The recent decision by Federal Reserve Governor Stephen Miran to oppose the majority’s move to cut interest rates signals more than just a disagreement over monetary policy; it exposes an unsettling erosion of the institution’s independence amid a politically charged atmosphere. While the Fed traditionally aims for objective, data-driven decisions, Miran’s push for a half-point cut—double the consensus—raises serious concerns about external influences infiltrating the central bank’s core functions. His stance doesn’t seem rooted solely in economic analysis but rather appears to be driven by broader political pressures, notably aligned with directives from the Trump administration.

Miran’s decision to advocate for a more aggressive rate cut unsettles the delicate trust placed in the Federal Reserve to serve the economy rather than political interests. The fact that he was recently confirmed by the Senate and immediately took a pronounced stance indicates a worrying politicization of what should be an autonomous entity. His position aligns disturbingly with the wishes of the executive branch, which has publicly expressed desire for significantly lower rates—a move that risks turning monetary policy into a tool for short-term political gains rather than sustainable economic growth.

Internal Discord and a Troubling Shift in Federal Reserve Dynamics

The split within the Federal Open Market Committee (FOMC) underscores deepening divisions that threaten the stability and credibility of the institution. While other new members, like Michelle Bowman and Christopher Waller, bore the mark of political ambition during their confirmation hearings, they maintained a semblance of restraint. Miran’s divergence from this trend by advocating an even larger rate cut signals a shift toward a more overtly dovish stance, influenced perhaps by partisan interests rather than rigorous economic analysis.

This internal discord sets a dangerous precedent: when key figures within the Fed openly challenge consensus without strong economic justification, it fuels uncertainty among markets and investors, undermining the very purpose of central banking—stability. The ambiguity surrounding the motivations behind Miran’s push for lower rates suggests that the Fed’s independence has been compromised, making it susceptible to external political pressures that threaten the delicate balance necessary for effective policymaking.

Political Appointees and the Erosion of Federal Reserve Credibility

The appointment of Miran by former President Trump, amid questions about the politicization of the judiciary and economic appointments, raises questions about the true independence of the Fed. Miran’s ongoing role as chair of the White House Council of Economic Advisors, coupled with his position on the Fed board, exemplifies a troubling blurring of lines between politics and monetary policy. This entanglement risks transforming the central bank into an appendage of the current administration, rather than a neutral arbiter focused on long-term economic health.

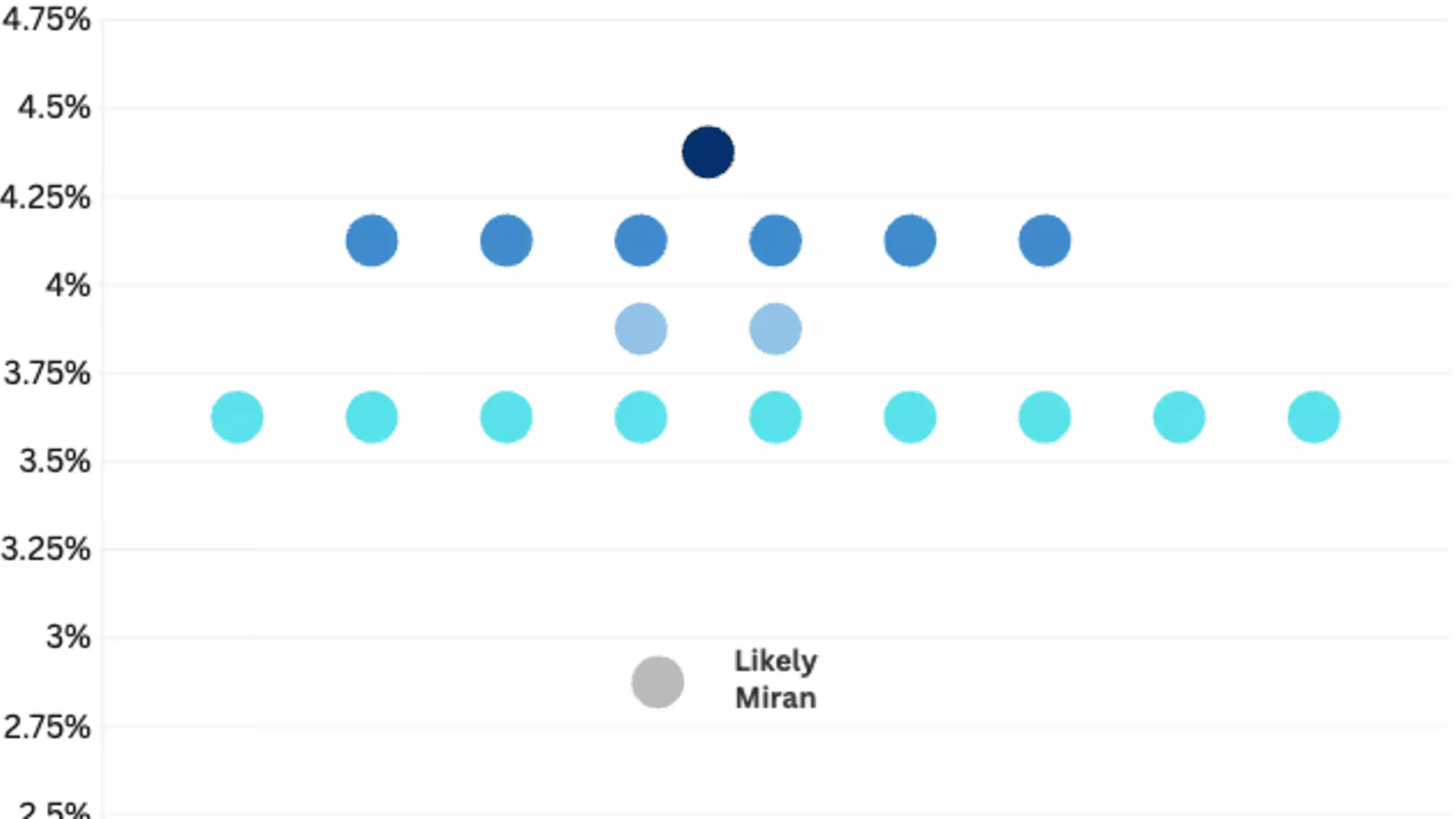

Furthermore, the White House’s attempts to interfere directly—such as Trump’s comments advocating for interest rates two to three percentage points lower—provide a potent example of political meddling. The Fed’s traditional role as an independent guardian of economic stability is being compromised, with appointments made not purely on merit but on political loyalty. This threatens to erode public confidence in the institution, especially if politicized figures wield disproportionate influence during times of economic turbulence.

The Future of the Federal Reserve in a Politicized Climate

As the Fed navigates this fraught environment, the risks ahead are profound. A central bank perceived as aligned with political ambitions diminishes its credibility and hampers its ability to act decisively during economic crises. Miran’s stance, seemingly echoing Trump’s demands, exemplifies how political pressures can distort monetary policy, creating a landscape fraught with unpredictability and risk of future instability.

Advocates for a balanced, centrist approach must now confront these developments critically, emphasizing the importance of protecting the Fed’s independence. While some may see Miran’s dissent as a sign of fresh debate within the Fed, it instead reveals troubling cracks in the institution’s foundation—cracks that could deepen if political interference continues unchecked. The role of the Fed is to serve the economy through prudent policies, not to be a pawn in political gamesmanship, and any deviation from this principle must be met with skepticism and vigilance.