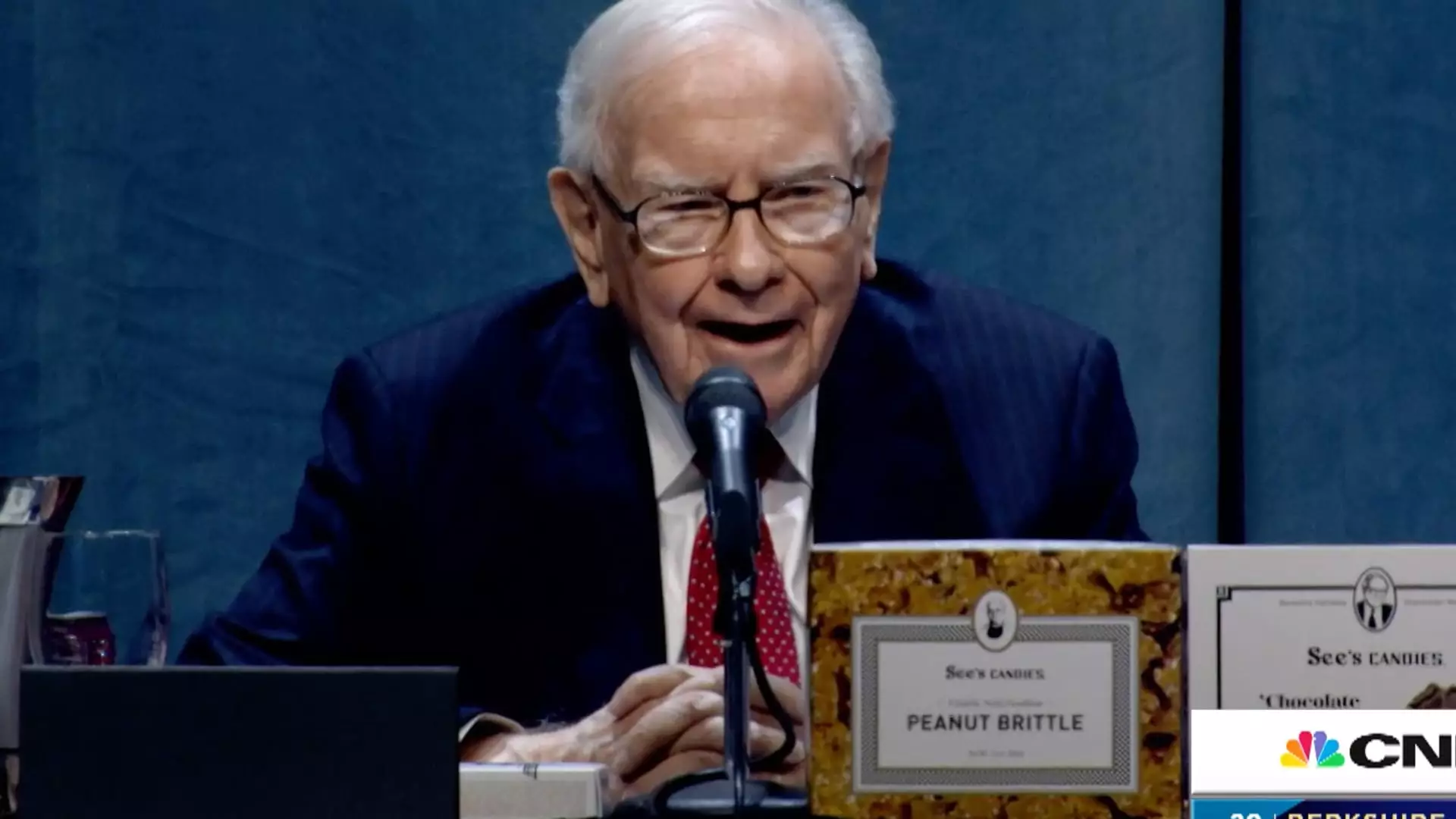

In a rare expression concerning President Donald Trump’s trade policies, the esteemed investor Warren Buffett voiced his concerns regarding tariffs, describing them as a potentially destructive force within the economy. He emphasized that tariffs serve as a burden on consumers, effectively acting as a tax on goods, and metaphorically likened them to an act of war. This analogy serves to underline the significant impact that such economic strategies can have, reverberating beyond simple trade disputes to affect broader market stability.

Buffett’s commentary was particularly striking, not only because it provided insight into his perspective as the CEO of Berkshire Hathaway—a conglomerate heavily invested in a diverse range of sectors including insurance and manufacturing—but also due to the rare nature of his public remarks on political subjects. His playful yet serious disclaimer about tariffs—“The Tooth Fairy doesn’t pay ’em”—punctuates the absurdity he sees in imposing these duties without considering the subsequent ramifications for the economy and consumers.

The Ramifications of Trade Wars

The economic landscape is fraught with uncertainty, as evidenced by the announcement of imminent tariffs against imports from Mexico, Canada, and China, which are set to take effect soon. Such aggressive trade policies provoke fears of retaliation, particularly from China, which has already indicated a readiness to respond. This back-and-forth can unravel long-negotiated trade relationships and spiral into a trade war, elevating costs for consumers and businesses alike.

Buffett’s cautionary words illuminate the complexities involved in such maneuvers, as they often lead to unintended economic consequences. Historically, he has maintained a measured tone when discussing trade tensions, warning that a heavy-handed approach could lead to global repercussions, and this current situation seems to echo those previous warnings. He notably refrained from commenting directly on the current economy but indicated that the subject itself is profoundly significant.

Market Response and Future Outlook

Market responses to the uncertainties surrounding tariffs and trade have also shown signs of volatility. Over the past year, Buffett has adopted a conservative approach by divesting stocks and accumulating cash reserves. Such actions have led some analysts to speculate that he may be preparing Berkshire Hathaway for a leadership transition while others interpret his caution as a bearish signal regarding future economic conditions.

The S&P 500’s modest growth of just about 1% this year underscores the prevailing worries about slowing economic activity alongside unpredictable policy adjustments from the Trump administration. The market’s jitteriness reflects a broader anxiety about future growth, making Buffett’s insights even more relevant.

Warren Buffett’s remarks shed light on the intricate relationship between tariffs, consumer pricing, and economic stability. As he emphasizes a more cautious, measured approach, it becomes clear that the consequences of trade policies extend far beyond the immediate impacts, posing risks not just to U.S. consumers but to the global economy as well. The art of negotiation and the crafting of economic policies must be conducted with a deep understanding of the potential backlash, ensuring that the economic landscape remains resilient in the face of adversity.