The Biden administration’s recent withdrawal of significant student loan forgiveness plans raises critical questions about the future of student debt relief in the United States. Two major proposals aimed at allowing the Secretary of the U.S. Department of Education to cancel loans for specific groups of borrowers have been sidelined. This decision comes at a crucial time, as the nation grapples with an ongoing education debt crisis that affects millions of Americans. The implications of this withdrawal are profound and deserve a thorough examination.

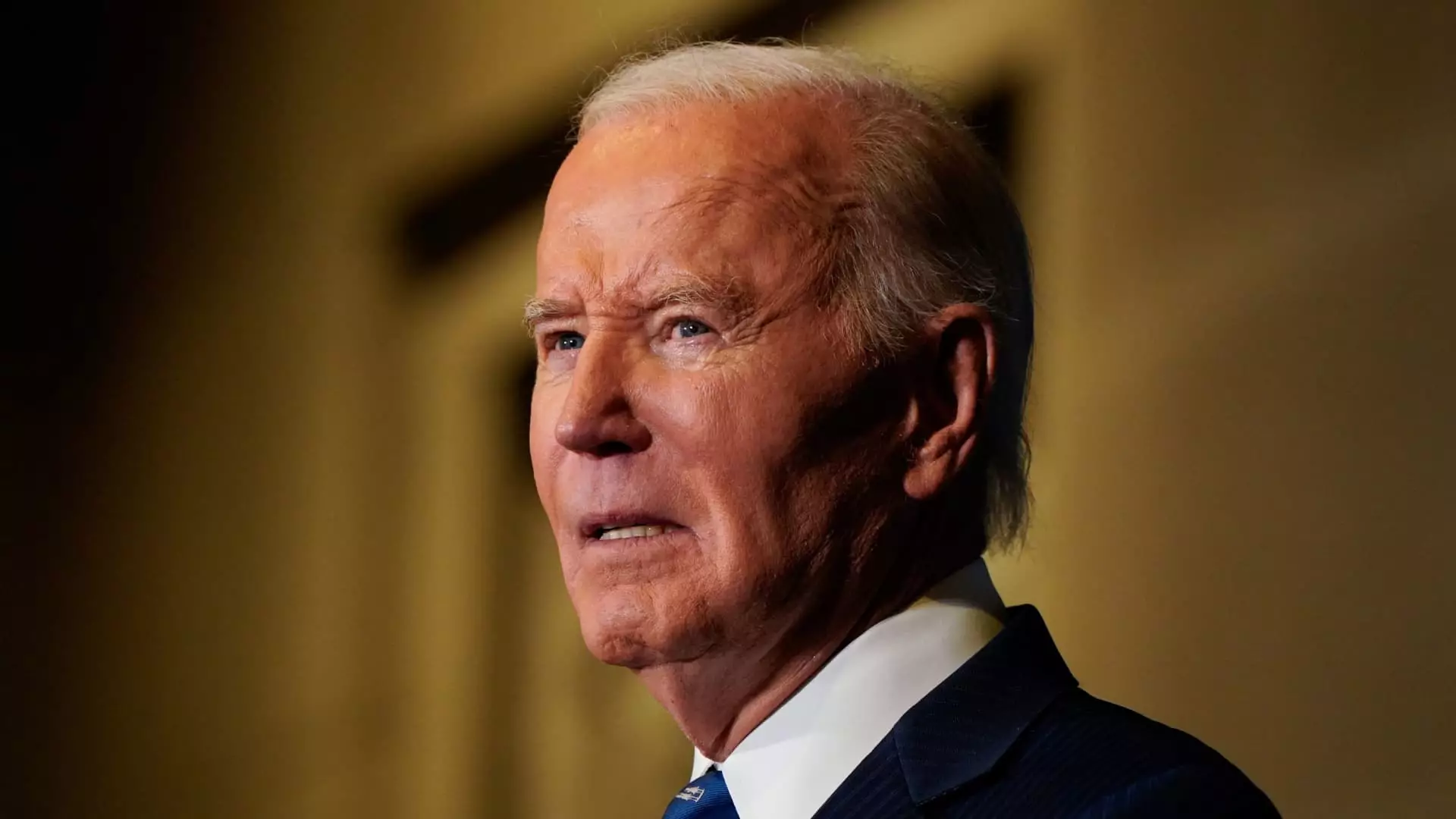

The official notice from the Education Department cited “operational challenges” as the reason for terminating the proposed regulations. This is particularly concerning given that these plans had the potential to alleviate the financial burdens of borrowers who had been in repayment for decades or those facing economic hardship. The timing of this withdrawal, just weeks before President-elect Donald Trump assumes office, suggests a consequential shift in policy direction.

Higher education expert Mark Kantrowitz highlighted that the Biden administration was likely aware of the impending obstacles posed by a Trump presidency, given Trump’s vocal opposition to student loan forgiveness efforts. The public reaction has been decidedly mixed; consumer advocates have expressed profound disappointment and concern about the potential fallout from this decision. Persis Yu of the Student Borrower Protection Center articulated a common sentiment: the proposed forgiveness could have provided relief to millions struggling under the weight of student loans.

The withdrawal of these proposals illustrates a systemic issue that has plagued American borrowers for years. Student loan debt in the U.S. has surpassed $1.6 trillion, impacting not just individual borrowers but the economy as a whole. Many borrowers, especially those from marginalized communities, face a compounded struggle with job instability and rising living costs, exacerbating their ability to manage debt repayments.

The Education Department has indicated a shift in focus toward helping at-risk borrowers successfully return to repayment, but many critics remain skeptical. Elaine Rubin, director of corporate communications at Edvisors, pointed out that concerns regarding the longevity and adaptability of remaining student loan forgiveness programs persist. With the shifting political landscape, the viability of these alternatives, like the Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness programs, is increasingly uncertain.

The PSLF program, designed to forgive federal student loans after 10 years of qualifying payments for certain nonprofit and government employees, remains in place for now, yet its fate is ambiguous. Many borrowers, both current and prospective, express anxiety about potential changes as a new administration prepares to take office. As Rubin stated, terminating such programs would require Congressional action, leaving borrowers in a precarious position.

Moreover, while the Biden administration has recently announced forgiveness for an additional $4.28 billion in student debt targeted at public service workers, it may not be enough to quell rising frustrations and fears among borrowers. These developments point to a growing divide between policy intentions and practical outcomes. Borrowers are encouraged to stay informed through resources like Studentaid.gov, which provides information on available federal relief options, but the uncertainty can be overwhelming.

The Biden administration’s retraction of major student loan forgiveness plans marks a pivotal juncture in the ongoing discourse surrounding educational debt in America. The need for comprehensive and accessible debt relief solutions is more pressing than ever. As the political landscape shifts, borrowers must navigate a landscape rife with uncertainty, advocating for their rights while seeking clarity on their options.

In light of the many challenges that lie ahead, a collective effort to address the student loan crisis is essential. Building coalitions in support of debt relief policies, engaging in effective advocacy, and fostering constructive dialogues can create pathways for meaningful reform. The future of student loan forgiveness hangs in the balance, and it is crucial that the voices of borrowers are heard and prioritized in forthcoming policy discussions.