At first glance, AMD’s recent financial results paint a picture of resilience and potential. With a revenue rise of 32% year-over-year and surpassing analyst estimates, it might seem the company is charting a solid path forward. However, beneath this veneer lies a complex web of vulnerabilities, strategic uncertainties, and geopolitical hurdles that threaten to undermine its apparent momentum. It is vital to scrutinize these numbers critically, for they mask underlying issues that could derail AMD’s ambitions in the fiercely competitive tech landscape.

The sharp decline in AMD’s stock—over 5% following its earnings release—signals investor skepticism that is well justified. The catalyst was not just a slight miss in adjusted earnings per share but also the troubling pause in China shipments due to export restrictions. While AMD boasts about a promising future fueled by a robust data center business, that optimism is often predicated on uncertain premises. The company’s reliance on geopolitical glitches, like the U.S. government’s restrictions on AI chip exports to China, exposes a fragility in its global supply chain and revenue streams.

It’s also worth questioning whether AMD’s reported growth is sustainable. The revenue surge primarily stems from demand in the data center segment, which accounted for a lion’s share of recent gains. Yet, critics argue that operating leverage remains elusive because of mounting operational expenses. As AMD invests heavily in software and infrastructure to support its enterprise offerings, profit margins could be squeezed—a risk that could turn what looks like promising growth into a mirage. This highlights a critical flaw in the narrative: high revenue does not automatically translate into long-term profitability or industry dominance.

Geopolitical Dangers and Strategic Delays

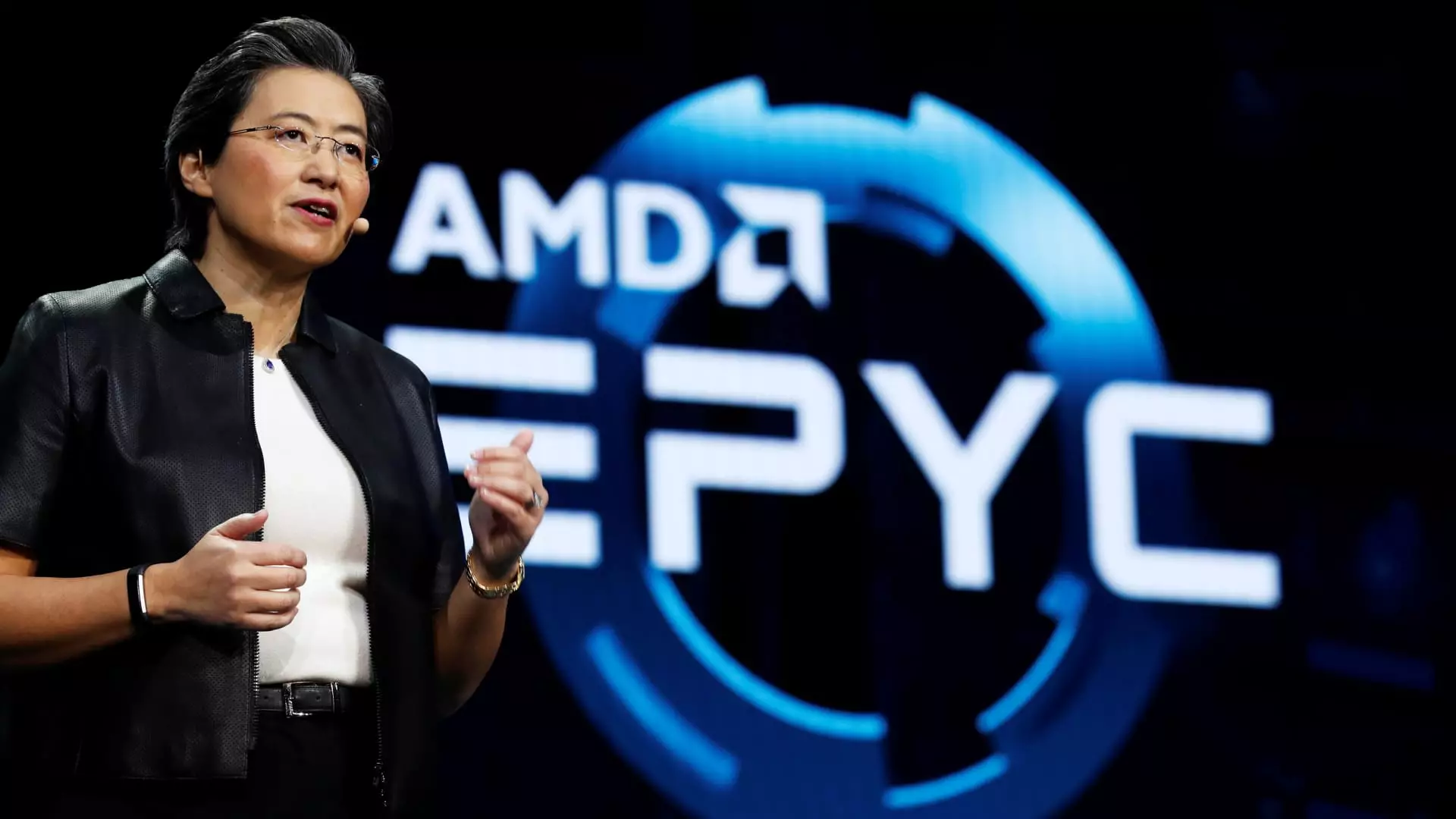

Perhaps the most glaring obstacle is the shadow of U.S.-China geopolitics. AMD’s CEO, Lisa Su, acknowledged ongoing efforts with the Trump administration to secure licenses to send chips to China. The uncertainty surrounding these approvals makes AMD’s future revenue from the Chinese market tenuous at best. The company’s anticipation of resuming shipments is optimistic but lacking concrete timelines, leaving investors to grapple with the possibility that a significant portion of its growth prospects could be delayed or even permanently lost.

This geopolitical tension underscores a broader vulnerability: AMD’s strategic positioning is at the mercy of fickle foreign policies. For a company vying to be a global powerhouse, overreliance on markets facing regulatory hurdles is a grave risk. Attempting to navigate U.S. restrictions while maintaining momentum in China echoes a fragile balancing act that could easily tip the scales against AMD if diplomatic relations sour further or if licensing processes prove more cumbersome than anticipated.

Moreover, the political climate itself is unpredictable, with policy shifts that can abruptly alter market conditions. AMD’s cautious guidance and intentional delays in shipments reflect an awareness of this instability but also highlight how external factors—often beyond corporate control—can stifle growth. The hope of “tens of billions” in market opportunity may be overshadowed by the reality of a fragmented global supply chain reinforced by political antagonisms.

The Uncertain Future of AMD’s Core Competencies

While AMD’s data center segment shows promise, skeptics question whether this growth can be sustained or scaled meaningfully across the industry. Goldman Sachs analysts have expressed concern over operational expenses ballooning as AMD invests to develop software and systems for enterprise clients. This kind of investment, while necessary, could limit earnings leverage if revenues do not outpace expenses rapidly enough.

The company’s core strength—its innovative products—faces fierce competition from industry giants like Intel and Nvidia, both of whom have entrenched market positions and substantial R&D budgets. AMD’s voice of confidence regarding the upcoming “inflection point” in the third quarter is optimistic but feels somewhat disconnected from reality, given the mounting operational costs and geopolitical headwinds. The worry is that AMD’s leadership is underestimating how these external pressures could erode its competitive advantage over time.

Furthermore, the viability of AMD’s future growth heavily depends on its ability to secure a steady stream of sales for its AI chips and GPUs in a highly competitive, rapidly evolving market. The current restrictions and delays cast doubt on whether AMD can capture the market share it envisions without significant strategic shifts or geopolitical concessions.

A Cautionary Outlook for a Promising yet Fragile Corporation

Overall, AMD’s recent financial disclosures mask a multitude of fundamental risks. The company’s growth trajectory is deceptively optimistic, rooted more in hope and strategic positioning than in assured stability. The external pressures—be it geopolitical restrictions, operational costs, or fierce competition—loom large, threatening to undermine even the most promising facets of its business. Sustainable growth in the modern chip industry requires resilience not just in innovation but also in navigating the complex political and economic realities of global markets. AMD’s future, while still holding promise, remains vulnerable to the forces it dare not ignore.