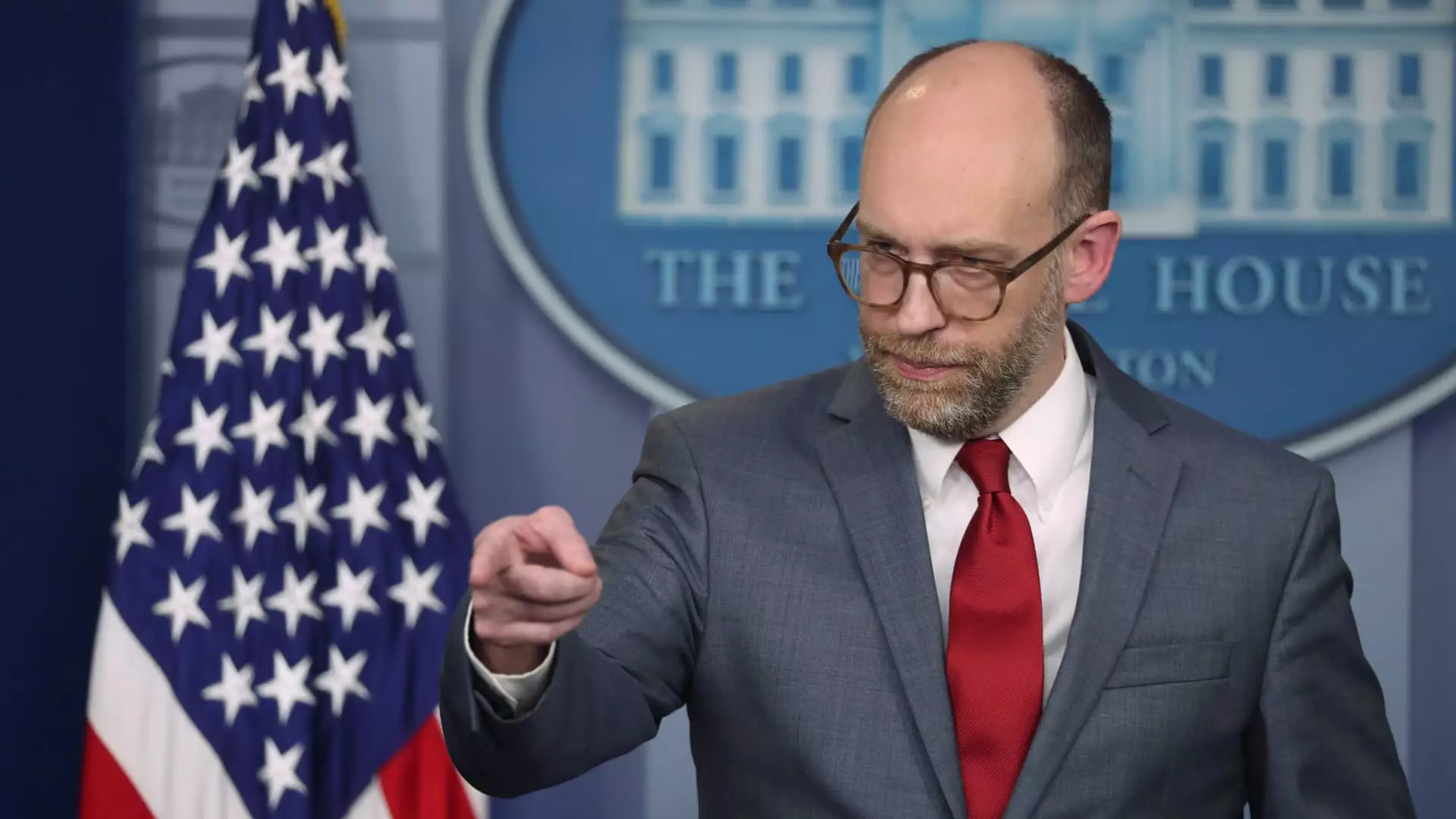

The Consumer Financial Protection Bureau (CFPB) stands at a precarious crossroads following significant organizational upheaval. A recent internal memo revealed plans for employees to work remotely due to the closure of their Washington, D.C. headquarters until mid-February. This directive, communicated by Chief Operating Officer Adam Martinez, comes in the wake of an earlier order from acting CFPB director Russell Vought, which effectively froze most regulatory activities at the agency. Such developments signal growing unrest within the CFPB, an agency established to protect consumers from financial exploitation.

The leadership shake-up at the CFPB has raised eyebrows within both governmental and financial circles. Under Vought’s first memo, many of the essential responsibilities of the CFPB, including the oversight of financial institutions, were curtailed. This halt in operations is not merely a procedural issue; it presents a stark challenge to the essential functions the CFPB is meant to uphold. With the agency’s future uncertain, a culture of fear has permeated the workplace, as employees receive troubling whispers about possible layoffs or administrative leave.

Moreover, the political context intensifies the stakes involved. The CFPB’s recent struggles come amidst concerted efforts by opponents to undermine its authority. Funded by the financial services industry reluctant to comply with stringent regulations, the agency has consistently faced legal challenges contesting its legitimacy. As attention turns towards the agency, its very existence may be in jeopardy—a concern exacerbated by Vought, who has openly endorsed drastic governmental restructuring.

Compounding the situation is the involvement of operatives from Elon Musk’s DOGE initiative, having gained access to the CFPB’s sensitive data repositories. This intrusion raises alarming questions about the agency’s operational security and integrity. Reports indicate that these operatives have been granted access to confidential materials, including performance reviews of CFPB staff members. Such an arrangement compromises employee privacy and raises significant ethical concerns about how external influences may shape the Bureau’s future direction.

Musk’s public pronouncements further amplify anxieties surrounding the CFPB. On his social media platform, he made headlines last Friday by proclaiming “CFPB RIP,” signaling his crosshairs aimed at the agency. This rhetoric has the potential effect of emboldening others who may wish to see the agency dismantled or severely restricted in its powers.

At the heart of the CFPB’s mission is the protection of consumers from predatory practices in the financial sector. The Bureau came into being as a direct response to the 2008 financial crisis, aiming to shield Americans from abuses by banks and other financial entities. Without the agency’s oversight and monitoring, critical initiatives designed to save consumers from excessive fees and unreasonable credit reporting might be put on indefinite hold.

Reports indicate that a potential reduction in workforce could significantly hinder the CFPB’s ongoing efforts, particularly those aimed at ensuring fair treatment of consumers. It’s imperative for the agency to maintain its operational capacity to oversee bank activities, enforce compliance with regulations, and advocate for consumer rights in the face of increasing adversity. A diminished workforce could substantially undercut those goals, costing American consumers a collective savings estimated in the tens of billions of dollars.

As the CFPB navigates these turbulent waters, the need for accountability and clear leadership is paramount. The agency’s mission cannot be sidetracked by political maneuverings, nor should the welfare of its employees be compromised by external influences. Stakeholders, including lawmakers and consumer advocates, must rally to protect the CFPB from potential dissolution or stifling regulatory paralysis.

The consequences of dismantling such an agency could echo throughout the financial landscape for years, ultimately eroding consumers’ protections and undermining public trust. Maintaining a robust CFPB is crucial to ensuring responsible practices in the financial industry, where millions of Americans rely on a competent government entity to safeguard their interests. As the future remains uncertain, vigilance and advocacy will be essential to uphold the foundational principles of consumer protection in finance.