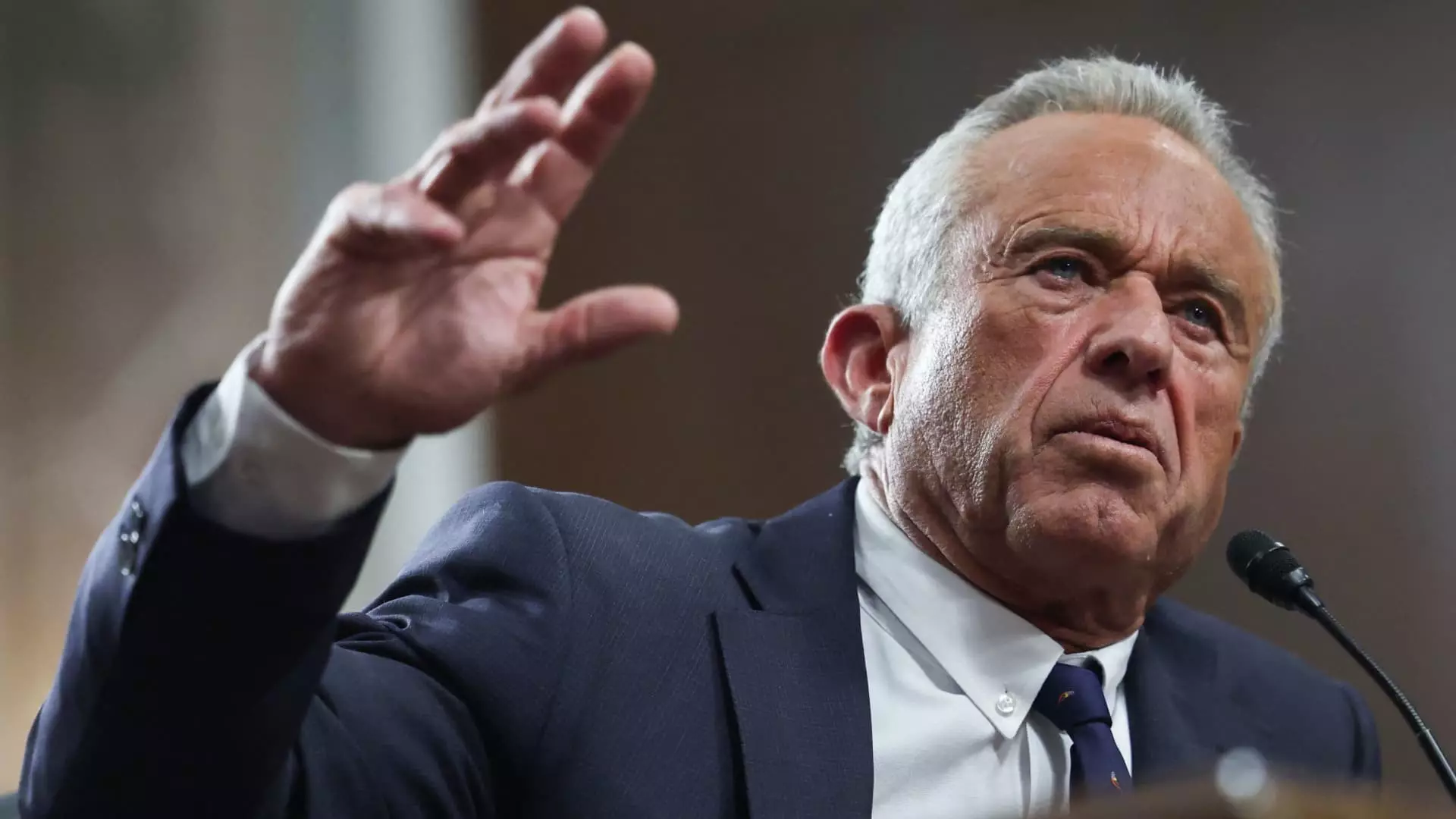

In recent years, a disconcerting trend has emerged in the United States regarding personal finance: a striking increase in credit card debt. As of 2024, Americans’ collective credit card balances surged to an unprecedented $1.17 trillion, painting a troubling picture for consumers across various income levels. Even affluent individuals are finding themselves entangled in this financial web—one case in point being Robert F. Kennedy Jr., who disclosed in a recent financial statement that he carries between $610,000 and $1.2 million in credit card debt. This revelation raises critical questions about the financial habits of Americans, particularly the rich, and the implications of such debt on overall economic stability.

Credit card debt has become a significant financial burden, with monumental ramifications for those entangled in it. According to Ted Rossman, a senior industry analyst at Bankrate, Kennedy’s staggering debt serves as a “truly massive account.” This assertion underscores not only the magnitude of his situation but also the broader themes of financial mismanagement and reckless borrowing that transcend socioeconomic status. American consumers now face an average credit card balance of approximately $6,380, compounded by exorbitant interest rates averaging around 20.13%.

What’s particularly alarming is the fact that credit cards have increasingly become a lifeline for many who are grappling with rising costs of living and stagnant wages. As inflation continues to constrict disposable income, credit cards are often used as makeshift emergency funds, a trend that places borrowers in precarious positions. Financial analysts emphasize the importance of addressing this debt categorically, highlighting that the longer one carries such debt, the more it erodes potential wealth accumulation.

The implications of carrying high credit card balances are dire, especially when considering the associated interest rates that are currently high—hovering between 23.24% and 23.49% in some cases. For someone like Kennedy, this means that, regardless of his substantial income, the longer he delays repayment, the more he will pay in interest. Calculations indicate that committing to repayments of $50,000 per month could see his smaller balance cleared in approximately 15 months, accruing around $93,000 in interest. However, the consequences grow graver if he is indeed dealing with the higher figure of $1.2 million, where it would take over two years and lead to interest payments approaching $434,000.

This steep financial cost illustrates the importance of not just examining the principal debts but also understanding the long-term assessments of carrying high-interest debt. Financial experts assert that accelerating repayments can significantly mitigate the economic toll. The warning is clear: delaying payment can have disastrous consequences.

The story of Kennedy’s credit card debt serves as a cautionary tale for everyday consumers. Despite his undeniable wealth—estimated at $30 million—he illustrates that financial missteps are not limited by income brackets. The concern extends beyond the ultra-wealthy to average households, for whom managing credit card debt is often a significant strain on monthly budgets. As unsecured debts rise, hitting an average of $29,364, the plight of managing such financial burdens grows increasingly dire.

For many, prioritizing debt repayment over other financial objectives like saving or investing is a critical strategy in the fight against crippling credit expenses. According to financial advisors, putting funds towards high-interest debt can yield guaranteed returns on investment, underscoring the prudent approach to financial health.

Interestingly, data reveals that higher-income individuals are increasingly prone to maintain long-term credit card debt, with a notable 59% of borrowers earning more than $100,000 finding themselves in this predicament. This statistic sheds light on the complex dynamics of wealth, credit limit access, and financial decision-making. The allure of credit card perks can sometimes lead to irrational financial habits that impair overall wealth management.

Financial professionals suggest alternative borrowing strategies for the wealthy. For instance, using credit lines, which incur no ongoing costs, can be an effective way to finance substantial purchases without incurring significant interest expenses. Establishing credit lines in advance also enables affluent individuals to avoid liquidating investments—an often costly endeavor owing to capital gains taxes.

With credit card debt climbing to alarming levels, both rich and poor must reassess their financial behaviors. The ongoing trend emphasizes an urgent need for better financial literacy and responsible borrowing practices. As America grapples with its credit card crisis, the lessons gleaned from high-profile cases like Kennedy’s can serve as vital warnings. The need for thoughtful financial planning has never been greater—it is imperative that individuals recognize not just the shadows of debt but also the pathways to financial freedom. As the landscape evolves, adopting more prudent financial strategies will be essential if consumers hope to thrive in an increasingly indebted society.