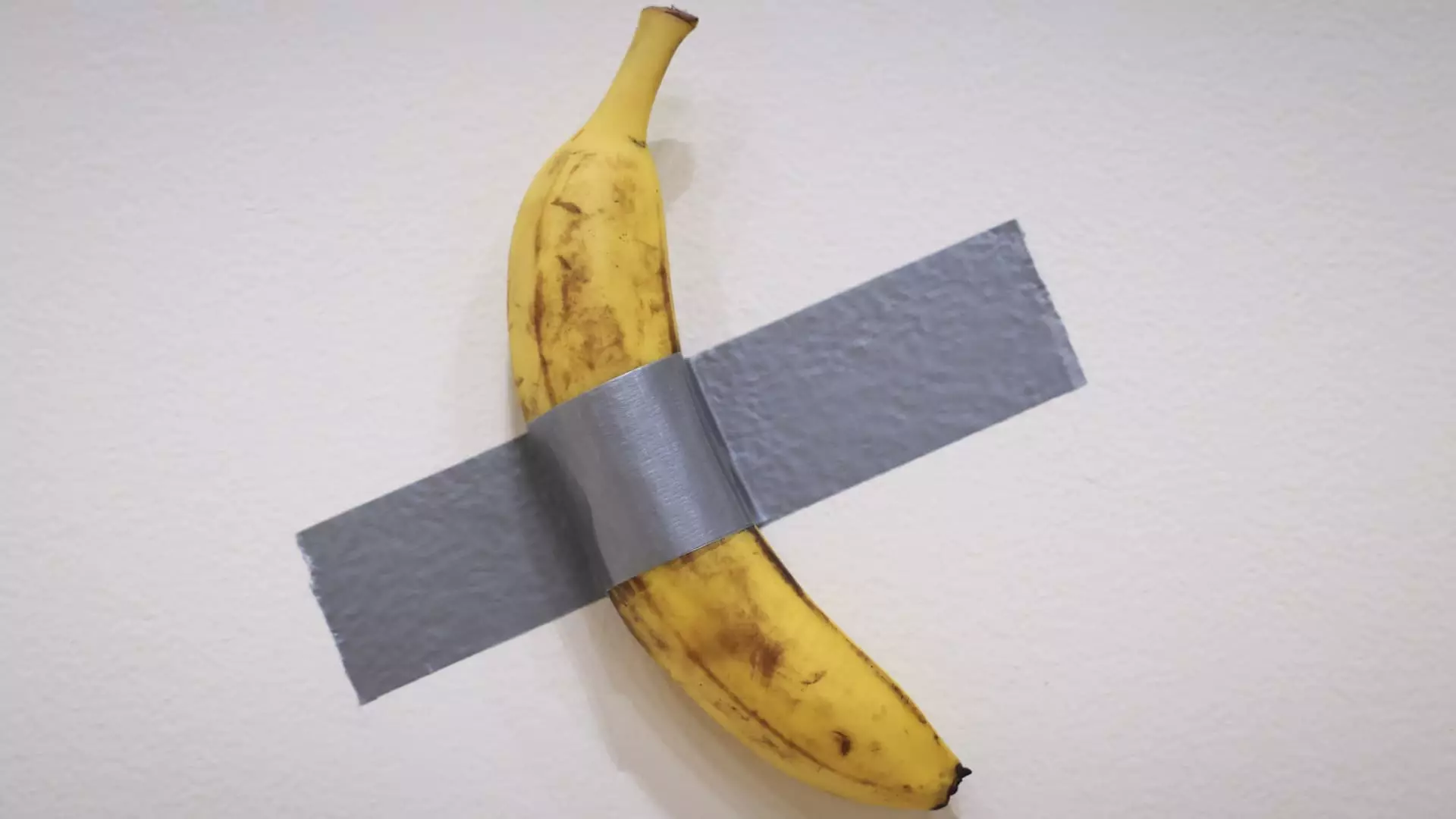

In a remarkable display of the contemporary art market’s absurdities, Justin Sun, a prominent cryptocurrency investor, made headlines by purchasing a banana duct-taped to a wall for an astounding $6.2 million. This controversial piece, dubbed “Comedian” and crafted by the avant-garde Italian artist Maurizio Cattelan, serves as not only a representation of modern art but also as a commentary on the interplay between high-value collectibles and the digital currency trend. As more investors turn to unconventional mediums—like crypto and viral sensations—the implications for both the art world and financial sectors grow increasingly significant.

The auction at Sotheby’s drew intense interest, culminating in a bidding war that saw participants grappling over an artwork that many perceive as more a meme than a masterpiece. Sun, who emerged victorious amid a highly charged atmosphere, expressed his view on the impact of the piece. He declared, “This is not just an artwork; it represents a cultural phenomenon.” His statement suggests that the banana transcends physicality, sparking dialogues about creativity and relevance in the modern world, while also nodding towards the integration of art, memes, and cryptocurrency.

“Comedian” caught public attention when it debuted at Art Basel Miami Beach in 2019, priced at $120,000—an already hefty sum reflective of its provocative nature. The juxtaposition of a common fruit and the prestigious art world shook norms surrounding what constitutes art, echoing throughout social media and attracting throngs of curious spectators. In an age where value is dictated not solely by the object but by its cultural significance and the narratives that surround it, this artwork exemplifies the evolving concept of artistic merit.

The anatomy of the sale exposes intriguing layers. Sun’s purchase included not just the duct tape, a pair of installation instructions, and a guarantee of authenticity, but it inherently positioned the banana as a transient object—a fruit destined to decay. Ironically, the true value lies in the certificate that vouches for the artwork’s originality, akin to how Non-Fungible Tokens (NFTs) have disrupted traditional understandings of ownership in the digital realm. For many supporters in the crypto space, this sale reflects an uncanny overlap between tangible and digital assets, as cryptocurrencies increasingly serve as legitimate mediums of exchange in high-stakes art transactions.

As Sun’s purchase suggests, the art market is witnessing a curious resurgence following a period of downturn. The recent robustness reflected in Sotheby’s auctions indicates a renewed sense of optimism among high-net-worth collectors. With the combined sales at notable auctions exceeding $1 billion and exceptional prices fetched for renowned pieces—like Monet’s water lilies at $65.5 million and Magritte’s surrealism reaching $121 million—collectors are demonstrating an appetite for significant investments.

This trend highlights a broader societal shift, where wealthy individuals seek to bolster their portfolios with culturally relevant artifacts as alternative investments. The art market’s ability to adapt and respond to economic shifts augurs well for its future, with emerging artists and ideas challenging traditional paradigms. As the lines continue to blur between physical art objects and their digital counterparts, the conversation surrounding value, culture, and authenticity in art is bound to evolve further.

The Future of Art and Cryptocurrency

Reflecting on Justin Sun’s audacious acquisition, it becomes clear that the trajectory of art and investment is becoming increasingly intertwined. The significant price tag attached to a duct-taped banana can be interpreted as a signal that viewer perception is paramount, transcending conventional standards of artistic worth. As the realms of high art and crypto converge, we stand at a crossroads where future artists may utilize unconventional materials and methods, claiming unexpected places in the annals of art history.

The spectacle of Sun’s banana purchase is emblematic of the times we live in, where technology, culture, and finance collide in creative and sometimes bizarre ways. Whether heralded as a groundbreaking moment in art or critiqued as a reflection of an over-inflated market, “Comedian” serves as an influential touchstone, provoking thought about where we are heading in the art world amidst the digital revolution and the epoch of cryptocurrency. The future appears ripe with possibilities, and it will be fascinating to witness the unfolding narrative as artists, collectors, and investors navigate this new paradigm.