescinded the “AI diffusion rule.” This decision, while welcome, may only offer a temporary reprieve. The administration still harbors intentions to overhaul export regulations, leading to an uncertain future for companies like Nvidia. As Morgan Stanley analysts rightly assert, the conversation regarding the future of U.S. export policy is not merely a topic for boardrooms but a matter of national and corporate survival.

These complex dynamics masterfully illustrate the dual nature of technological advancement—where the scintillating light of innovation often casts long shadows of uncertainty. Nvidia, once a symbol of unwavering growth, now finds its trajectory curbed by geopolitical strife. The tune of growth has changed, and companies must learn to adapt or face being rendered obsolete.

The stakes could not be higher, and as Nvidia approaches its upcoming earnings report, the question of how to navigate these tumultuous waters remains paramount. Whether the company can muster the resilience to counteract these external pressures will dictate not only its future but also the larger landscape of the global semiconductor market.