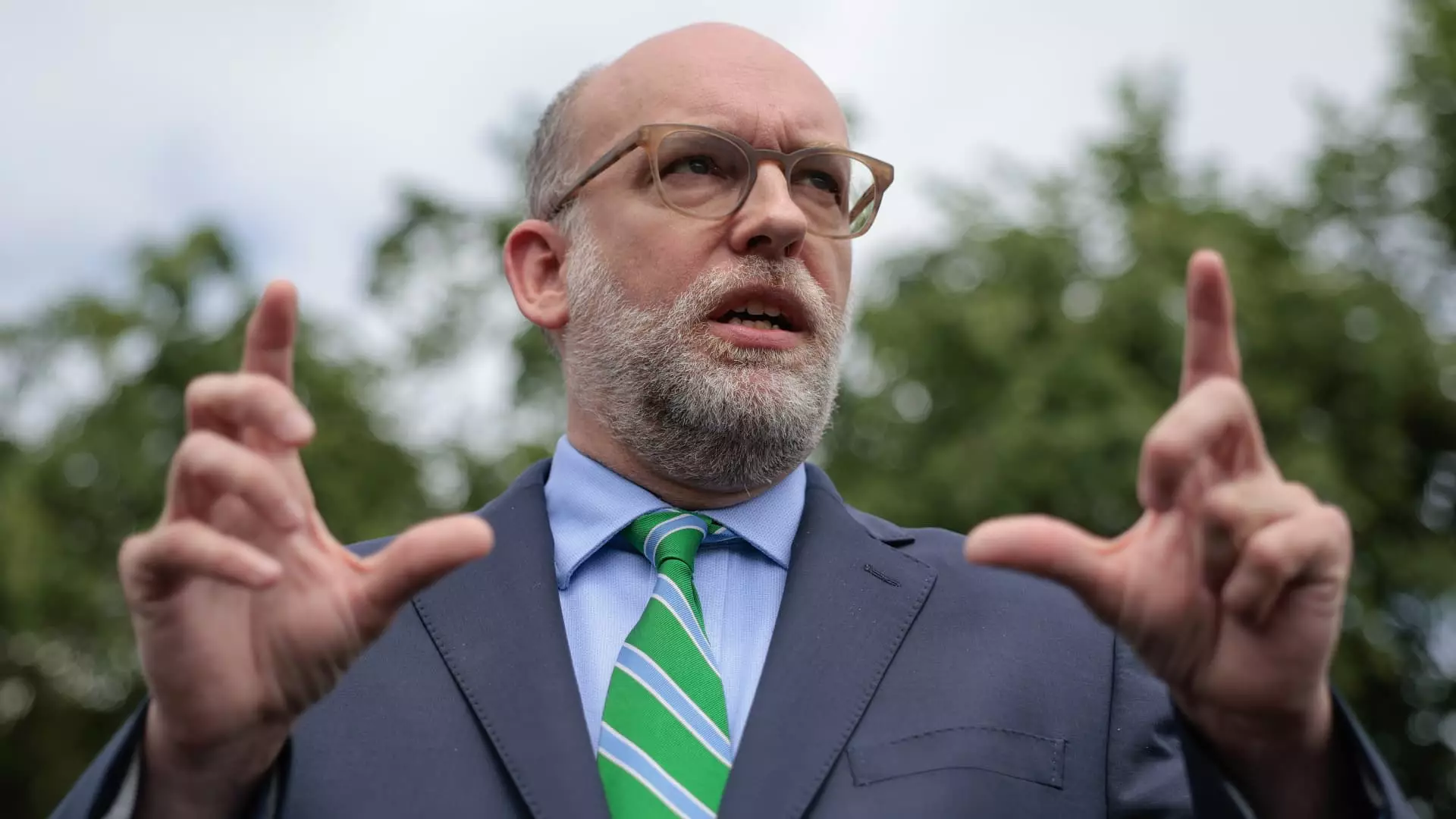

In recent times, the narrative surrounding government spending and institutional accountability has been skewed by superficial outrage and political theatrics. The controversy ignited around the Federal Reserve’s renovation project epitomizes this spectacle—a high-stakes game where spectacle often clouds substance. Alarmingly, the criticism, driven by Office of Management and Budget Director Russell Vought, frames the entire enterprise as a symbol of lavishness and mismanagement, casting the Federal Reserve as an inefficient behemoth “living in a palace.” But beneath these accusations lies a deeper question: Are these criticisms rooted in genuine concern for fiscal discipline, or are they merely political weapons designed to undermine an institution that operates on complex, often opaque mandates?

The allegations of a $2.5 billion renovation may seem extraordinary, yet they reveal a fundamental misunderstanding, or perhaps a deliberate misrepresentation, of the Fed’s unique role. As a quasi-governmental agency, the Fed has a degree of independence vital for maintaining economic stability. Its spending decisions—such as building renovations—are often justified as modernization efforts, not unnecessary extravagance. When political figures portray the Fed’s headquarters as a symbol of excess, they risk conflating institutional autonomy with fiscal irresponsibility, a dangerous narrative that threatens to undermine the very independence needed for effective monetary policy.

The Political Weaponization of the Federal Reserve

The current fracas is emblematic of a broader trend: the politicization of economic policy institutions. President Trump’s relentless criticism of Fed Chair Jerome Powell cannot be detached from this context. Calling on the Fed to cut interest rates, accusing Powell of “mismanagement,” and insinuating political bias are tactics designed more for spectacle than substantial critique. These actions do not reflect a serious concern about fiscal policies but rather an ideological ploy—fueling populist sentiments that blame institutions for complex economic realities outside their control.

What is most troubling is the strategic use of distractions like the renovation controversy to serve political ends. By highlighting the supposed “luxury” of the Fed’s headquarters, critics aim to paint the entire institution as elite and out of touch, reinforcing a narrative of government excess. Yet, such framing ignores the importance of an independent monetary authority that can make decisions free from political pressure. Recasting the Fed’s infrastructure projects as symbols of mismanagement risks setting a precedent where political entities interfere overtly in decisions that require technical expertise and stability.

Overreach or Necessary Oversight?

While it is valid to scrutinize government and quasi-governmental spending, the manner in which these accusations are pursued appears deeply flawed. The fascination with the Fed’s headquarters, and the accusations of overspending, distract from the more pressing issues—such as inflation, unemployment, and economic inequality—that directly affect everyday Americans. Redirecting attention toward a renovation project reveals a fundamental bias: an eagerness to attack the Fed’s legitimacy rather than engage critically with its policies.

Furthermore, the debate over what constitutes the Fed’s authority over its facilities exposes a legal gray area. The Federal Reserve Act grants it control over its buildings, but public outrage may be motivated by a desire to scrutinize or even diminish its independence. The question arises: should oversight extend to every detail of Fed spending, or does that threaten the autonomy essential to its function? In a functioning democracy, accountability must strike a careful balance—yet this controversy seems more invested in spectacle than substantive reform.

The Broader Implications for Financial Governance

The intersection of politics, financial oversight, and institutional independence is a tinderbox. The spectacle of political figures insinuating that the Fed’s expenditures reflect systemic mismanagement risks undermining the credibility and stability of the entire financial system. If policymakers continuously seek to portray the Fed as an overindulgent beast, they threaten to erode the public’s trust in its capacity to function free from political interference.

Moreover, the broader narrative—linking infrastructure costs with supposed fiscal mismanagement—ignores the complexities of government budgeting. Infrastructure projects, even when large, are integral to maintaining an effective and secure institution. Demonizing them as unnecessary luxuries fuels cynicism and disillusionment, rather than fostering constructive debate on fiscal responsibility.

In essence, the controversy does more to underscore the fragility of institutional independence than to serve the public interest. It reflects an environment where political motives increasingly threaten the scientific precision and stability that underpin the financial system, ultimately jeopardizing the very economic security that the Fed’s existence aims to protect.