As we usher in 2025, the financial markets are experiencing a vibrancy reminiscent of the late 1990s, characterized by rampant speculation and volatile trading patterns. Various sectors within the stock market witnessed explosive increases, driven by retail traders who are more empowered than ever, fueled by social media platforms and a growing appetite for innovative investments. This frenzy has not only impacted traditional stocks but has also reignited the cryptocurrency market, sending ripples across both established and emerging trading arenas.

One of the most striking trends is the remarkable resurgence of cryptocurrencies. Bitcoin’s recent surge above $96,000 has catalyzed a broader rally among crypto-adjacent stocks. Companies such as Microstrategy and Coinbase have seen impressive gains, highlighting the reinvigoration of interest in digital currencies. Microstrategy itself experienced an astounding 360% increase in 2024, which has evidently buoyed investor sentiment into the new year. This spike in cryptocurrencies is not limited to major players; even obscure tokens are finding their moment in the spotlight, with ‘fartcoin’—a humorous yet volatile asset—soaring by 45%, pushing its market value to an eye-watering $1.38 billion.

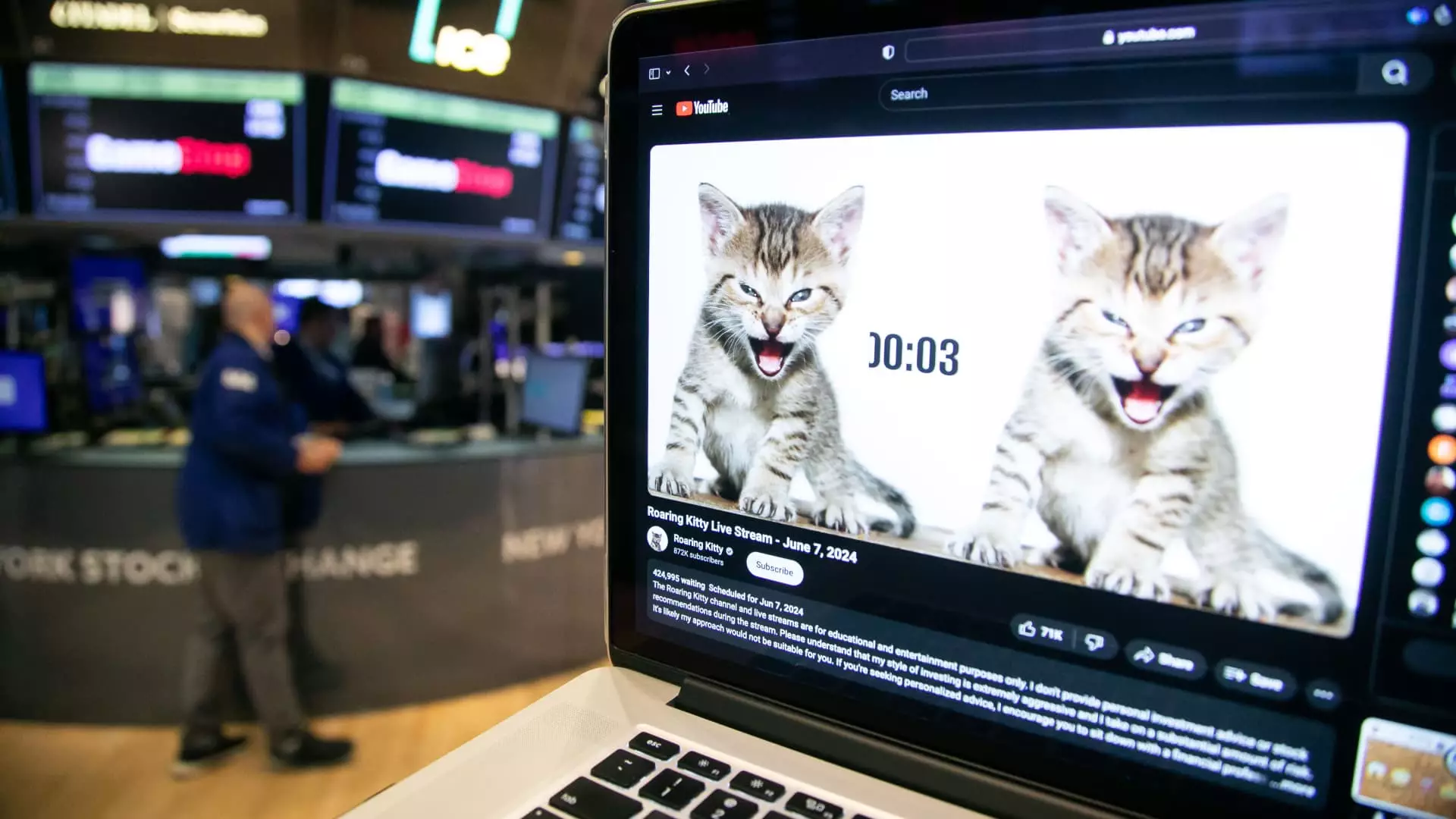

Meme Stocks and Social Media Influence

The role of social media in shaping market dynamics cannot be overlooked. The enigmatic online figure known as Roaring Kitty, or Keith Gill, has resurfaced with cryptic messages that are stirring speculation among retail traders. His social media antics illustrate the intensity and unpredictability of meme stock trading. Unity Software’s stock surged 11% following speculation surrounding Gill’s latest post, evidencing the profound impact that online personalities have on market behavior. Historically, this phenomenon has created significant volatility around stocks such as GameStop—the original meme stock—indicating that retail investors are still keen to capitalize on these speculative movements.

Sector Performance: The Semiconductor Surge

Another facet of this financial narrative is the performance of the semiconductor industry, which continues to outperform in the backdrop of an AI-powered technological landscape. Stocks like Broadcom and Nvidia once again played a crucial role in lifting the broader market, as they cater to the burgeoning needs of tech across various platforms. Their gains signal investor confidence in the continued demand for high-performance computing capabilities, despite earlier downturns at the close of 2024.

Market Indices and Volatility

As the new year commenced, major indices reflected a positive sentiment, with the Dow Jones Industrial Average peaking with a 300-point gain at one point. However, this momentum proved fleeting as broader concerns surrounding inflation and the potential for protectionist policies under the new presidential administration began to loom over the market. While the S&P 500 and Nasdaq Composite managed modest gains of 0.4%, the overarching narrative of volatility persisted, echoing that of previous election cycles where initial excitement was tempered by longer-term economic concerns.

Investment strategists like Lisa Shalett of Morgan Stanley Wealth Management capture the paradox of current market dynamics. The engaging notion of ‘animal spirits’—an economic metaphor for investor confidence driving markets—hints at a fusion of optimism and trepidation among investors moving forward. If the incoming administration indeed leans towards deregulation, we might see a considerable influx of capital into equities, spurring growth. Nevertheless, investors remain vigilant, balancing enthusiasm with an awareness of potential pitfalls, including inflationary pressures and interest rate adjustments from the Federal Reserve.

The early trading days of 2025 are marked by noteworthy volatility and speculation in various asset classes, from cryptocurrencies to equities. While many investors exhibit a bullish outlook reminiscent of bygone eras, the complexities of the modern financial landscape necessitate a cautious approach. As the market continues to evolve, the interactions between technology, social media, and investor behavior will likely remain vital narratives influencing future trading sessions.