Recent years have witnessed a burgeoning recognition of the importance of financial literacy among high school students. One exemplary institution at the forefront of this movement is KIPP DC College Preparatory, which offers the NAF Academy of Business program. This initiative equips students not just with essential academic skills but also practical financial knowledge that extends beyond traditional classroom boundaries. In a world where economic fluctuations can drastically impact young adults, understanding budgeting, investments, and financial planning has never been more critical.

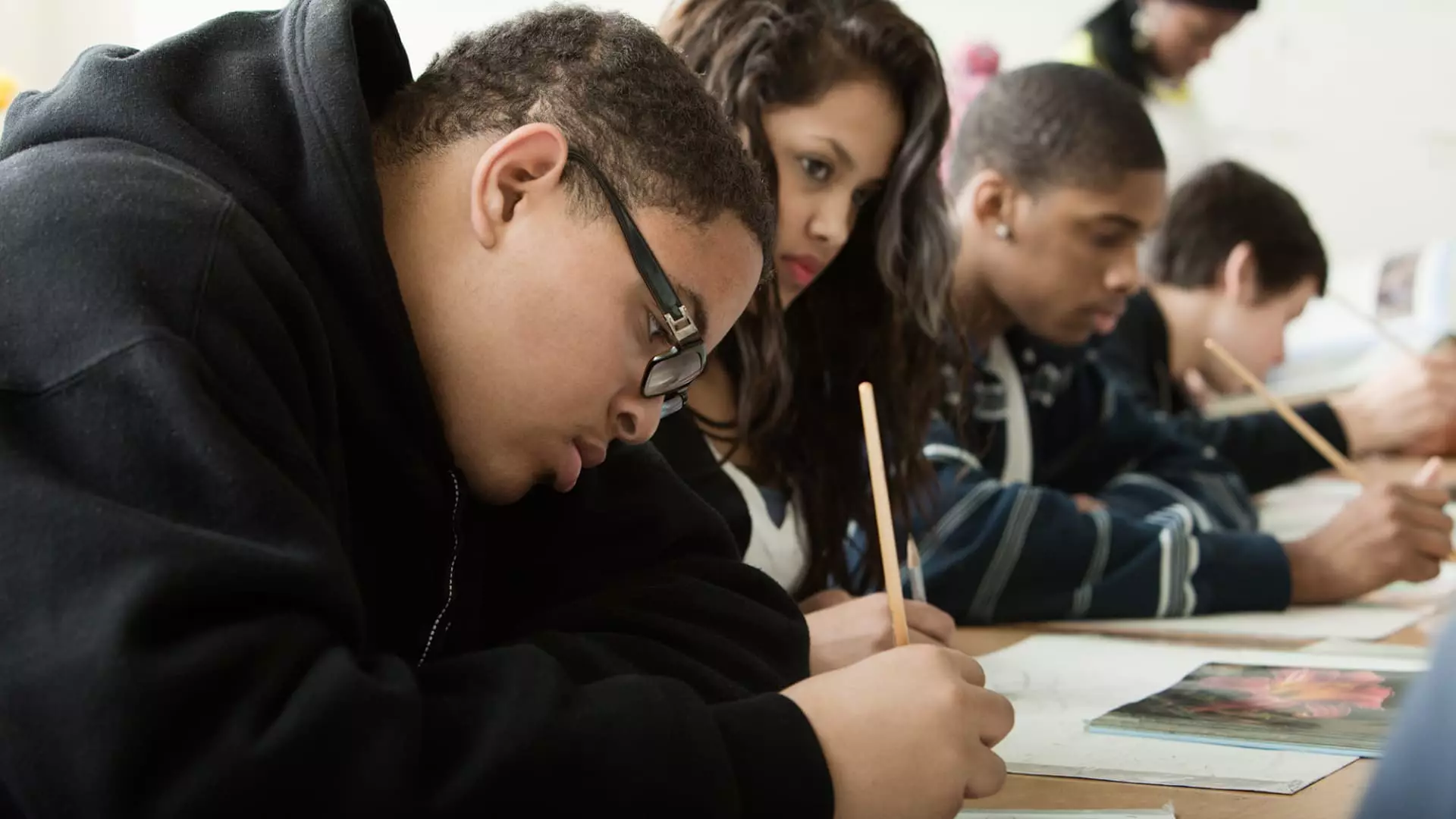

At KIPP DC College Preparatory, students like Keith Harris are immersing themselves in real-world financial education. By engaging in a comprehensive three-year curriculum that emphasizes financial literacy, these students cultivate skills that will serve them throughout their lives. Harris’s experience underlines the significance of such programs—while he excels academically, he also puts his financial acumen into practice, saving and investing his earnings from a part-time job. This dual approach of coupling academic and practical knowledge illustrates a model that could benefit many educational institutions nationwide.

A Robust Curriculum for the Future

This finance program is notable for its length and depth, transcending the typical one-semester courses that are often offered in schools throughout the country. Over 160 students participate in KIPP’s NAF Academy, learning critical themes such as managing risks, saving, and investing in stocks—a curriculum that not only prepares them for college but also positions them for successful careers. For those who complete the program, the NAFTrack certification signifies a robust preparation for both college and career, equipping students with credentials that can make a difference in job applications after graduation.

Moreover, programs like First Generation Investors provide students with unique opportunities to engage in capstone projects while benefiting from mentorship by university students. These experiences serve to create valuable connections within the financial industry, further enhancing the participants’ readiness for future endeavors. The partnerships with major employers, including Ernst & Young and Verizon, offer pathways directly into the workforce, embodying a model where education meets real-world application.

KIPP DC College Preparatory serves a demographic that often faces systemic challenges. Despite these barriers, the school boasts a remarkable statistic: 100% of its senior class members gain acceptance to at least one college. Shavar Jeffries, CEO of the KIPP Foundation, emphasizes the necessity of economic security in breaking cycles of poverty through education. The financial literacy taught at institutions like KIPP DC is not only an educational requirement; it serves as a critical tool for empowerment.

Donyae Vaughan, another student from KIPP DC, reflects the newfound confidence that comes from understanding financial principles. With aspirations of pursuing dental school, Vaughan highlights the importance of grounding her ambitions in financial reality. Her experience demonstrates how concepts learned in school can directly enrich family discussions about money management, further underscoring the program’s societal impact. By fostering an environment where financial literacy becomes a family conversation, students can cultivate a culture of economic understanding that extends into their homes.

Nationally, there is a palpable shift towards embedding financial literacy into curriculums across states. Approximately half of U.S. states now require or are working to mandate financial literacy courses before high school graduation. This movement is not just a trend; it is a critical response to the evident disparity in financial education available to students, particularly those from low-income families. As noted by Raven Newberry of the National Endowment for Financial Education, requirements may effectively close gaps in educational equity.

Studies consistently indicate that financial literacy correlates strongly with financial well-being. The arguments are compelling—students who engage in formal financial education exhibit more prudent financial behaviors, such as utilizing low-interest loans and avoiding high-interest credit arrangements. Furthermore, a positive correlation exists between financial literacy and higher credit scores, reduced debt delinquency rates, and improved saving and loan repayment behaviors among young adults.

The landscape of financial education is evolving, and schools like KIPP DC College Preparatory are trailblazing pathways for students eager to learn about personal finance. As financial literacy gains traction as a critical component of academic curricula, the potential ramifications for students’ futures are profound. By arming young adults with the tools necessary to make informed financial decisions, we are not just preparing them for college; we are shaping a generation better equipped to navigate the complexities of the financial world.

In advocating for comprehensive financial education, we move towards a society where financial empowerment is not merely a privilege but a baseline expectation for all students, regardless of their economic background. With ongoing efforts to enhance financial literacy in schools, the foundation is being laid for greater economic security and success for future generations.