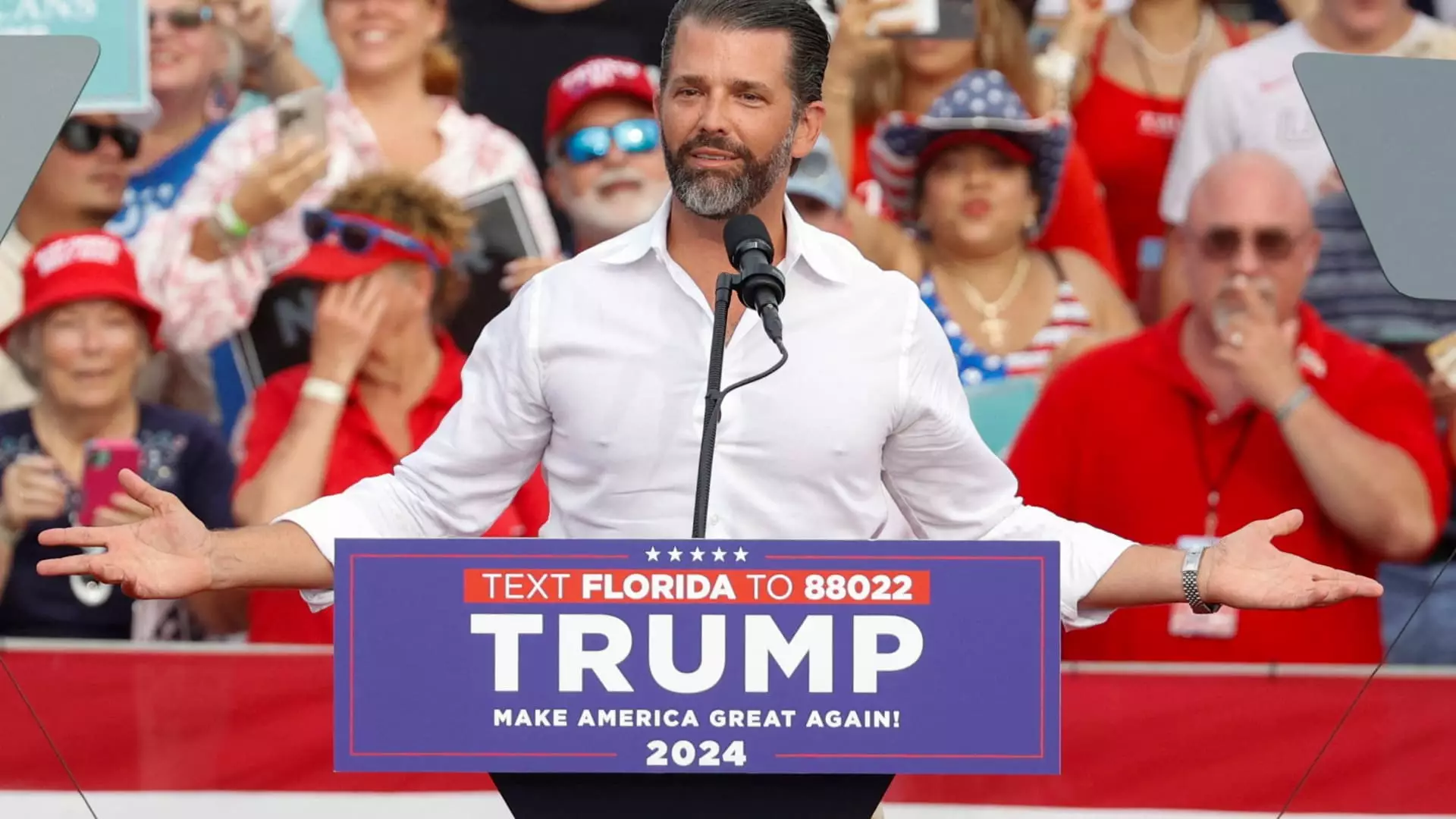

The announcement of Donald Trump Jr. joining the board of PSQ Holdings, which operates the online marketplace PublicSquare, sent waves through the financial markets, exemplifying the sensitive interplay between political figures and market movements. On the day news broke, the stock price soared by an astonishing 185%, signaling overwhelming investor enthusiasm. This surge raises questions about the influence of prominent political affiliations on market behaviors, especially when the company in question operates within a microcap sector, which, as of the last close, had a modest market capitalization of $72 million.

This phenomenon illustrates that market reactions can sometimes diverge sharply from fundamental financial metrics, such as revenue and profit margins. Despite PSQ reporting a mere net revenue of $6.5 million with significant operating losses exceeding $14 million for the September quarter, the stock’s rally implies a speculative excitement driven by investor sentiment rather than a robust evaluation of the company’s financial health.

Donald Trump Jr.’s prior investments in PublicSquare amplify the narrative of a growing “cancel-proof” economy. His assertion that PublicSquare is at the “forefront” of this movement connects strategic interests with the pursuit of a more conservative ideological marketplace. The integration of such political figures into corporate boards often blurs lines between business and politics, introducing an element of branding that may attract specific investor demographics.

Moreover, Trump Jr. has recently been joining multiple boards, including that of Unusual Machines, a drone manufacturing company, and entering partnerships with venture capital firms focusing on conservative investments. This trend signals a broader strategy of aligning business operations with political ideologies, potentially unlocking new avenues for capital through niche markets.

PublicSquare’s Strategic Positioning

PSQ Holdings positions itself at a unique intersection of commerce and ideological commitment. With a focus built around the principles of “life, family, and liberty,” the company is crafted to appeal to consumers who prioritize these values, especially in the context of societal pressures and perceived threats to free expression. This strategy is ambitious but also invites scrutiny as the efficacy of this business model unfolds in a competitive digital economy.

Despite the impressive stock performance, investors must remain wary of the broader implications of such rapid fluctuations. Future profitability will depend not only on PublicSquare’s operational execution but also on its ability to sustain the engagement of the politically charged consumer base.

While the sharp rise in PSQ’s stock is a clear indicator of favorable market sentiment, it also raises fundamental questions about the volatility and sustainability of such investments. The reliance on a singular political identity may pose risks as companies must also remain adaptable to changing market dynamics and consumer preferences beyond political affiliations.

As the landscape evolves, both investors and analysts will need to gauge whether the enthusiasm surrounding Trump Jr.’s appointment at PSQ translates into long-term growth or is merely a momentary spike driven by political passion. For those looking to navigate this arena, a careful approach that weighs the implications of melding business with political identities may be key to understanding the future trajectory of companies like PublicSquare.